Bonds and Bond Funds

A bond fund is a portfolio constructed by a fund house, which invests in bonds or debt securities with different maturities issued by a range of issuers. Just like an equity fund, the manager of a bond fund selects bonds or debt securities according to the established investment objectives and management policy.

Through an active management approach, these funds invest in a wide range of bonds to diversify risks and adapt the asset allocation to the changing market conditions, in order to capture gains.

In addition, the entry barrier for bond funds is generally lower compared to direct investments in bonds, which allows access to a diversified bond portfolio at a lower cost.

The difference between bond funds and bonds

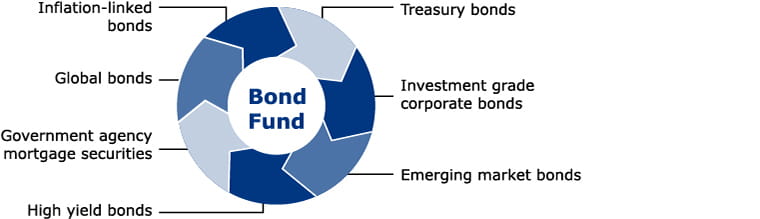

Different types of bond funds invest in different bonds and debt securities. The underlying assets may include more direct investments such as government or corporate bonds as well as more complicated investments such as asset backed securities (ABS).

An “all-in-one” bond fund

The return on bond funds depends on the interest payment and changes in market value of the underlying bonds and securities. In direct investments, an investor can receive regular coupon payment and the principal at maturity. However, bond funds have no maturity date and principal repayment. Any interest payout is subject to the distribution policy. Re-investing the dividend provides the opportunity to add value and hence increase the potential return.