Don’t downsize your goals

How investors can guard against lasting inflation

Summary

How can investors reposition their portfolios in the face of a persistent rise in consumer price inflation? In part two of a two-part paper, we share the results of our proprietary analysis into the asset classes that may provide an optimal inflation hedge.

Key takeaways:

- Given our view that inflation is set to last longer than many market watchers expect, we conducted our own analysis into how different asset classes performed in a range of inflation environments

- Our research found that with moderate inflation (2%-4%), equities were the top-performing asset class, and sovereign and corporate bonds both generated decent positive annual real returns

- Perhaps surprisingly to those who consider gold to be the ultimate hedge against inflation, gold’s returns were mixed across different inflationary environments

- Commodities consistently generated solid positive returns in times of high and rising inflation, but their longer-term outlook may be obscured by the transition away from fossil fuels

In our view, global central banks and many investors underestimate the probability that consumer price inflation may turn out higher than expected and last longer than currently priced into financial markets. While we don’t foresee a return to the price environment of the 1970s, we think medium-term inflation risks are nevertheless skewed to the upside, and we may see a more regular overshooting of central banks’ inflation targets over time. This is contrary to the consensus scenario (and the view of most central banks) that the rise in inflation is just a temporary phenomenon – a perspective that we think is a bit too sanguine. To learn more about the eight factors driving inflation higher, read Inflation: beyond transitory.

As a result, we believe investors should take a closer look at how their portfolios are positioned to hedge against inflation. In seeking to determine some of the optimal ways to provide this hedge, we conducted our own in-depth analysis of a range of asset classes. Explore the four sections below to see the results of our findings.

From our perspective, the conventional wisdom oversimplifies how inflation affects major asset classes – as shown in this high-level overview (see Exhibit 1).

Exhibit 1: the consensus view may oversimplify the effect of inflation on major asset classes

| Impact of inflation | |||||||

|

Asset class |

Conventional wisdom |

Our view |

Why? |

||||

Government bonds |

Inflation is a negative for government bonds |

Usually negative, but not alway |

Higher inflation isn’t always a drag on performance, in particular if it’s already priced into market-based inflation compensations (“inflation breakeven rates”). Moreover, the real risk-free rate can go down (driving bond prices up) if markets anticipate a slowdown in real GDP growth and, consequently, easier central bank rates. |

||||

Corporate bonds |

Inflation is better for corporate bonds, but still detrimental |

Mixed results |

Corporate bonds have a complex relationship with inflation (eg, investors make assumptions about inflation’s impact on corporate profits, the pricing of default risks, etc) |

||||

Equities |

In times of inflation, equities don’t perform as well as commodities |

Equity performance depends on the inflation level |

Inflation can affect equity valuations in multiple ways. Our research has shown that equities have done best in periods of moderate inflation – historically better even than commodities and gold. |

||||

Source: Allianz Global Investors.

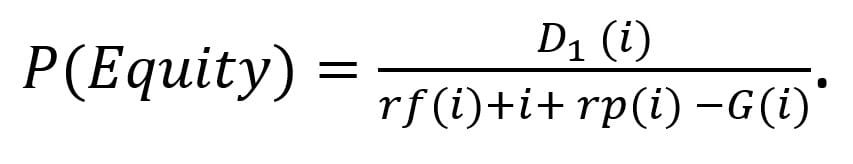

The equity example in particular is worth closer examination, as there are many ways to assess the relationship between inflation and equities. According to the Gordon Growth Model, which is a simplified dividend discount model widely used to value stocks, inflation – shown below as (i) – would enter the equation in many complex ways:1

The ultimate effect on equity prices stemming from higher forecasted inflation is unclear, as inflation affects both the numerator and denominator. Obviously, a higher inflation rate can raise the discount rate via a higher inflation premium. But, again, the real risk-free rate is likely to change as well.

Moreover, a higher inflation rate can also impact the expected dividend as well as the long-term earnings growth, both in nominal and real terms. For example, dividends and earnings very much depend on corporate pricing power, which itself is related to multiple factors. These include the industry in which a company operates, the difference between economic and accounting depreciation, and the origins of inflation (demand pull or cost push). In addition, the equity risk premium is likely to move – for example, if the outlook for central bank policy and inflation were to become less clear.

However, many investors are not aware of the complex dynamics between bonds, equities and inflation. As a result, they rush to simple and frequently incorrect heuristics when assessing the relationship between equities and inflation surprises. It is therefore of utmost importance to also analyse the empirical data that enable us to identify typical relationships between inflation and asset prices.

