The China Briefing

Dam good energy

China’s retail investors have been joining the party. Margin financing is at a 10 year high. Mainland flows into Hong Kong have climbed to 25% of daily turnover.

Please find below our latest thoughts on China:

- One of the features of the China equity market recovery this year has been the increasing participation of mainland China retail investors.

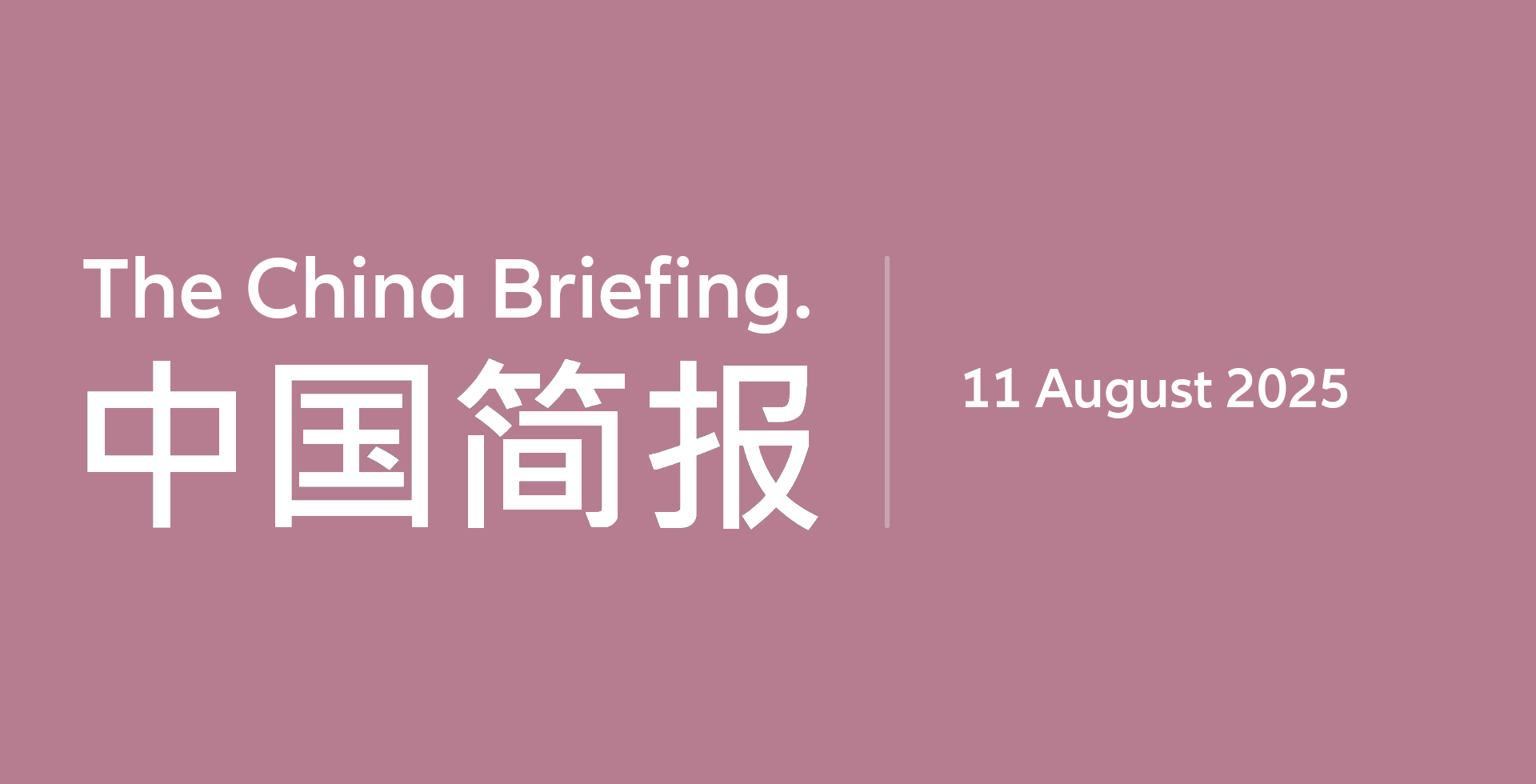

- The China A-Share margin financing and securities lending balance, a good real-time sentiment indicator, has reached a 10 year high.1

