Mineral commodities primer: Potash

Potash refers to a variety of potassium-rich compounds that are usually mined from underground deposits. The most common use of potash is as a plant fertilizer in agriculture – potassium can strongly boost crop yields by strengthening plants against stress and disease, deterring weeds and parasites, and improving the transfer and retention of water and nutrients from the soil to the plant.

Key takeaways:

- Global population growth and associated food demand to drive demand of potash

- Potassium-based fertilizers crucial to maintaining and increasing crop yields

- Russia and Belarus both major potash producers

Industry overview

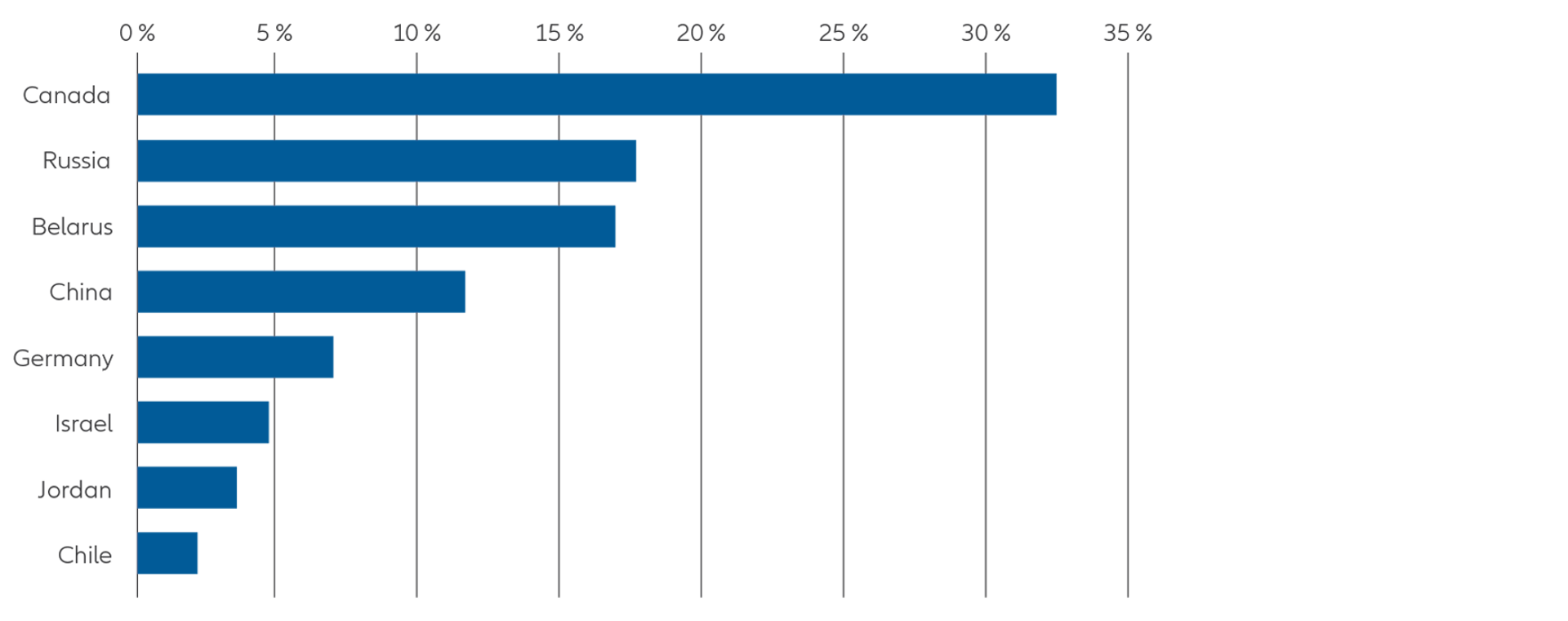

The commercial production of potash relies on mineral deposits formed millions of years ago by the evaporation of bodies of water. These evaporites are normally found deep below the earth’s surface and are thus obtained via traditional underground mining where ores are brought to the surface before being refined. Alternative methods of production include solution mining, where water is pumped into subterranean deposits which are then dissolved and brought to the surface for drying and evaporation – a more energy and water intensive process than conventional mining.2 Global potash production is currently strongly concentrated in Canada – around one third of global output in 2020 – with Russia, Belarus and China also making significant contributions

In terms of its structure, the potash market is consolidated with the top ten producers controlling around 85% of global supply. These large producers typically set prices in response to demand considerations, with smaller producers largely occupying the role of price-takers.

