Transforming Infrastructure

Digital infrastructure is a basic public service – from 5G to AI

The pandemic has high- lighted the importance of digital infrastructure as a public service. Just five years later, we have taken a significant step forward: many research and analysis tasks are already being performed using AI (artificial intelligence)-supported tools, and more and more people are using artificial intelligence to automatically compose emails and private correspondence. Digital infrastructure is rapidly becoming a cornerstone of modern basic public services.

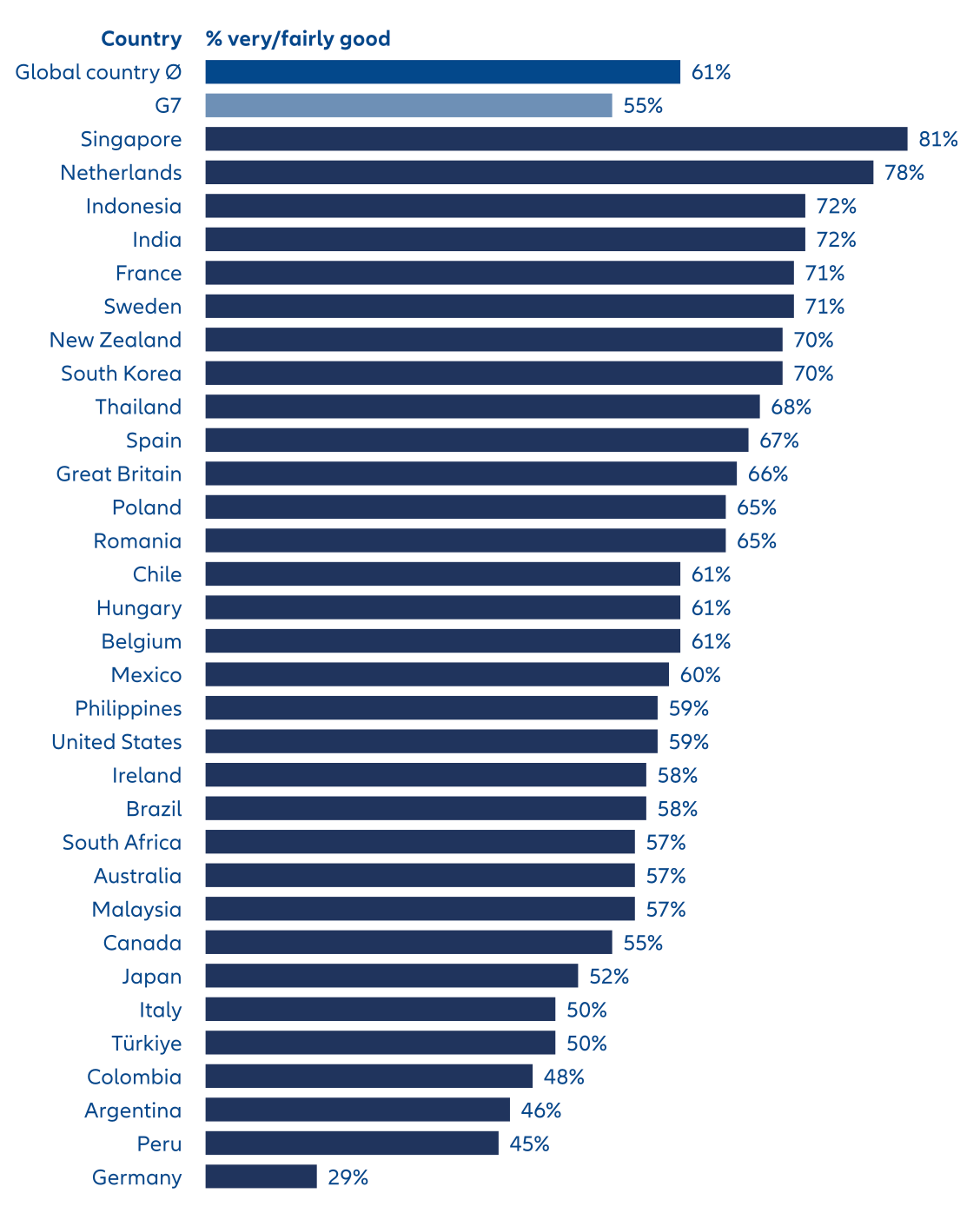

However, according to a study by GIIA, only 55% of respondents in the G7 countries consider the quality of digital infrastructure in terms of 5G and fibre optic internet in their country to be very good or at least fairly good (see Exhibit 1).

The increasing use of cloud solutions, artificial intelligence and networked applications is leading to a massive need for investment in telecommunication towers, fibre optic networks and data centres. This can create attractive investment opportunities for institutional investors: accordingly, the share of digital infrastructure in the total transaction volume has risen significantly in recent years. We expect this segment to remain one of the most dynamic and fastest- growing areas in the infrastructure sector in the future.

Exhibit 1: Ratings – Digital infrastructure such as high speed broadband, full fibre networks (FTTP), 5G

Source: Base: 23,530 adults (online), 32 countries, May-June 2024. Ipsos, Global Infrastructure Index 2024

Telecommunication towers – the pillars of mobile communication

Since its introduction in 2019, 5G, the fifth generation of mobile communications standards, has been regarded as the new benchmark for enabling a connected everyday life. In order to ensure the availability of 5G, cope with the ever-increasing volume of data and close remaining gaps in coverage, a significant densification of the existing network of telecommunication towers is necessary.

The use of 5G goes far beyond mobile data usage via smartphones. In combination with high-performance fibre optic networks, the ever-increasing amounts of data1 can be processed more efficiently.2

Real-time transmissions from device to device enable, for example, autonomous driving or the involvement of experts worldwide in operations that are accompanied by camera recordings, thus allowing live support. Intelligent networking in the ‘Internet of Things’ will continue to grow. 5G, with its higher transmission rates, can make an important contribution here. Approximately every ten years, a new generation of mobile communications emerges with expanded capabilities and higher speeds. Commercial use of 6G is not expected until 2030 at the earliest.3

