Active is: Investing globally

Winds of change favour China’s advanced tech companies

China has a long history at the forefront of innovation, and government policy is ensuring it continues that tradition to drive the next stage of the country’s ongoing economic growth story.

Key takeaways:

- China has ambitious economic growth targets, and advances in tech and innovation will be integral to achieving this vision

- Government policy is fostering innovation in China, with recent policy changes relating to the tech sector helping industrial tech players to outperform consumer tech

- Companies that embrace these changes – in available technology and government policy – will be well positioned to benefit

China’s most recent five-year plan, published in 2020, featured the word “innovation” 165 times while “digital” appeared 81 times. By contrast, “the Communist Party” was mentioned only 54 times. The importance China’s government is placing on its intensifying quest to become a tech superpower is clear, as it looks to double its GDP by 2035.

China’s recent growth story has been synonymous with consumer tech – both platforms and hardware – but the country is sharpening its focus on high-tech manufacturing, and embarking on a new wave of innovation intended to secure its position as the global leader in industrial tech. Succeeding in this goal will be key to China achieving self-sufficiency in those areas of the economy that it considers most strategically important, such as building the tech infrastructure needed to underpin the country’s targeted growth.

Notably the government has adopted a policy of channelling investment and resources into industrial tech over consumer tech. Equity markets foresaw this change in tech policy as long ago as 2019, when the semiconductor index started to outperform the internet index. That was two years before a high-profile crackdown on consumer tech began in 2021, which saw tighter government monitoring and stricter regulatory enforcement in the sector, impacting several big-name Chinese tech stocks.

A shift in government focus on tech

These policy shifts can tell us a lot about government plans for the future of tech in China. As a result, some domestic Chinese stocks could appeal to investors looking to benefit from China’s ongoing emergence as a distinct tech superpower.

Evidence of China’s new wave of innovation abounds. It is already the world’s largest market for electric vehicles (EVs), accounting for about 40% of global sales; it is the world leader in renewables, with more than 70% of global output across the solar production chain; it has more than 1,000 new drugs currently in development; and is the world’s largest market for industrial robots.

