“Slower global economic growth will likely weigh on results in the second half, but with fundamentals holding up better than once feared we think there is still room for positive surprises, which will support stock pickers.“

Virginie Maisonneuve

Global CIO Equity

Equity strategy: point of impact

With the US Federal Reserve taking a “hawkish pause” on interest rate hikes, and the European Central Bank (ECB) flagging there is no pause in sight – despite an economy technically in recession – investors will likely contend with further macro uncertainty in the second half of 2023.

Investors face three key questions: how fast will the monetary policy tightening of the last 12-15 months impact economies? What sort of recession or slowdown should we expect? And how will corporate earnings hold up under these conditions?

It normally takes 12-18 months for the lagged effect of monetary policy tightening to bite. However, it is fair to expect the impact may be delayed by the excessive liquidity central banks injected during the Covid-19 pandemic. The demonstrable resilience of the US economy is another factor.

Inflation stickiness will also impact how long the central banks send a hawkish message and determine their action going forward. Monitoring inflation data and its sub-trends will therefore be critical. Headline inflation numbers are easing, but central banks want to see clearer signs of cooling prices before they shift towards policy easing. In the US, core inflation – which strips out food and energy prices – eased to 5.3% year-on-year in May but hasn’t fallen much since December. Euro zone core inflation also eased to 5.3% in May, still higher than the start of this year.

With core inflation proving sticky, there is reason to believe price pressures for services will remain robust, even as economies potentially begin to slow. Significantly, labour costs are rising in many sectors even as raw material costs soften. The pick-up in euro zone wage growth to 5.6% in Q1 2023 (vs 4.8% in Q4 2022) will concern the ECB, for example.

So, while investors may be relieved this cycle of rate rises could be coming to an end, firms operating in the real economy will remain under pressure in the coming months. Some will prove more resilient than others.

Slowdown or recession?

While recession seems to be looming in some regions, so far the point of impact is proving elusive. The exception is Europe where -0.1% growth in both Q4 2022 and Q1 2023 meant a technical recession.

In the US and the UK, many economic indicators are pointing downwards. Money supply measures – which indicate the total amount of money in the economy – have been shrinking for several months. The latest manufacturing purchasing managers’ index (PMI) figures – closely watched measures of business activity – also showed ongoing declines.1

Despite this, in all three economies unemployment has remained at multi-decade lows, helping to delay the sort of contraction in consumer spending that might have pulled them into recession. With employment at a 30-year high and the OECD predicting growth of 0.9% in the euro zone this year, Europe’s technical recession shows unusual characteristics. A recession would normally feature weaker data on both fronts.

China’s economy, which rebounded in Q1 2023 thanks to its post-Covid reopening, is now weakening again on the back of lower global demand for its exports, because of slowing economies elsewhere. There is also the impact of some reorganisation of global supply chains – eg, the “China-plus-one” trend, where companies additionally expand their operations outside China with the aim of building more resilient supply chains.

We expect bad news to bring good news in China as the authorities are likely to give ongoing support to the property sector and consumers in the second half of the year. The authorities are also set to focus on reforms to support national industrial champions around technology and innovation. In the short term, though, the slowdown in Chinese growth will add to the global economic deceleration at play.

Earnings: the preservation game

Given this backdrop, what should investors look for? One of the major tests for companies will be whether they can pass on rising costs without sacrificing sales. In other words, which companies will be able to preserve margins?

If interest rates stay higher for longer, the fact that “money has a cost again” will cause some firms to struggle as employees demand higher wages and suppliers demand higher prices. Still, in the first quarter of 2023, many companies actually beat analysts’ earnings expectations after forecasts were lowered to account for the impact of inflation.

