Embracing Disruption

Beyond tariffs – Assessing the broader impact of trade rebalancing within a shifting world order

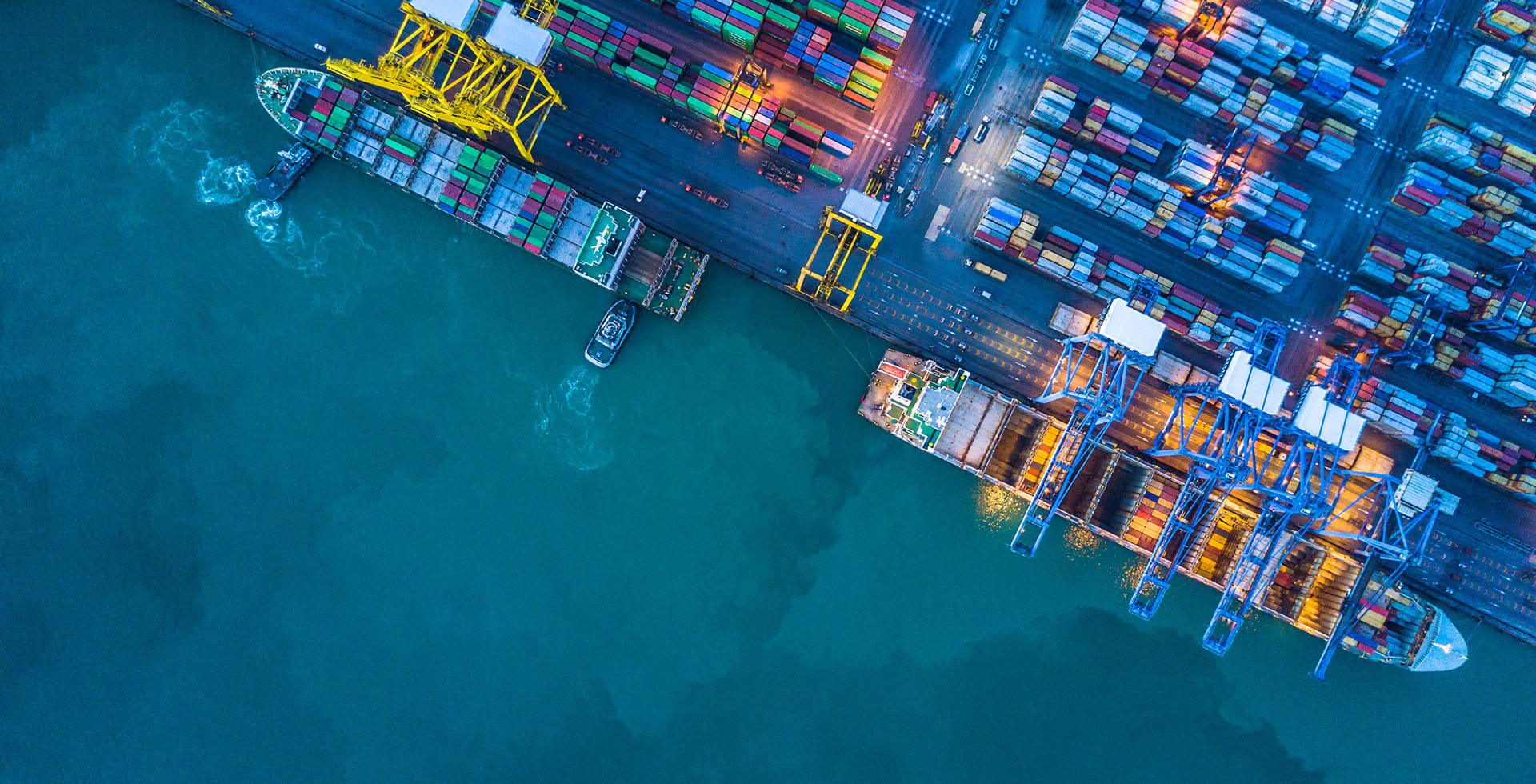

Despite the ongoing uncertainty and repeated walk backs, it is clear that we are entering a period where world trade is rebalancing. Greater barriers to trade – principally between the US and China, but also between the US and the rest of the world –are expected to stay for some time at least. And there is also the danger that protectionism spreads in an unpredictable way, as both the US and China threaten smaller trading partners against conducting independent deals.