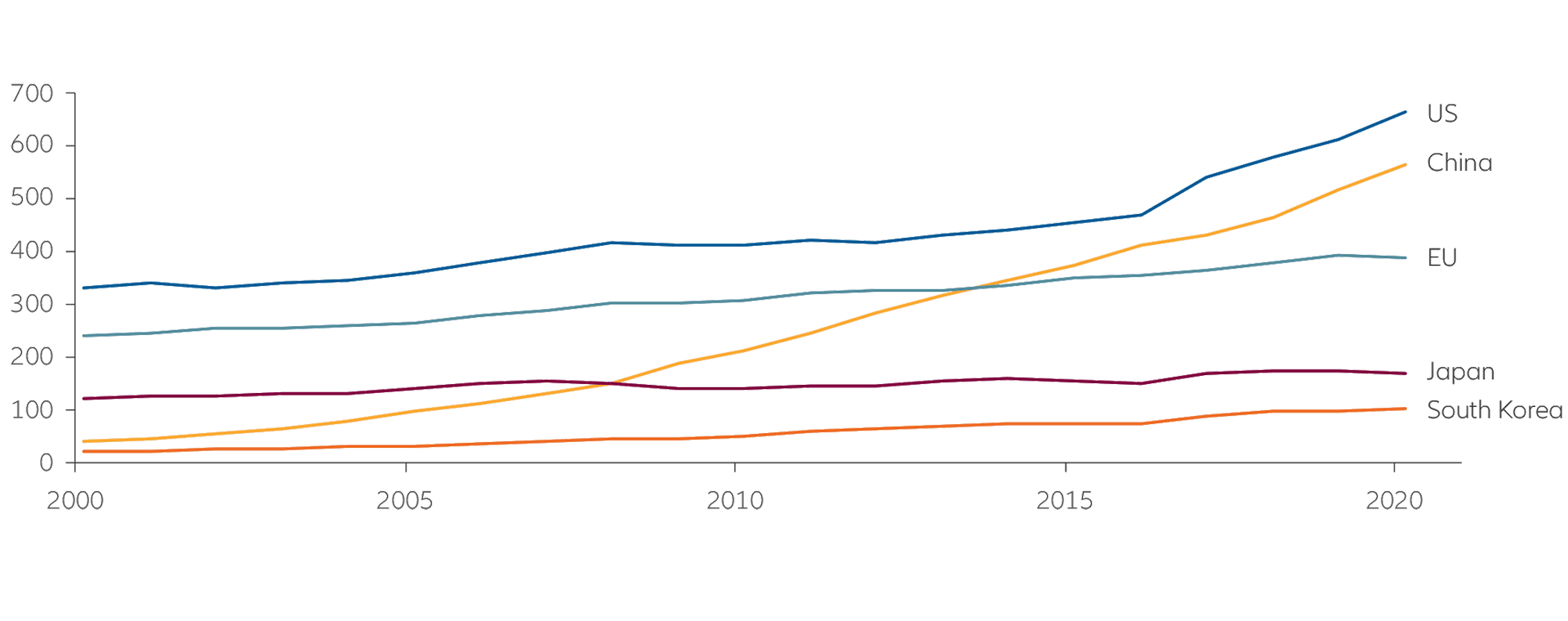

Additionally, China accounts for the highest number of patent and trademark applications globally; in 2020, the country accounted for 45.7% of all patent filings and 54.3% of trademarks.1 As Exhibit 1 shows, North America still leads in terms of research and development spending, but China is closing the gap.

Exhibit 1: Global R&D expenditure (USD bn)

Source: OECD data, Allianz Global Investors, as of 2020

Policy supporting new tech

Those companies at the forefront of harnessing new technologies are benefiting from policy and economic tailwinds, which are accelerating their profit growth. We believe that opportunities will exist for investors in areas such as industrial automation, green tech, healthcare, semiconductors, and smart transportation.

Robot density is often used as a yardstick of a country’s technological development. With an ageing population and increasing labour costs, Chinese companies are embracing industrial automation and installing robots at a rate that has seen the country quickly rise to rank in the top 10 countries globally in terms of robot density. The adoption of robotics is likely still at an early stage and there remains further room for growth.

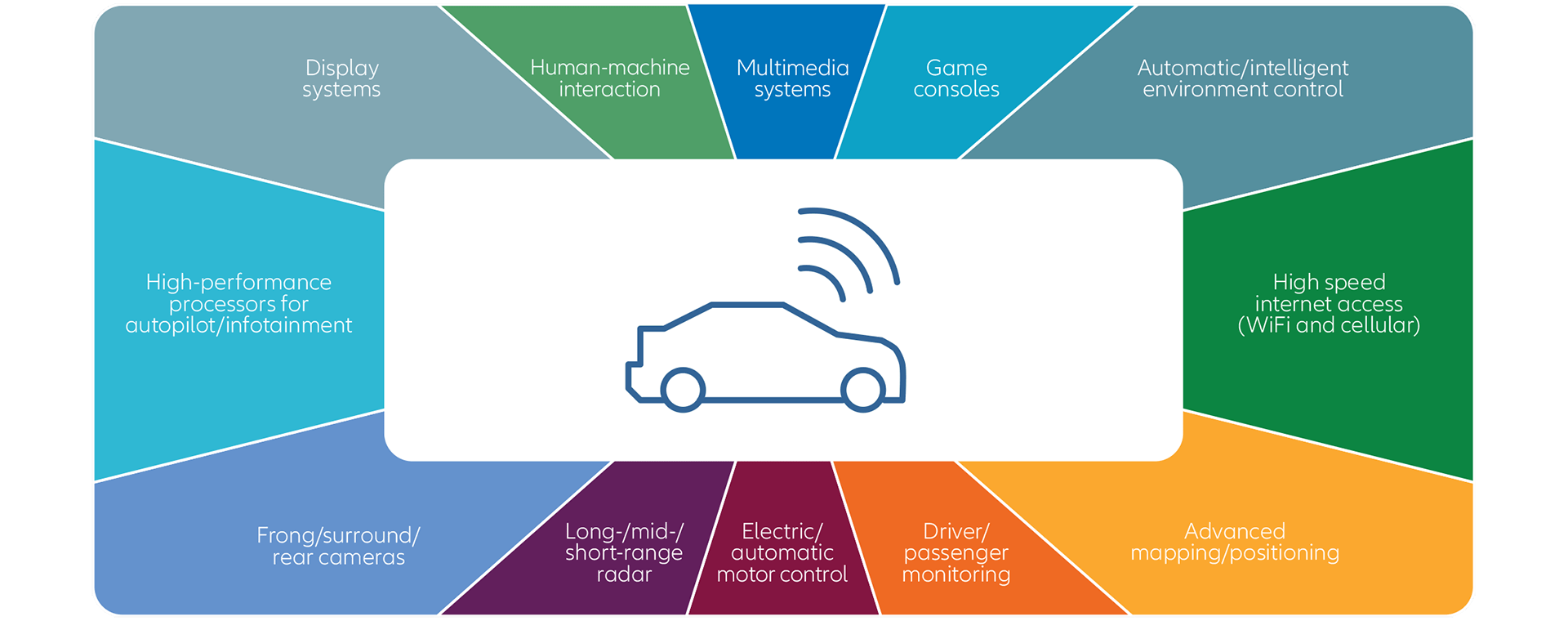

Semiconductors are probably even more important for the country’s future ambitions. By value, China imports more semiconductors than it does oil. The chips are the key commodity for various aspects of manufacturing tech. Just consider EVs: as Exhibit 2 shows, semiconductors are needed for functions including motor control, cameras, human-machine interaction, high-performance processors, display systems and many other features. As demand for the technology underpinned by semiconductors rises, so demand for the semiconductors themselves will likely rise in line.

