The China Briefing

China’s rare earth leverage

The jousting of recent weeks shows key industries are extremely vulnerable to China’s stranglehold on rare earth processing

Please find below our latest thoughts on China:

- Recent weeks have seen a more confident tone to China markets. Both China A and China H shares are trading above “pre-Liberation Day” levels.1

- This is despite the uncertainty caused by the on-again, off-again US-China trade negotiations.

- One interpretation could be that markets are expecting that some form of longer-lasting agreement will be reached, with China’s control of rare earth minerals providing important leverage.

- Rare earth elements are, in fact, not so rare. Theoretically, they can be mined in many places. Countries such as

Brazil, Vietnam, Australia, India and even the US all have significant rare earth reserves.2

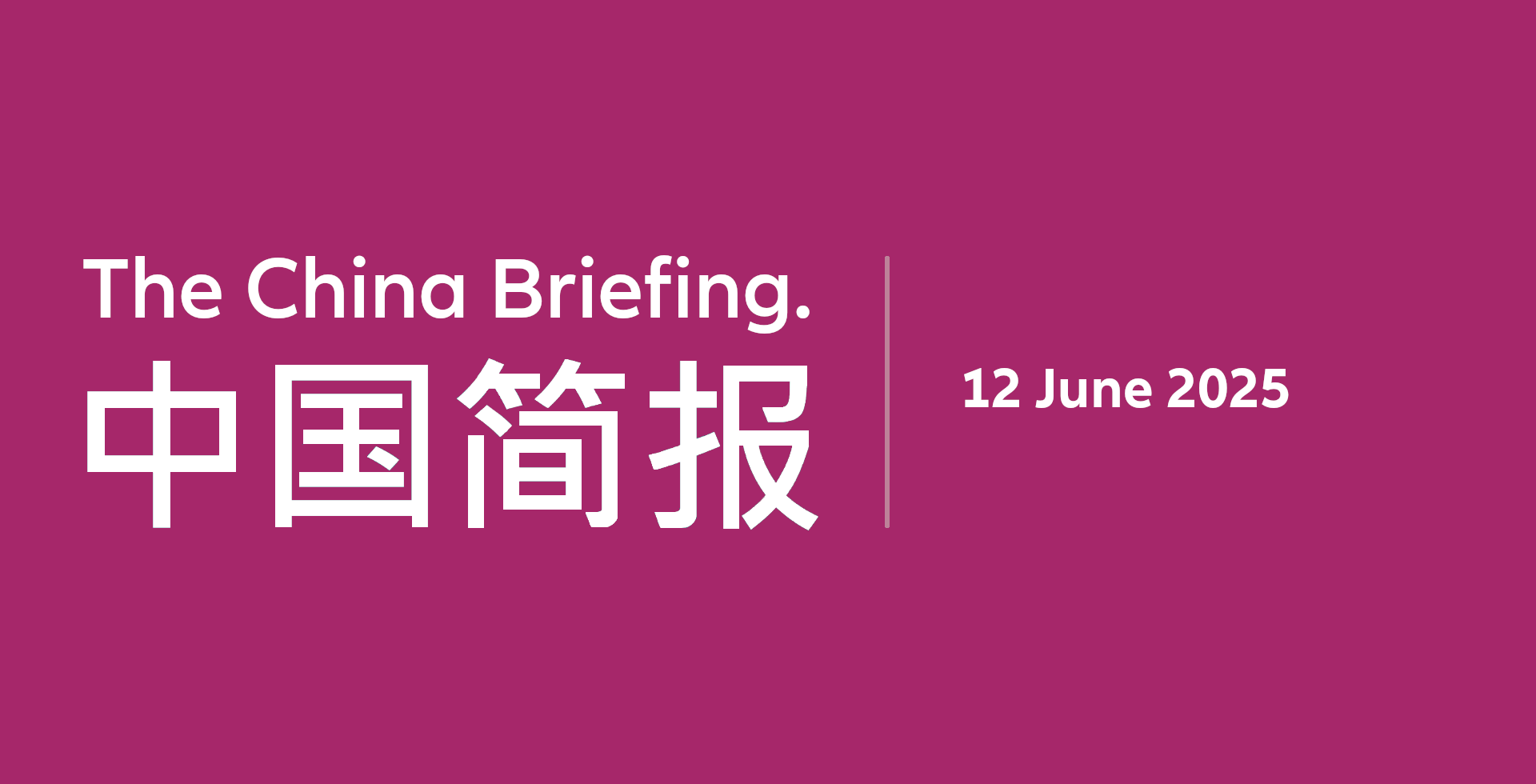

Chart 1: China 5 year CDS (over 5 years)

Source: Bloomberg, Allianz Global Investors, as at 10 June 2025.

