The China Briefing

Déjà vu

US-China tensions persist amid trade talks, tech decoupling, and rare earth moves. China pivots to tech-led growth, driven by domestic liquidity

Please find below our latest thoughts on China:

- The recent bout of China-US turbulence has a strong sense of déjà vu.

- The sequence of events has become quite familiar:

- The two counties have talks – recently in Madrid, where a TikTok framework was agreed.

- They seem to be making progress towards a trade agreement.

- In advance of this, and to gain negotiating leverage, the US makes a move to tighten sanctions or ramp up export controls – in this case an expansion of the entity list.

- China responds with matching countermoves – expansion of export controls around rare earths – as a reminder of the cards it is holding.

- President Trump threatens extreme measures – 100% tariffs.

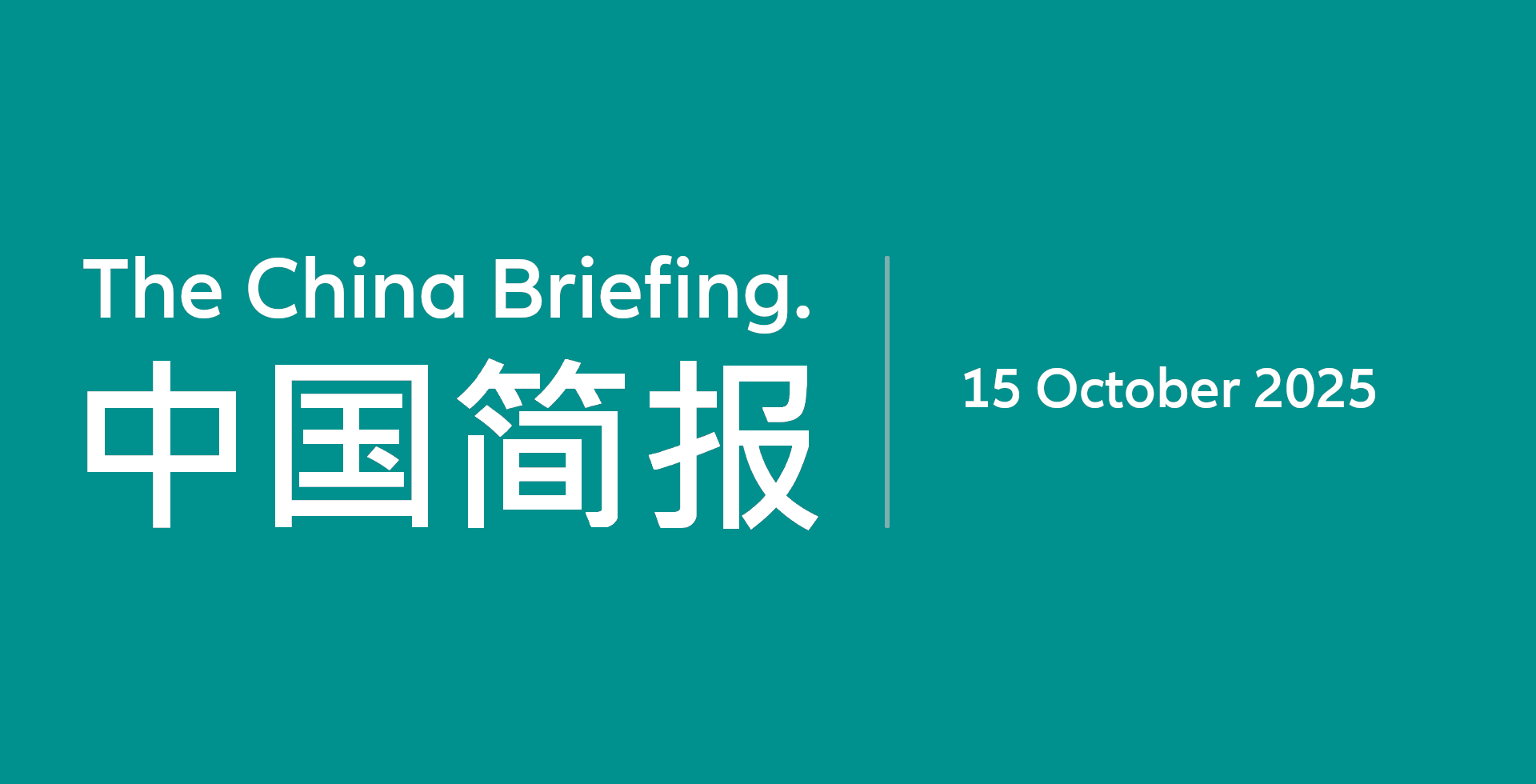

- Market volatility ramps up. - Earlier this year, the playbook was escalate to de-escalate – cooler heads prevailed and markets quickly recovered.