Exhibit 2: Semiconductor demand to rise with technological advancement (eg, smart transportation)

Source: Allianz Global Investors

Pioneering medicine

Another area of innovation that is growing rapidly – driven by the burgeoning needs of a population which is growing older and more affluent, but less healthy– is healthcare. By 2060, we estimate that China’s population will include about 400 million over-65s – almost a third of the population. About half of that number are predicted to suffer from cancer or cardiovascular or neurological diseases. At the same time, rates of diabetes and obesity are surging among younger people.

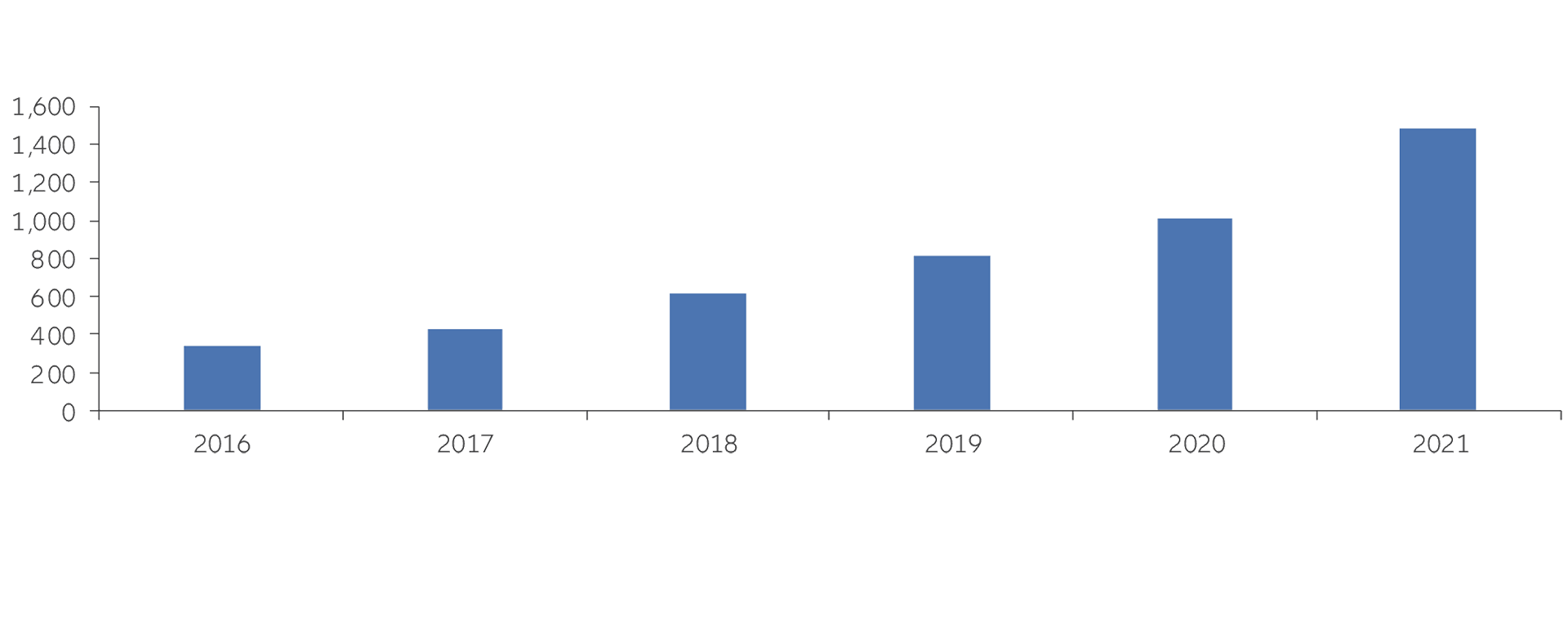

To treat these illnesses, innovation in drug development and medical devices is booming. As Exhibit 3 illustrates, there are around 1,500 drugs in clinical trials, up from about 300 as recently as 2016.