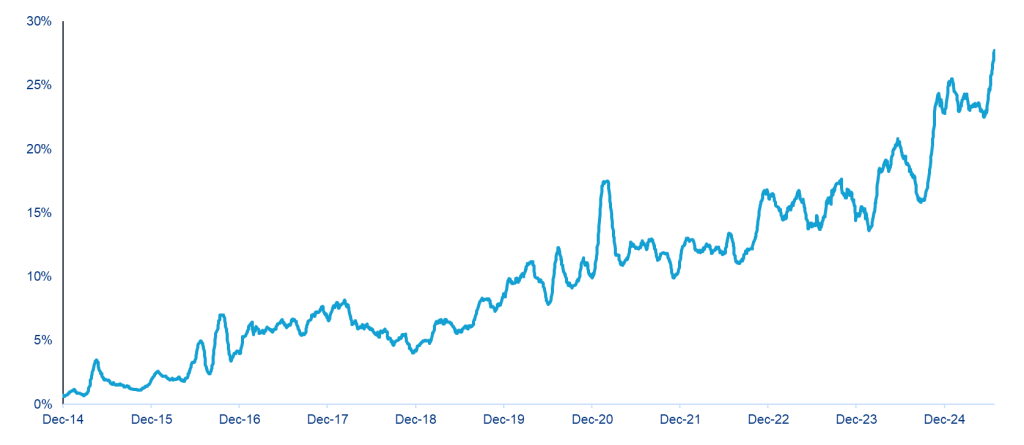

- There have also been strong flows from mainland China into the Hong Kong market. Southbound Stock Connect volumes now account for around 25% of daily turnover in Hong Kong, double the level of three years ago.2

Chart 1: Margin trading outstanding balance in China A-Shares (CNY billions)

Source: Bloomberg, Allianz Global Investors, as of 7 August 2025

- There are a number of reasons for this increased retail participation, in our view.

- Partly, it reflects the relative paucity of other investment options for domestic investors, especially with 10-year government bond yields hovering around 1.7%.3 There are more than USD 20 trillion in household deposits, much of which was invested in one-year time deposits when rates were significantly higher than they are now.4

- There are more than USD 20 trillion in household deposits, much of which was invested in one-year time deposits when rates were significantly higher than they are now.5

- And partly it also reflects growing domestic excitement about emerging growth themes, mostly based around technology-related developments.

- An initial catalyst was the DeepSeek moment, which illustrated how China’s technological progress is far more advanced than previously understood.

- More recently, the news that the US revoked export curbs that required US companies to obtain licenses to provide chip design software to customers in China – as part of an agreement intended to ease trade tensions – has also provided a further boost to China’s AI ambitions.

- More broadly, there has been an emerging realisation that the Chinese economy is transforming rapidly. The original semiconductor embargo in 2018 pushed China to invest heavily in a bid for greater self-sufficiency in key industrial components.

Chart 2: Southbound Stock Connect as % of Hong Kong equity market turnover

Source: Wind, Allianz Global Investors, as of 11 July 2025. Turnover is calculated based on 30 day moving average number.

- China’s growing technological strength is underpinned by a robust ecosystem that has been steadily developed over many years.

- A cornerstone of this ecosystem is sustained investment in science and technology education. Of the 12 million university graduates in China this year, approximately 40% hold degrees in STEM fields – science, technology, engineering, and mathematics.6

- China now awards more doctoral degrees in science and engineering than the United States.7

- Another critical pillar is China’s energy infrastructure, particularly its focus on expanding electricity generation and distribution.

- The industries of the future will be increasingly electricity dependent. While data centres are well-known for their high-power consumption, many emerging sectors –such as electric and autonomous vehicles, drones, robotics, sensors and the semiconductors and AI that power them – are also highly energy-intensive.

- Moreover, the production of essential materials for high-tech industries such as steel, aluminium and copper requires significant electricity for smelting.

- China has long viewed electricity dominance as a strategic foundation for manufacturing leadership. Its installed power generation capacity is substantially more than the US and EU combined.8

- Indeed, China already generates more than double the amount of electricity that the US does. It has 42 ultra-highvoltage transmission lines in place, covering 25,000 miles, with another 12 under construction; the US has none.9

- This extensive infrastructure provides Chinese manufacturers with access to cheap and reliable power nationwide – a major competitive advantage.

- Within this theme, a recent eye-catching announcement was the start of construction on the world’s largest hydropower project, located in Western China on the Yarlung Tsangpo River.

- This huge project will require an investment of RMB 1.2 trillion (USD 170 billion). Its power generation capacity will be nearly three times larger than the Three Gorges Dam on the Yangtze and will produce electricity equal to around 2% of China’s current output.10

- This project ticks a number of high-priority boxes: advancing electrification, reducing reliance on fuel imports, and strengthening energy security.

- It also significantly contributes to China’s sustainability targets by replacing 90 million tons of coal consumption – equivalent to 2% of the country’s total carbon emissions last year.11 Dam good energy, it might be said.

1 Source: JPMorgan, 11 August 2025

2 Source: Wind, 11 July 2025

3 Source: Bloomberg, 11 August 2025

4 Source: Goldman Sachs, 14 April 2025

5 Source: Goldman Sachs, 14 April 2025

6 Source: JPMorgan, 22 June 2025

7 Source: JPMorgan, 22 June 2025

8 Source: Gavekal, 14 July 2025

9 Source: Gavekal, 14 July 2025

10 Source: Gavekal, 1 August 2025

11 Source: JPMorgan, 3 August 2025