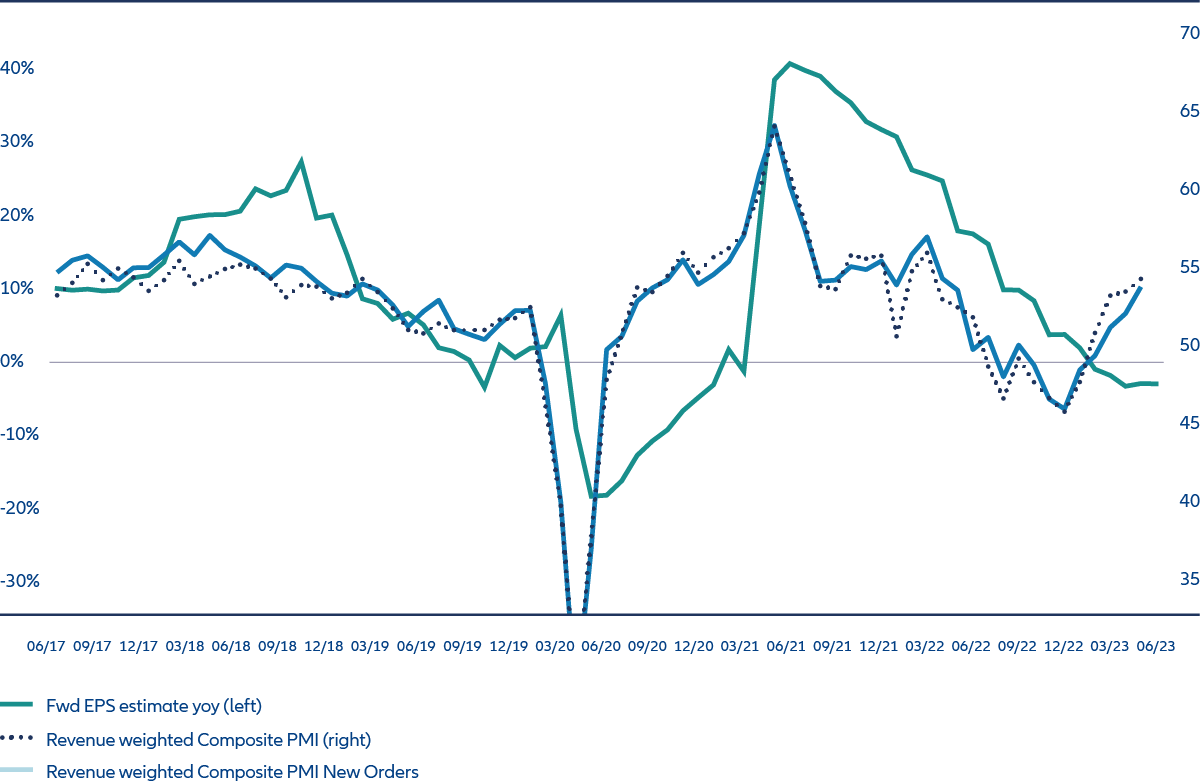

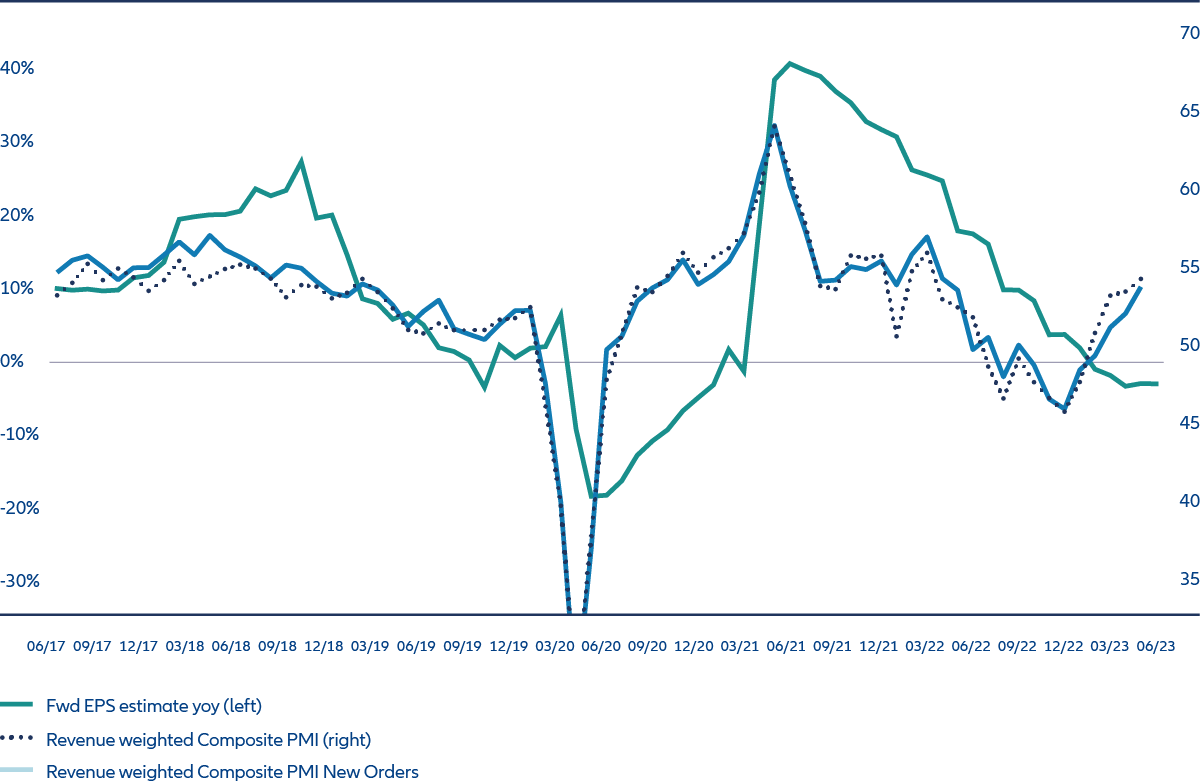

Some firms have shown a tendency for “greedflation”, where they are pushing prices beyond inflationary pressures – hence some of these earnings beats. But this approach can have a detrimental effect on volumes and impact future earnings. We want to hold quality companies with genuine pricing power. Slower global economic growth will likely weigh on results in the second half, but with fundamentals holding up better than once feared (see Exhibit 2) we think there is still room for positive surprises, which will support stock pickers.

The stresses in the banking sector – and its concentration on some very specific names – are a timely reminder that the impact of higher rates will play out unevenly across regions and asset classes. Another reason for investors to avoid any “one size fits all” approach.

Rely on resilience and structural trends

As the focus shifts from interest rates to the timing of recession or slowdown, volatility could return to equity markets, particularly as earnings expectations appear out of kilter given the shifting macroeconomic visibility.

Our focus for the rest of 2023 will be on resilience and long-term structural growth opportunities. Investors should seek to ensure portfolios are resilient to further volatility while positioning for the opportunities that appear – including those companies that are resilient to higher input costs and margin pressures.

Key for portfolios will be holding strong companies across the style spectrum with an emphasis on quality, dividend and sustainability, and anchored around reasonable valuations and long-term structural trends.

Themes we believe remain attractive include profitable technology firms and artificial intelligence and selected industrials, such as companies benefiting from reshoring, automation or climate solutions. In our view, China’s historically counter-cyclical economy also continues to present selective opportunities.

Exhibit 2: Which firms will be resilient to the earnings downturn?

Source: AllianzGI Economics & Strategy, Refinitiv Datastream. Data as at 14 June 2023.

1 Source: U.S. manufacturing slumps further in May; employment picks up, Reuters, 1 June 2023; Euro zone business growth slowed in May as factories struggled-PMI, Reuters, 5 June 2023; UK factory output contracts again in May, Reuters, 1 June 2023