Mobile towers continue to be the pillars of mobile communication and offer institutional investors attractive investment opportunities. The ongoing densification of networks – driven by the rapid spread of 5G and, in future, 6G – and increasing demands on network coverage and capacity require continuous expansion, which generates significant investment needs.

AllianzGI provided part of the financing for Cordiant’s acquisitions of the leading broadcasting and telecommunications infrastructure platforms in Poland and the Czech Republic.

A key industry trend is that many telecommunications companies are increasingly focusing on their core business and gradually selling or outsourcing their tower portfolios. This model, which has long been proven in the United States, is also gaining significant momentum in Europe. By outsourcing or selling their infrastructure, network operators create financial leeway for investments in innovation and services, while specialised tower companies and institutional investors gain access to high-quality portfolios with a stable, diversified customer base.

For investors, this can provide an opportunity for long-term, often index-linked leases with creditworthy mobile network operators, while also allowing them to participate directly in the growth of digital infrastructure. They can often benefit from a solid business model with low technology risk, as the active antennas are usually owned by the network operators and existing masts can continue to be used regardless of the technology. The quality of the locations, the diversification of the portfolios, the contract terms and the creditworthiness of the tenants are decisive factors for the success of the investment.

Allianz Global Investors is also invested in mobile towers worldwide, both on the equity and debt side. For complete 5G and gigabit coverage within the EU alone, additional investment of over €200 billion is expected.4

Fibre optic networks – The foundation of modern connectivity

Over the past 15 years, the number of internet users worldwide has more than doubled, while global internet traffic has increased twentyfold.5 However, in some European countries, and particularly in more rural areas, the availability of high-speed broadband is still insufficient to meet demand.