Chart 1: Percentage share of global production

Source: U.S. Geological Survey, Mineral Commodity Summaries, January 2022

Supply, demand, and price outlook

Global population growth and associated food demand, as well as declining arable land availability due to urbanization in many developing countries, point to continuing strong potash demand growth for the foreseeable future.3

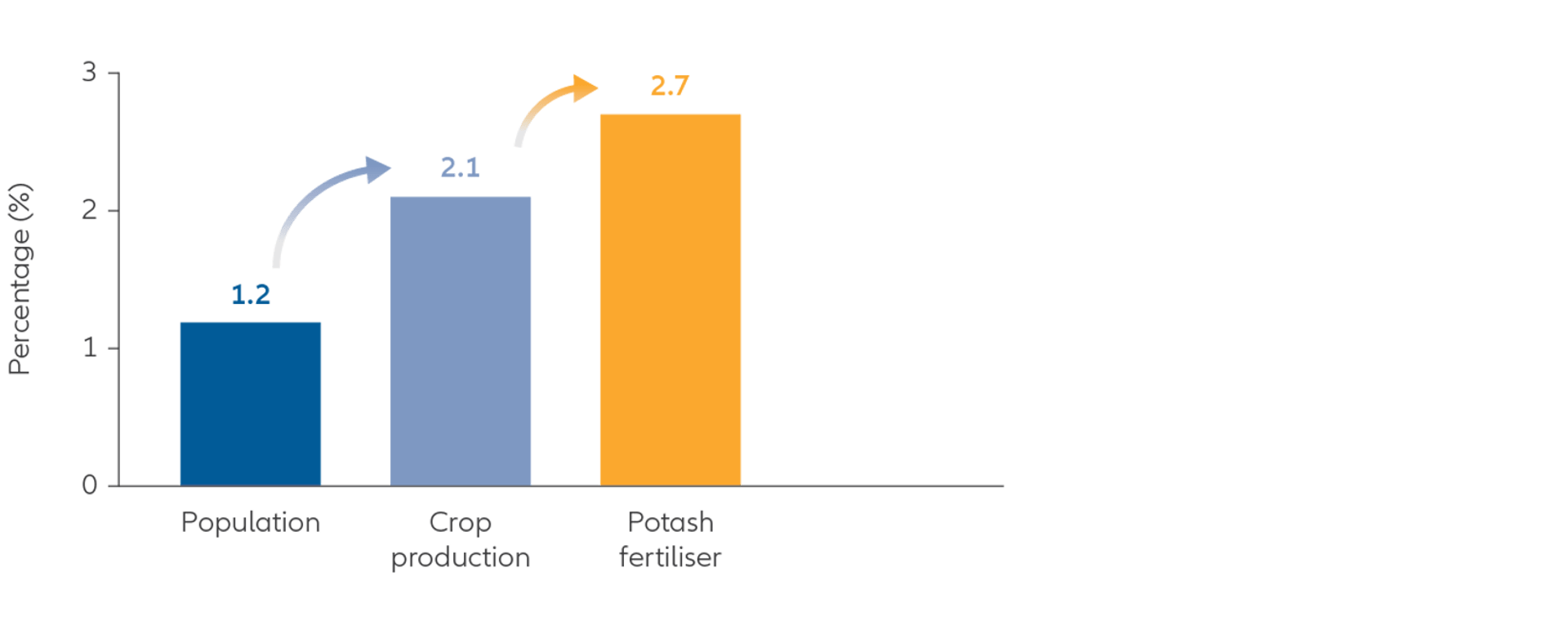

Indeed, recent decades have shown that growth in potash production outstrips growth in crop production, which itself outstrips population growth.

