Transforming Infrastructure

From AI to Gen Z – how infrastructure is shaping our future

“But apart from the sanitation, the medicine, education, public order, (…), roads, a freshwater system, and public health, what have the Romans ever done for us?” Do you remember this line from the famous movie “Life of Brian”? These are all examples of critical infrastructure.

Infrastructure is the key to unlock growth

There is a good reason why many politicians in the last 18 months have addressed the topic of infrastructure in their various electoral campaigns as infrastructure is key to the economic and social development of a country. Coverage blackspots, delayed trains, power-cuts, potholes, insufficiently equipped schools – just some of the infrastructure inadequacies many of us experience every day. Only 36% of the respondents in G7 countries in a Global Infrastructure Investor Association survey carried out in 32 countries in 2025 stated that they are very/fairly satisfied with their national infrastructure.1 There is much room for improvement in many areas, from digitalization to housing, from EV charging to roads and trains. But infrastructure is not only about the provision of essential services to the public. Infrastructure is also at the core of the efforts Europe needs to make to remain competitive. A recent report by the former ECB president Mario Draghi to the European Commission pointed out that in order to stay competitive investments of an average EUR 800bn annually are needed with a primary focus on digitalization and decarbonization.2

The 3Ds

Energy transition, Green infrastructure & Mobility

Data, AI & Infrastructure

Aging society & Infrastructure needs

The 3Ds shape the transformation of our world.

Investments in green energy, digital infrastructure, and social adaptations are crucial to overcoming future challenges.

D LIKE DECARBONIZATION

Energy grids, renewables, and transport

The energy transition is top of the agenda of many countries and companies worldwide who have taken measures to reduce carbon emissions and transform their energy policies and business models. According to the International Renewable Energy Agency, investments of USD 150 trillion in transition technologies and infrastructure by 2050 are needed in the 1.5°C scenario, which equates to USD 5.3 trillion per year on average.3 The decarbonisation of several sectors comes with a rising need for green energy and investments. Currently around 25% of global CO2 emissions come from the cement, steel and fertiliser industries.4 Green hydrogen derived from using renewable electricity to hydrolyse water will be critical in helping to decarbonise these sectors. But more (green) energy needs more renewable power plants, more powerful energy grids with decentralised access points, and more storage capacity. Today´s infrastructure is just not ready for this transformation yet. More than 40% of Europe´s energy grids are older than 40 years and more.5 Huge efforts are currently being made both by politicians, authorities, and industry to build the infrastructure of tomorrow that can generate more green energy, transport it and store it.

According to the Energy Transition Commission, around 70% of the investments needed for the energy transition worldwide should flow to the power sector estimating an annual investment need of USD 2.4tn by 2050.6 Furthermore, these investments will not only contribute to the safety of energy supply which has become an essential topic especially in Europe but cross-border energy infrastructure projects such as interconnectors can also help to lower energy costs by EUR 9bn per year until 2040.7

Another significant lever for the energy transition is the transport sector which accounts for 25% of all greenhouse emissions worldwide.8 Of these transport-related emissions, around 72% are generated by road vehicles, such as cars, trucks, buses, and motorcycles.8 The electrification of transport, more green fuels, and more EV charging infrastructure can bring about change. Furthermore, more attractive alternative means of transport are needed to promote the shift to rail and public transport.

D LIKE DIGITALIZATION

AI, data centres, and fibre

It is not just since the pandemic and the proliferation of home working that digital infrastructure has become regarded as critical infrastructure. Additionally, the range of digital infrastructure, from fibre networks to data centers, from mobile towers to smart software solutions – has increased significantly. The telecommunications sector has seen very rapid developments in the last 20 years, and we can expect further game-changing developments with AI. In the last 15 years the number of internet users worldwide has more than doubled with global internet traffic increasing twenty-fold.9 However, in some countries in Europe the coverage with high-speed broadband is still not sufficient to cope with this level of demand, in particular in rural areas. Data is becoming critical for everyday functions, it needs to be stored, and more data is created every day. AI will further accelerate this development with more and more applications leveraging off AI. With more digitalization comes more data that requires more storage and processing capacity in data centers, which leads to more investment opportunities worldwide. Today, the majority of investments in digital infrastructure is made in Europe (ca 30%),10 North America (ca 45%),10 and parts of the Asia-Pacific region (ca 20%).10

But the digital sector is also a complex one to enter for institutional investors. Investors need to anticipate trends and developments, stay on top of innovations and closely monitor which technology might prevail. Just recently, we have seen AI markets reel from the new entry of DeepSeek purporting to deliver AI solutions at a fraction of the cost of existing algorithms.