Fibre optic networks are the cornerstone of a powerful, future- proof digital infrastructure and open up a wide range of investment opportunities. With the ongoing digitalisation and exponential growth of global data traffic, the demand for fast, efficient networks is constantly increasing. Around the world, outdated copper and cable networks are increasingly being replaced by modern, energy-saving fibre optic technology. The State of the Digital Decade 2025 report from the European Commission shows for example that the Fibre to the Premises (FTTP) coverage in Europe is 69.2% with an annual progress of 8.4%.6 The expansion and economic use of existing networks therefore continue to offer considerable investment potential.

Large institutional investors such as Allianz are already heavily involved in fibre optic projects in Europe, thereby contributing to improved connectivity, particularly in rural areas.

The market environment remains challenging: rising interest rates and operational challenges are putting pressure on new market entrants without sufficient capital resources in particular. Institutional investors with appropriate capital structures and a long-term investment horizon have a clear advantage here. They can often take advantage of stabilising expansion costs and actively shape the potential consolidation of the market. Attractive opportunities may currently arise here, particularly for established, financially strong equity investors.

The initial phase of fibre optic expansion is characterised by classic greenfield investments, which require a long-term investment horizon and a corresponding willingness to take risks. On the debt capital side, many investors are currently acting cautiously. Targeted public guarantees and subsidy programmes could further facilitate access for a broader investor base and mobilise urgently needed capital for nationwide fibre optic expansion.

It is clear that copper cable, with a service life of approximately 60-70 years, has had its day in telecommunications and must be replaced by fibre optics in order to meet today’s requirements. In addition, fibre optics consume significantly less power than copper cable during operation. Fibre optics therefore remain a sector that institutional investors should keep an eye on in every phase and through the whole capital spectrum.

Data centres – the indispensable cornerstones of the digital future

According to a study by OpenAI and the National Bureau of Economic Research (NBER), ChatGPT currently has more than 700 million weekly active users and the number is continuing to grow rapidly.7 The areas of application are diverse, ranging from data analysis and brainstorming to research, which is currently the most common use case. According to estimates, artificial intelligence, AI-based tools and cloud solutions will see an annual growth rate of nearly 40%.8 The spectrum ranges from voice assistants, smart energy solutions and educational program- mes to applications in the medical field and the transport sector.

Data centres are indispensable for all internet-based applications and services. Every digital business model relies on powerful data centres. They provide the physical infrastructure that directs, stores and processes gigantic data streams, thereby ensuring the pulse of our networked economy. Without data centres, there would be no internet, no digital communication and no automated industrial processes. They are therefore not only systemically important, but also a key piece of infrastructure – a technological constant that cannot be virtualised in any way.

This segment offers an attractive investment opportunity for insti- tutional investors such as insurance companies, pension funds and asset managers. Demand for computing power is growing exponentially: artificial intelligence, big data, the Internet of Things and cloud solutions are driving the global flood of data to previously unimagined dimensions, thereby continuously increasing the need for high-performance data centres. At the same time, data centres are remarkably resilient to economic fluctuations thanks to long-term customer contracts and their system-critical nature – and offer reliable, predictable cash flows.

The rapid growth in global data volumes requires a new generation of high-performance data centres. Hyperscale data centres in particular – large facilities typically with around 5,000 servers – are increasingly attracting the attention of institutional investors. While technology companies provide the servers, infrastructure partners invest in operations, buildings, energy supply, connectivity and cooling. One example of this is Allianz Global Investors’ recent investment in the international data centre platform Yondr, which specialises in the development and operation of these hyperscale centres.

Due to high initial investments, regulatory requirements and technical complexity, market entry for new competitors is usually challenging. Existing operators secure sustainable competitive advantages through long-term contracts and strong partnerships. Investors thus have the opportunity to invest in scalable, future-proof infrastructure and, at the same time, fully capitalise on the megatrends of digitalisation.