We analysed more than 50 years of performance across asset classes

In seeking to determine some of the optimal ways to hedge against inflation, we looked at periods when US inflation was at least 2% and rising, year over year, since this matches what we think is the most likely scenario for the near future. We analysed the year-over-year performance (in US dollars) of several asset classes – US cash, US government and corporate bonds, US and global equities, and commodities. (Note that we believe our key conclusions would likely hold true for non-US markets as well.) And we sought data going back at least 50 years, when the world entered the current fiat money system post-Bretton Woods. (Where possible, we also looked for data reaching back to 1945 – the end of the second world war.)2

The top-line findings from our research presented several surprises

Based on these parameters, the key findings from our study have been presented in the following table (Exhibit 2). See the Appendix for a closer look at our findings.

Exhibit 2: key findings from our research into inflation’s effect on key asset classes

|

Annual inflation level |

Equities |

Fixed income3 |

Commodities and gold |

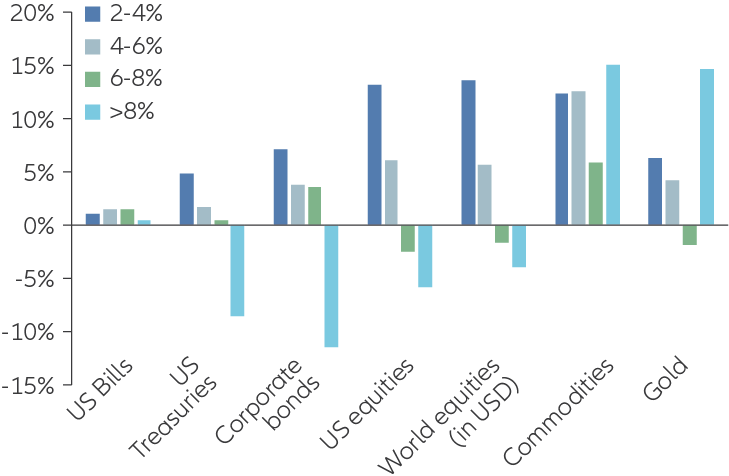

2%-4% |

Equities were the top-performing asset class (see Exhibit 3). Real returns were in double digits on average (vs long-term average of 7%) |

Sovereign and corporate bonds generated decent positive annual real returns (around 5% and 7% respectively) |

|

4%-6% |

Equities outperformed bonds, but absolute year-over-year returns were in low- to mid-single digits (lower than their long-term average) |

Bond returns were also in low- to mid-single digits |

|

6%-8% |

Negative absolute returns on average – underperforming bonds |

Bonds outperformed equities |

|

Greater than 8% |

Negative absolute returns on average, though better than Treasuries and corporates |

Corporates performed worse than sovereigns |

Source: Allianz Global Investors.

Exhibit 3: historically, commodities had been the best hedge against inflation – but equities also did well in moderately inflationary environments

Average annual real asset returns since 1971 in times of positive inflation surprises and inflation above 2%

Source: Allianz Global Investors.

Other research and empirical evidence appear to back up our findings

Importantly, we also found other empirical evidence that backed up our main findings from an economic perspective.

- Bond returns were likely to suffer in times of higher inflation rates that are perceived not to be only transitory. This is because investors will demand higher inflation compensations, as the historical data show. It’s also important to keep in mind that the low current yield of most fixed-income instruments today provides a weak cushion against a rise in inflation and interest rates.

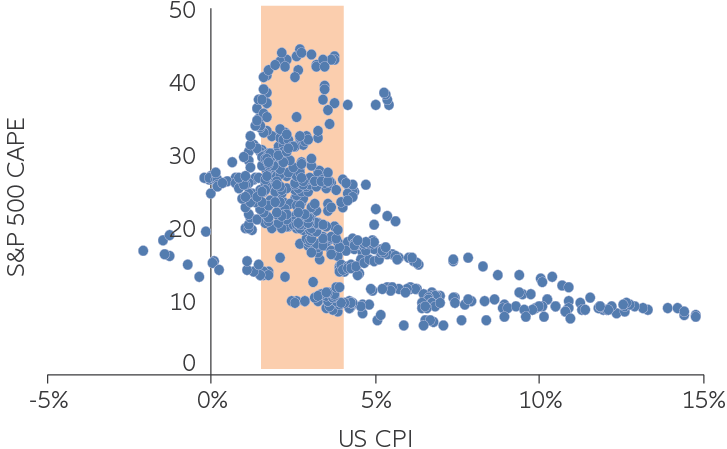

- For equities, low- to mid-single-digit inflation rates turned out to be a critical hurdle rate for certain economic variables. It turns out that US equity valuations, based on the cyclically adjusted price-to-earnings (CAPE) ratio, tended to be in a sweet spot at inflation rates between approximately 1.5% and 4% (see Exhibit 4). But once inflation rose further, multiples tended to fall.

Exhibit 4: equity prices historically responded best when inflation was around 1.5%-4%

CAPE vs inflation since 1971

Robert Shiller, Allianz Global Investors. Data as at September 2021. CAPE = cyclically adjusted price-to-earnings; CPI = Consumer Price Index.