Healthcare innovation will likely drive further opportunities for investors as China seeks to build on its long history of pioneering medicine. Currently the market capitalisation of the five biggest Chinese healthcare companies, equates to only about a quarter of the five largest EU healthcare firms, and just 15% of the five largest US firms’ market cap. We anticipate significant room for further growth in the next 10 to 20 years.

Exhibit 3: Number of Chinese clinical trials for “innovative” drugs

Source: PharmaGO database as at May 2022. The information above is provided for illustrative purposes only, it should not be considered a recommendation to purchase or sell any particular security or strategy or an investment advice. Past performance, or any prediction, projection or forecast, is not indicative of future performance.

Industrial tech and healthcare driving China’s growth

While sectors like domestic consumption and real estate led China’s growth in the past decade, in the 2020s the baton has been handed to advanced technology, most notably industrial tech and healthcare. The importance of these sectors to the broader Chinese economy should mean that the government continues to foster a supportive environment for companies operating in these areas.

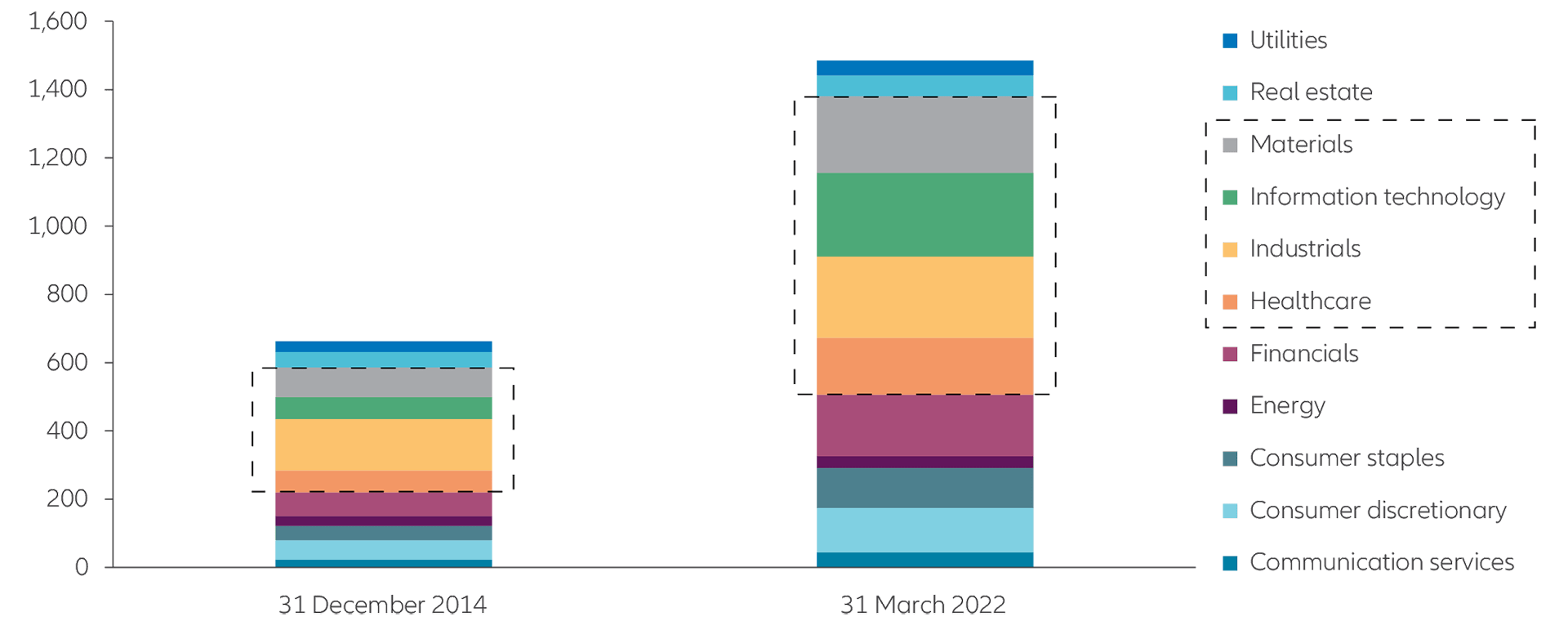

These sectors have already seen significant expansion, as Exhibit 4 shows. Those companies harnessing innovation most successfully should yield still greater opportunity in the future.

Exhibit 4: Number of stocks per sector in MSCI China and MSCI China A Onshore Index combined

Source: Bloomberg as at 31 March 2022. The information above is provided for illustrative purposes only, it should not be considered a recommendation to purchase or sell at any particular security or strategy or an investment advice.