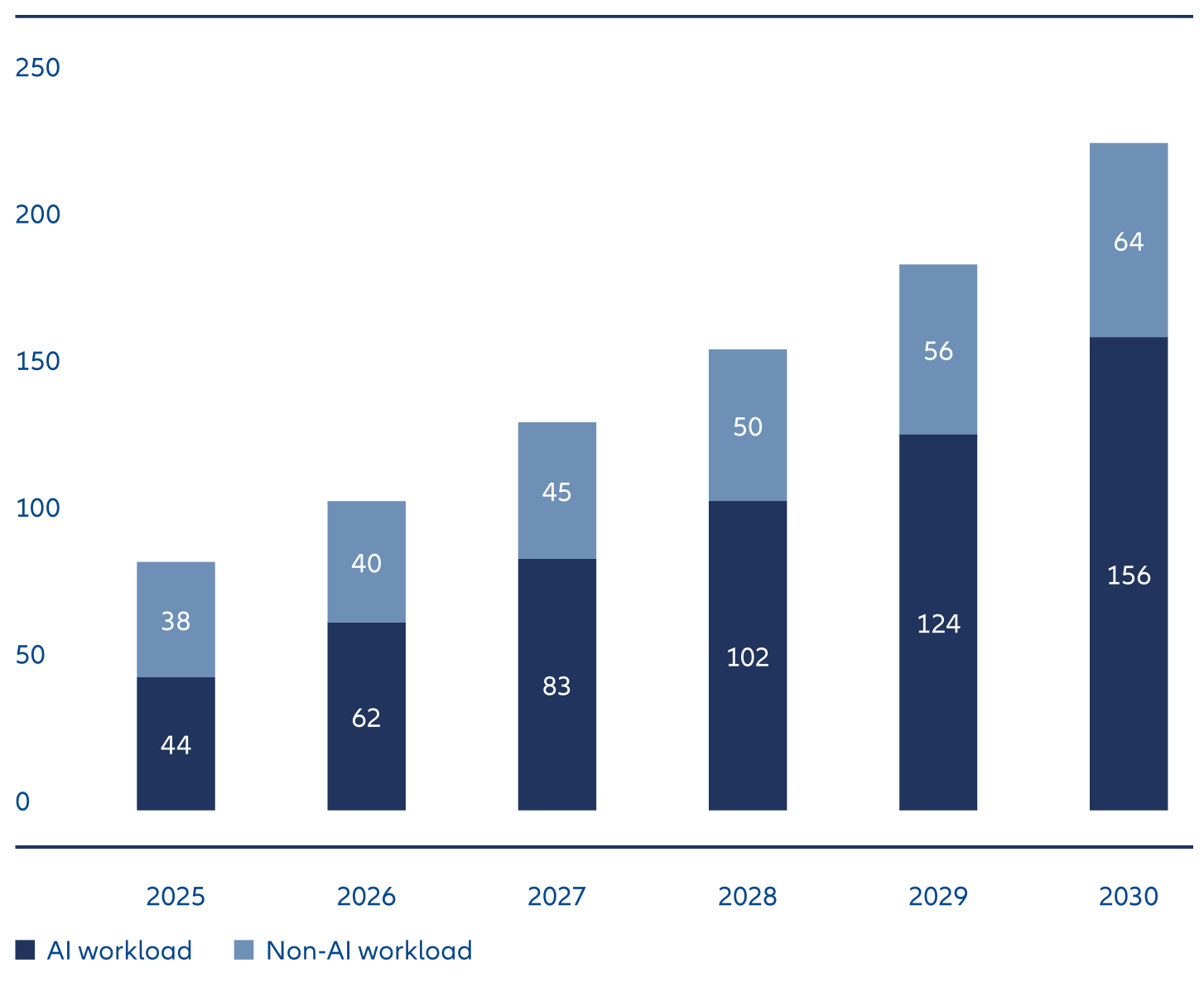

Exhibit 2: Estimated global data center capital demand, continued momentum scenario, in gigawatts

Source: Allianz Research, 3.5% to 2035: Bridging the global infrastructure gap; McKinsey and Company, McKinsey Data Center Demand Model, Gartner reports, IDC reports, Nvidia capital markets reports, Allianz Research.