US Treasury Secretary Scott Bessent and trade advisor Peter Navarro recently suggested Trump’s tariffs could raise up to USD 600bn, a figure – if it’s achievable – that would roughly tally with the costs of tax cuts currently being discussed by Congress. While the “final” rate of tariffs on China, Europe, and elsewhere, are yet to be seen, budget imperatives mean that we are very likely to see a concerted effort by the administration to raise revenues in this way. Where the final burden fall is yet to be seen, but it seems likely the bulk of these funds will be extracted from US- China trade, with smaller levies on the EU and other trade partners, which in itself will dampen trade levels, and will put into question the USD 600bn headline figure. Either way, it seems unlikely that 2024’s record USD 33 trillion of global trade – an increase of 3.3% on the previous year – will be matched in 2025.

Wide-ranging consequences

While the medium- and long-term impacts of this new world of trade protectionism are difficult to predict, the rebalancing of trade that is already taking place chimes with other trends in the global economy, such as China’s move from the world’s workshop to an innovator and leader in many fields, and the emergence of its own “tech hemisphere”. Greater difficulties in accessing technology from the US is likely to accelerate this trend as Chinese firms step up to provide alternatives – the hype around DeepSeek R1 earlier this year gives a possible taste of what’s to come.

With the IMF’s latest World Economic Outlook taking a percentage off predicted US growth this year, as well as downgrading its outlooks for virtually all the world’s other major economies, the immediate consequences of the administration’s recent actions are clear – global growth is set to slow considerably and recession risks have risen markedly. Looking further ahead, a range of scenarios are possible. While inflation in the US is likely to be stoked – in the same report, the IMF predicted an extra percentage point on US price growth this year – the effects on Europe and the rest of the world may be mitigated by the impact of Chinese exports originally destined for the US seeking a new market. Indeed, the ECB predicts eurozone inflation will continue to moderate in 2025, while declining close to the 2% target in 2026 and 2027. Current inventory build-ups due to transactions being delayed or canceled may also dampen production and growth later in the year.

Yet the effect on Europe will be profound, even if it takes some time to see which direction the continent takes as it reacts to the realignment of trade between the world’s other two trading behemoths. And, of course, these developments come alongside the changing defence and security relationship between Europe and the US, as the latter’s burgeoning isolationism is reaching across the geopolitical as well as trade spheres. Whether Europe’s growing military independence comes alongside other geopolitical realignments is yet to be seen, but a growing closeness with China and other Asian partners can’t be ruled out. Indeed, in the wake of the US’ recent actions, the European Commission dismissed the idea of “de-coupling” from China and statements from prominent figures such as the British Chancellor have been bullish on ongoing trade relations with the Asian giant. The longer-term effects on the profile of European industrial production are difficult to predict, but there is likely to be some rebalancing, perhaps towards newer tech-focused sectors.

The upending of global trade norms is also having a marked effect on currency markets, with the dollar recently depreciating over 5% across a basket of currencies, and even further against some, including the euro. This weaker dollar will exacerbate tariff-related inflationary pressures in the US, while cheaper US exports may lower the trade deficit in the mediumterm – a stated goal of Trump administration. However, despite potentially making exports more competitive, the danger of loss of confidence in the world’s biggest economy is that foreign holders of US debt begin offloading these assets, driving rates damagingly higher. Alongside continuing political pressure on the Federal Reserve and pervasive geopolitical instability, the future for the USD remaining the key safe haven currency is being questioned as tariffs, trade competitiveness, and the unclear financing of a growing US trade deficit weighing on investors’ minds.

Seeking resilience and managing uncertainty

The existing changes to the world order we have been experiencing since at least before the Covid pandemic will be accelerated by the US’ new positioning, impacting trading patterns and the geopolitical balance. Even if tariffs remain at the relatively low level of 10% for most countries, the shock to US-China trade will still be felt more broadly, and those countries which manage to show the most resilience will fare best. For China, fiscal and monetary stimulus, as well as pension reform, will certainly help cushion the impact. For others, resilience will entail finding ways to support domestic while deftly negotiating the new political landscape to avoid alienating the key protagonists in this latest round of trade drama.

Another potential unintended consequence of the US’ moves to rebalance global trade is a shift in global flows of foreign direct investment (FDI). In a world where it becomes more expensive to trade and exchange goods, global firms will now consider carefully where to invest – perhaps “bringing jobs to the US”, or other geographies. This might take time to unfold as companies digest the implications of such shifts, especially in a world that is currently volatile in terms of growth outlook, demand, and currency stability.

Despite the second Trump administration noting how “tariff shopping” led to some of the ineffectiveness of the first administration’s policies, there will no doubt be attempts to cushion their impact using similar strategies. Of course, this remains extremely difficult given the current uncertainty and almost daily announcements of future new tariffs, exemptions, or walk backs. How individual firms fair will be largely dependent on these decisions, alongside the actions taken by national governments struggling to make sense of their place in a rapidly changing world order.