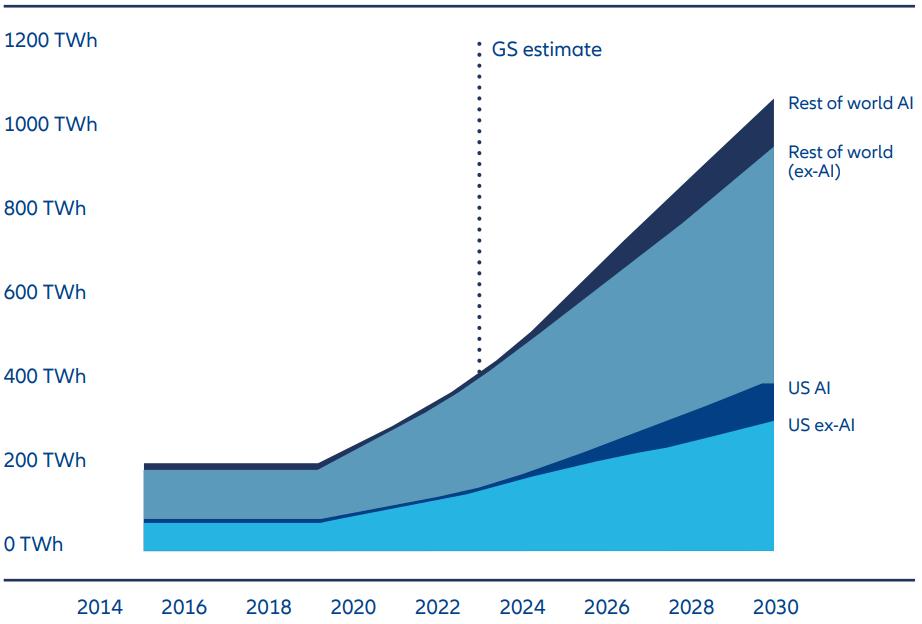

The rise of data centers, fibre networks, mobile towers, and IT solutions results in higher energy consumption. Certain digital assets are increasingly needing more power such as AI etc. Moreover, bitcoins etc. which are completely useless consume more energy than some small countries.11 To reconcile the need for decarbonization with accelerated digitalization is an important aspect of the transformation. Digital services and tools such as smart meter solutions can also help to make better use of energy and support decarbonization efforts. Many big tech companies try to address this environmental challenge by agreeing with renewable energy providers to supply them with green energy. Alternatively, they can further develop cooling and other storage technologies at a lower energy efficiency consumption which could lead to further investment opportunities in the surrounding digital sector.

Figure 1: Data is power hungry

Source: Masanet et al. (2020), Cisco, IEA, Goldman Sachs Research

D LIKE DEMOGRAPHICS

An aging society and its challenges

By 2030, one in six people in the world will be aged 60 years old or over and the share of population they account for will rise from one billion now to 1.4 billion. The retirement of the boomer generation – those born between 1946–1964 will have a large impact on many regions.12 An aging and longer-living society will require more elderly care, different housing, and healthcare. Furthermore, countries already need to cope with the challenge of a changing and lower workforce in the long run to manage the green and digital transformation. A growing and aging population needs to be met by a stable and resilient core infrastructure e.g. energy and water utilities and communications as well as sanitary services. An aging population cannot be served by an aging infrastructure.13

There is already a shortage of elderly care today and utilities use sewage systems, energy grids, and communication networks that are already at their capacity limits. Telemedicine can support elderly people in the countryside to remain independent as long as they can. A prerequisite is a modern health system and a powerful fibre network. To overcome the demographic challenge, we believe that it is crucial to invest both in the aging workforce to stay healthy and on top of technological developments in the next generation and their education so that they are well prepared for future job profiles. Unfortunately, in many countries, schools are not well equipped, there is not enough accommodation for students, and educational training and medical services are not accessible for everyone. Investments in education, student housing, hospitals, digital solutions, and services as well as a stable and modern core infrastructure can help to tackle the demographic challenge for both GenZ and Gen Alpha as well as the baby boomers and retired people.14

Private capital can do more

An aging society and aging infrastructure are an immense societal challenge. While there is a huge infrastructure gap that must be bridged, countries need to bear the burden or high retirement provisions which will continue to widely impact country budgets. But national budgets are already struggling after the years of the pandemic and a new world order with higher defense spending, energy costs, and inflationary pressure.

