New Opportunities for Investors

Summary

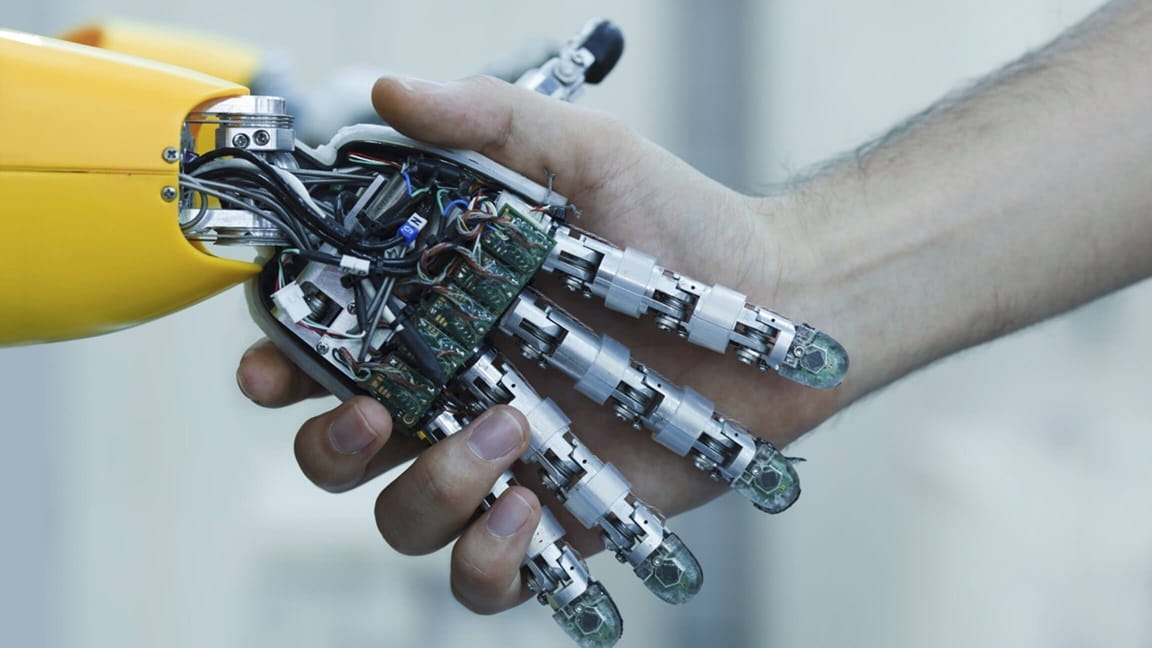

As a high-tech force with the potential to disrupt entire industries, artificial intelligence could transform today’s world even more than the internet once did. And with AI at an inflection point, investors have an exciting opportunity to tap future sources of growth potential across the market.

|

Key takeaways

|

Today’s artificial-intelligence (AI) technology might not yet be the stuff of science-fiction fantasies, but it is already changing the world in which we live. In fact, promising new AI developments are set to drive the next wave of innovation and automation for decades to come. Like the personal computer and the internet, it is a truly transformational force that has the potential to create new industries and dramatically change the business models of existing businesses. That is why understanding the impact of AI is critical to active investing – and not just in the high-tech space.

Why AI is reaching an inflection point

AI has a long history. While the principles behind it first emerged in the 1950s, it was only with the unprecedented convergence of today’s powerful cloud-based computing, mobile technology and “big data” resources that genuine AI became a real possibility. Better chips are gathering and processing more information at an exponential rate, which helps make AI deeper and more powerful than ever before. Moreover, the ubiquity of smartphones – to communicate over social media, make purchases and more – is resulting in enormous amounts of data that are stored, analysed and interpreted in real time. All the while, machines continue to learn with each interaction.

It is important to understand that much of what today’s AI is already achieving is behind the scenes or merely the start of the journey. Here are just a handful of practical applications that already show the potential for AI to transform our daily lives:

- Route-planning algorithms adapt to changing traffic conditions, and smart sensors enable self-parking and other advanced safety features.

- Consumers routinely communicate using virtual assistants like Amazon’s Alexa, Apple’s Siri and Google Assistant – devices that get smarter with each question asked.

- AI is starting to be used to identify breast cancer and diagnose pulmonary hypertension – in some cases with greater accuracy than human specialists.

These changes to our world will have a dramatic impact on the companies in which we invest, both directly and indirectly. For example, the work being done on driverless cars by companies like Google, Tesla and Uber threatens not only established auto giants, but the businesses that support them. Cars guided by AI will not only move differently, but they may be owned, repaired and, with the elimination of “human” error, insured differently too. Such is the wide reach of a truly disruptive technology.

The AI era is just beginning

Artificial intelligence is likely to be the largest driver of innovation and disruption across every industry group for decades to come. In fact, the accelerating pace of innovation in AI means that companies will need to identify and deploy new business strategies infused with AI or find themselves at a competitive disadvantage. We believe that companies that are able to effectively embrace this innovation are likely to capture a large portion of their industries’ profits. As a result, vulnerability to disruption is something we have actively chosen to include in our broader company analysis here at Allianz Global Investors.

Is AI the next industrial revolution?

The potential benefits from AI have led some to compare its advancement to the next industrial revolution. In much the same way that steam-powered machines changed the face of rural economies and the labour force, AI has the potential to transform entire industries. For our part, we believe AI could have a bigger and more profound impact on people’s lives and society than even the internet. And for our clients, this inflection point represents an exciting opportunity to access future sources of innovation and growth potential across the market.

As active investors, it is our job to recognize the companies that will drive and benefit from those changes, and to help our clients take advantage of them. Embracing and adapting to those challenges will be a large part of what will make being an investor in the coming decades so exciting.

The information presented here is intended for general circulation. It does not constitute a recommendation to anyone; it also has not taken into account the specific investment objectives, financial situation or particular needs of any particular person. Investors should not rely solely on this material but should seek advice from a financial adviser before making an investment decision. However, if investors choose not to seek professional advice, he should carefully consider the suitability of the product for himself. Investors should read the Prospectus obtainable from Allianz Global Investors Singapore Limited or any of its appointed distributors for further details including the risk factors, before investing. Prices of units in the Fund and the income from them, if any, may fall as well as rise and cannot be guaranteed. Past performance of the fund manager(s) and the fund is not indicative of future performance. Investing in fixed income instruments (if applicable) may expose investors to various risks, including but not limited to creditworthiness, interest rate, liquidity and restricted flexibility risks. Changes to the economic environment and market conditions may affect these risks, resulting in an adverse effect to the value of the investment. During periods of rising nominal interest rates, the values of fixed income instruments (including short positions with respect to fixed income instruments) are generally expected to decline. Conversely, during periods of declining interest rates, the values are generally expected to rise. Liquidity risk may possibly delay or prevent account withdrawals or redemptions.

The issuer of this material is Allianz Global Investors Singapore Limited (12 Marina View, #13-02 Asia Square Tower 2, Singapore 018961, Company Registration No.199907169Z) on 24 May 2017.

Healthcare

Summary

How the Artificial Intelligence revolution is reshaping our lives