What accounts for the fact that a higher amount of inflation had a negative effect on equity valuations? Economic theory suggests that inflation above a certain level creates all kinds of distortions weighing on economic growth:

- The higher the inflation rate, the more private households and companies find it difficult to differentiate between absolute and relative price increases. Consequently, they may make suboptimal spending and investment decisions, which can dampen economic growth. Private households typically cannot increase their nominal income (ie, wages) in sync with rising expenditures. Consequently, real disposable income suffers from rising inflation, which can also be a drag on growth.

- While corporate input costs usually increase during periods of rising inflation, companies may struggle to adjust their production processes and output prices accordingly.

Empirically, we found that inflation rates between 4% and 6% “moved the needle” in the wrong direction. Inflation-adjusted corporate earnings growth tended to fall once inflation went beyond these levels. In the same vein, private household per capita consumption and real GDP growth suffered as well. This can help explain our other findings for the various asset classes we studied:

- Equities have been an imperfect hedge against inflation – not only in absolute terms, but also relative to bonds, once inflation rose to mid- to high-single-digit levels.

- In the same vein, corporate bonds have been inferior to sovereign bonds in times of very high inflation (which we define as greater than 8%). This may be because growth concerns take over, and investors start to price in significantly higher risk premia (spreads).

- The findings on commodities, admittedly, may also be dominated by the oil price shocks of the 1970s. It remains to be seen if energy prices will continue to rise structurally in a world that is moving away from fossil fuels.

- Gold is not an ideal inflation hedge, in our view. The gold price primarily benefits from low, if not negative real interest rates, which are the opportunity costs of holding any asset paying zero cash flows, like gold. The level of real interest rates, though, depends more on monetary policy and real economic factors – such as economic growth and the savings/investment balance – than on the inflation rate. Nevertheless, gold may be supported by growing concerns about the sustainability of the current fiat money regime, in light of ever-rising private and public debt levels and unprecedented global money supply.

Equities: based on our view of inflation, equities are a hedge worth considering

While we expect inflation to surprise on the upside relative to current market expectations, we also believe it will remain far below the levels we saw in the 1970s and early 1980s. This would put the inflation rate somewhere between 2% and 4%. At that level, our research shows that equities have historically generated strong inflation-adjusted returns – better than bonds. In the end, equities are real assets and may be able to provide a solid hedge against unpleasant potential inflation surprises – notably compared with highly priced bonds.

Nevertheless, we should keep in mind that US equity valuations are quite stretched already, which may dampen the return outlook. Moreover, a rise in inflation volatility, not just the inflation rate itself, also matters for equity valuations. Our long-term absolute return expectations for equities are therefore moderate.

Fixed income: active managers can still seek positive returns when inflation is rising

While rising inflation is one of the biggest risks for investors in nominal government bonds, there are ways for active managers to generate positive returns in such an environment. The four building blocks of nominal government bond yields are the real risk-free rate, the real term premium, the expected inflation rate and the inflation risk premium. Active fixed-income managers can seek to generate returns from positioning on changes in each of these factors using a variety of instruments. To learn more, read “How inflation can be an opportunity for active fixed-income investors” by Jan Simon King, Fixed Income Product Specialist at Allianz Global Investors.

Commodities: strong historical performers during inflationary environments, but climate change could affect the outlook

Commodities have historically done even better than equities in most inflationary environments, but the outlook for commodities is less clear to us. Economic policy that addresses climate change could create some headwinds for energy commodities, whereas demand for industrialized metals – particularly copper, which is a highly efficient heat and energy conductor – will be reinforced by the “green transition”.

Private markets: for institutional investors, a strong contender as an inflation hedge

Although outside the scope of our research for this paper, institutional investors may also want to consider investing in the debt or equity of privately held companies. Private market assets can help investors hedge against – and even benefit from – a sustained return of inflation. This may be because of their long-term buy-and-hold qualities and their ability to pass on cost increases. To learn more about this unique asset class, read “How private markets can help navigate rising inflation expectations” by Emmanuel Deblanc, Head of Private Markets at Allianz Global Investors.

Information herein is based on sources we believe to be accurate and reliable as at the date it was made. We reserve the right to revise any information herein at any time without notice. No offer or solicitation to buy or sell securities and no investment advice or recommendation is made herein. In making investment decisions, investors should not rely solely on this material but should seek independent professional advice. However, if you choose not to seek professional advice, you should consider the suitability of the product for yourself. Investment involves risks including the possible loss of principal amount invested and risks associated with investment in emerging and less developed markets. Past performance of the fund manager(s), or any prediction, projection or forecast, is not indicative of future performance. This publication has not been reviewed by the Monetary Authority of Singapore (MAS).

Issuer: Singapore – Allianz Global Investors Singapore Ltd., [Company Registration No. 199907169Z].

Don’t downsize your goals

Two bond market ideas to help guard against rising inflation

Summary

After many years of falling inflation, the second half of 2021 could be remembered as the time when prices started to rise again. How should bond market investors respond? Here are two more ideas.

Key takeaways

|