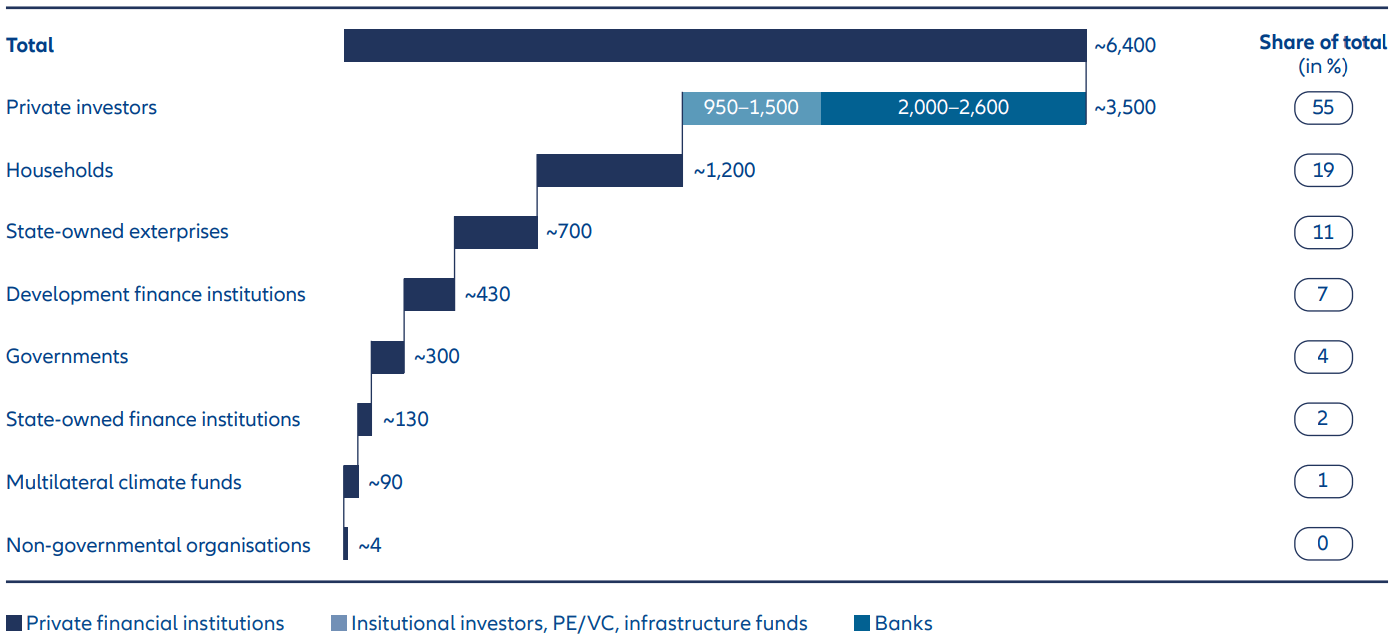

According to a recent report from the GIIA in the G7 countries only 26% of the respondents agree that their country is delivering national infrastructure projects well.15 Private capital, whether from large institutional investors, from countries investing on behalf of their policyholders, or from retail clients accessing private markets through vehicles such as the European Long-Term Investment Fund (ELTIF), can play a crucial role in the future of infrastructure investment, while also providing an element of many people´s retirement provision.

Many large institutional investors such as Allianz who have been investing in infrastructure worldwide since 2008 have a wealth of experience in investing and managing infrastructure projects and assets. Global Infrastructure polls15 reveal public concerns over climate resilience and support for private investment Institutional investors can play a pivotal role if they can find a stable political and regulatory environment. To overcome the pressing challenges of a green and digital transformation in view of the demographic trend we need to make huge efforts. And we need to make them now. By joining forces with private capital, countries can make a big leap forward, help boost the economic and financial performance, create new jobs, and invest in the future of everyone.

Figure 2: Private financial institutions could finance about 55% of net-zero investment needs (2022–2050)

Average annual investment needs for low-emission assets (in USD)

Source: Financing the net-zero transition: From planning to practice, McKinsey, January 2023

1 Global infrastructure index 2024

2 The Draghi report on EU competitiveness, 2024

3 World Energy Transitions Outlook 2023

4 Global-CCS-Institute-Fact-Sheet_Capturing-CO2.pdf

5 Actions to accelerate the roll-out of electricity grids, European Commission, 2023

6 Breaking Down the Cost of the Clean Energy Transition

7 Factsheet_EU Action Plan for Grids.pdf

8 Mobility – Energy in Transition – Powering Tomorrow, Auswärtiges Amt

9 Data centres & networks, IEA

10 Inframation, based on global deal volumes for digital infrastructure in 2024

11 How Much Energy Does Bitcoin Actually Consume? Harvard Business Review, 2021

12 Ageing and health, WHO

13 An ageing population needs a different approach to housing and care. This is how to provide it, World Economic Forum

14 Beyond retirement: a closer look at the very old, Bruegel, 2024

15 Global infrastructure poll reveals public concerns over climate resilience and support for private investment, GIIA