Furthermore, there are currently no known substitutes for potassium-based fertilizers and while farmers will occasionally take “potash holidays” in reaction to elevated pricing, these are normally short lived as maintaining high soil potassium levels is seen as crucial to consistent crop yields and farm profitability.

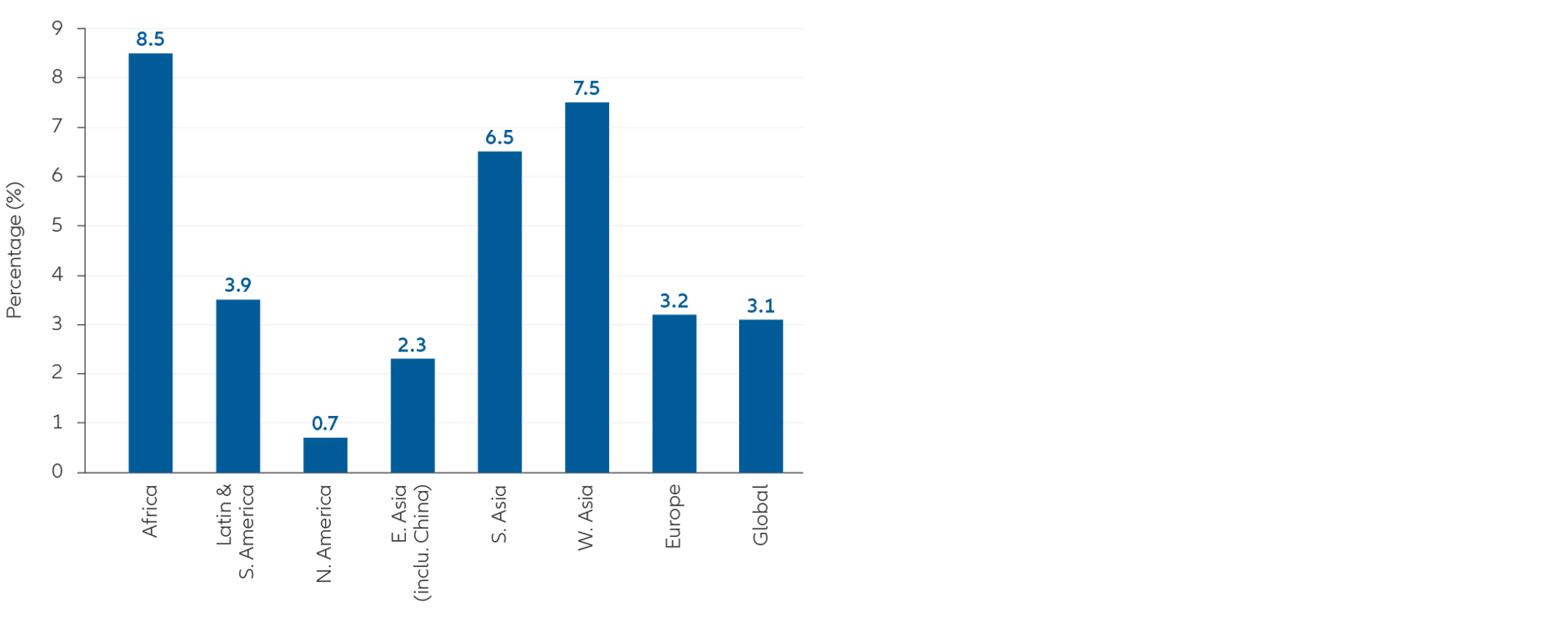

Chart 2: Global Potash consumption growth (CAGR between 2015-2020)

Source: FAO (2017), FD

Chart 3: CAGR, 1993-2020 (%)

Source: BHP, Potash outlook and fundamentals, 17 June 2021