Opportunities and risks across the entire capital spectrum

Digital infrastructure – from data centres and telecommunications masts to fibre optic networks – is the foundation of modern innovations such as autonomous driving and telemedicine. It forms the backbone of our connected society. AllianzGI made its first investment in digital infrastructure 10 years ago.

Long-term inflation-proof contracts ensure stable cash flows and offer investors a solid risk structure. Nevertheless, greenfield investments, regulatory delays and the current interest rate environment pose challenges for financing. Not only is the capital requirement high, but competition for interesting projects – whether equity or debt – is also fierce, unless investors have exclusive access to transactions. A decisive factor is therefore finding the right partners to jointly tackle such projects. High ESG standards are essential for sustainable investment success, especially for energy- intensive digital infrastructure. The high investment requirements, broad diversification of institutional portfolios and dynamic development of AI and cloud applications make the sector a particularly exciting investment field on both the equity and debt sides. Investors who already have a robust international network and many years of experience in digital infrastructure often have the best access to attractive projects – and no AI can provide that yet.

Selected examples of Allianz Global Investors’ investments in digital infrastructure

Unsere Grüne Glasfaser: Founded in 2021, UGG is now one of Germany’s largest self-financed fibre optic infrastructure providers, focusing on the expansion and connection of fibre optic networks, particularly in rural areas. The rollout is progressing: a network for over one million households is currently under construction, with 600,000 house- holds already connected.

XpFibre: XpFibre is now the leading independent fibre optic infrastructure provider in France and plays a central role in the transition from copper to fibre optic technology. Since Allianz Global Investors entered the market in 2019, the network has been continuously expanded: By the end of 2025, around 7.2 million households in 30 expansion areas are expected to have access to high-speed internet, which corresponds to around 25% of France’s total land area. All major French internet providers already use the XpFibre network, which will become the sole fixed-line infrastructure in these regions by 2030 as part of the planned copper phase-out.

American Tower Corporation (ATC) Europe is the European business of one of the world’s leading mobile infrastructure operators and plays a central role in the expansion of 5G and digital connectivity, particularly in regions without fixed-line coverage. The parent company ATC operates over 149,000 sites in 22 countries, of which ATC Europe accounts for over 30,000 sites in Germany, Spain and France.

Yondr: Yondr is an international developer and operator of data centres, operating in key markets such as Germany, the Netherlands, the United Kingdom, the United States and Canada. With a capacity of over 420 MW for hyperscale customers, Yondr is a major player in the data centre sector.

For Cordiant’s acquisitions of České Radiokomunikace and Emitel – the leading broadcast and telecommunications infrastructure platforms in the Czech Republic and Poland – AllianzGI provided part of the financing.

Tier Point: The US company TierPoint operates geographically clustered and interconnected data centres around major US cities such as Chicago and Dallas and is one of the leading data centre operators in the United States.

Rede Aberta: Rede Aberta is a leading provider of independent fibre optic networks in Spain. Since 2020, the company has been driving expansion in rural areas of Galicia and is now active in over 80 municipalities, with more than 2,000 kilometres of fibre optic cable laid.

1EJahresbericht Telekommunikation 2023, Presse, Bundesnetzagentur

2 Drei Voraussetzungen für 5G, Deutschland spricht über 5G

36G: Wann kommt der Mobilfunkstandard der Zukunft?, o2 Business

4Bericht zu digitalem Wandel in der EU: Deutschland muss Digitalisierung der öffentlichen Dienste beschleunigen, Europäische Kommission

5Data centres & networks, IEA

6State of the Digital Decade 2025 report, Shaping Europe’s digital future

7How people are using ChatGPT, OpenAI

7Artificial Intelligence Market Size, Share, Growth Report 2030, grandviewresearch.com