- In reality, however, China controls about 60% of global production of rare earth ores and as much as 90% of the global supply of refined rare earths, which are essential inputs to global auto production among other industries.3

- Beyond this, the International Energy Agency’s recently published “Global Critical Mineral Outlook 2025” shows that China is the leading refiner and processor of 19 out of 20 minerals essential to global high-tech production, with an average market share of 70%.4 These include gallium, germanium and antimony, which are key minerals for semiconductor production.

- China would therefore appear to hold a strong set of cards and will likely drive a hard bargain as further details of the recently agreed trade framework are hammered out.

- On the other hand, a key vulnerability for China is that although it has significantly ramped up self-sufficiency in recent years, important industries such as electric vehicles still rely primarily on imported semiconductors.5 So we think any de-escalation of tensions is likely to include some walk back of US technology export controls.

- More broadly, the overall shock factor and market impact of tariff-related announcements seems to be diminishing.

- One way to look at this is through China credit default swaps (CDS). The China 5-year CDS – the cost to insure against a default on Chinese sovereign debt over a 5-year period – initially spiked after “Liberation Day” but has since rallied sharply and is now trading at the lowest level in more than three years.6

- This is encouraging as a broad measure of market confidence in China. It also contrasts with China equity risk premia which remain at quite elevated levels, especially for onshore markets. 7

- Why is this? In our view it primarily reflects domestic factors, especially a lack of retail investor confidence.

- Household bank deposits have ballooned since the disruptive impact of the Covid pandemic, reflecting factors such as macro weakness, increased job uncertainty, and a decline in house prices. Deposits as a proportion of GDP are around 30% higher than in the pre-Covid savings environment.8

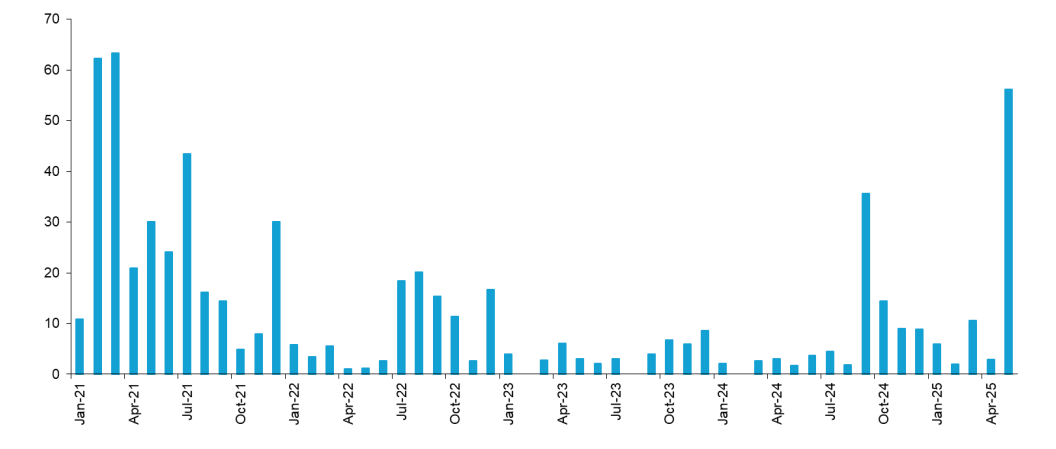

Chart 2: Funds raised via IPO in Hong Kong (HKD billion)

Source: HSBC as at 31 May 2025. IPO = Initial Public Offering

- If the level of deposits were to return to pre-pandemic levels, this would release approximately RMB 50 trillion (USD 7 trillion) back into the economy for consumption or investment.9

- It is unrealistic to assume this pool of capital will be redeployed over the near term, especially given that recent employment and property data remains weak.

- However, it does help to explain the record flows – equivalent to USD 80 billion – that have been channelled into the Hong Kong market via the Southbound Stock Connect scheme since the start of the year.10

- This has also helped to fuel the resurgence of the IPO market in Hong Kong, allowing Chinese companies to raise capital for their ongoing expansion globally. The number of Chinese companies which become household names is set to grow significantly, in our view.

- More broadly, signs that some of these excess savings are starting to be reallocated to risk assets should help to support China equity valuations, especially in an environment of lower domestic interest rates.

1 Bloomberg, 11 June 2025

2 World Population Review, 31 May 2025

3 Gavekal, 6 June 2025

4 International Energy Agency, May 2025

5 Gavekal, 23 April 2025

6 Bloomberg, 10 June 2025

7 BNP Paribas Securities, 10 June 2025

8 BNP Paribas Securities, 10 June 2025

9 BNP Paribas Securities, 10 June 2025

10 HSBC, 2 June 2025