- Given that both the US and China have a lot to lose both economically and financially, our base case is to expect something similar this time around as well.

Chart 1: Performance of onshore and offshore China equities ytd (rebased to 100, USD)

Source: LSEG Datastream, Allianz Global Investors, as of 14 October 2025. Past performance, or any prediction, projection or forecast, is not indicative of future performance.

- Nonetheless, these recent events are also a reminder that the US and China remain set on a long-term decoupling path both economically and technologically. This presents both risks and challenges, as well as potential opportunities. China Briefing 15 OCTOBER 2025

- Taking a step back, it’s worth considering how the global backdrop has changed in a relatively short period.

- In Mr Trump’s first presidency, China had to absorb some painful body blows from US tariffs. Huawei, the flagship technology company and widely regarded as a “national champion”, had its smartphone business brought almost to a standstill as a result of dependency on Western supply chains for critical technology components.

- China’s response was to double down on technology investments. Huawei pivoted towards its own operating system, invested heavily in chip design, cloud computing and so on. A similar surge in R&D was reflected across many different sectors and companies.

- The progress made was heavily camouflaged during the Covid years and by subsequent macro weakness. And, until recently, in our view this progress was also underappreciated and undervalued in equity markets.

- From China’s perspective, what it means is that things look very different when it comes to Trump 2.0. Combined with dominance in the production of rare earth and other critical minerals, China sees itself as being able to commit to a much tougher negotiating strategy.

- As such, the US is dealing with a peer rival for pretty much the first time since the USSR during the cold war years.

- And as these two economic super powers butt heads, we seem to be locked into a scenario where the lessons learnt from each round of negotiations is that it pays to push hard politically and talk tough – and the economics will then take care of themselves.

- It is in this context that China’s upcoming next five-year plan should be viewed. The high-level strategy will be announced from 20-23 October, during the 4th Plenum.

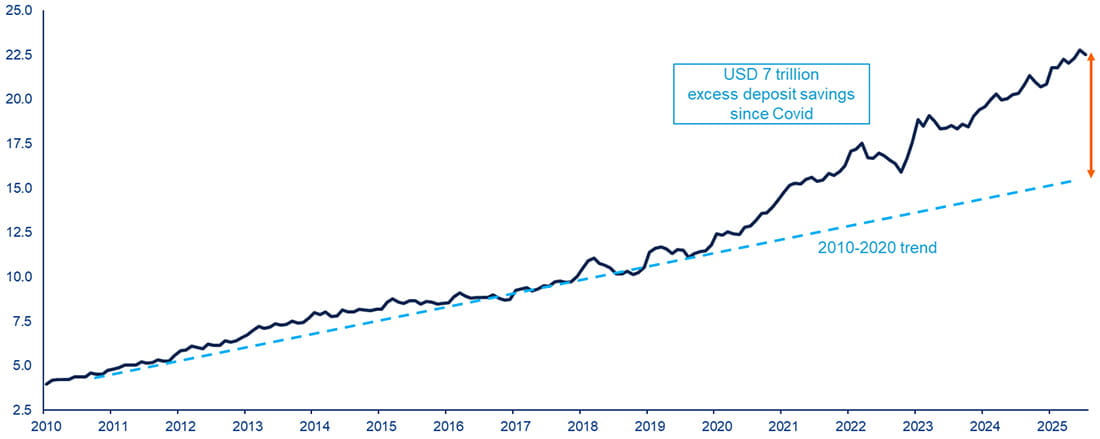

Chart 2: Household bank deposits in mainland China (USD trillion)

Source: Wind, HSBC, Allianz Global Investors, as of 31 July 2025

- Continuity will likely be the buzzword. And in tune with the global zeitgeist, a closely watched area will be all things tech, including China’s plans for AI as well as next-generation areas such as quantum technology.

- We do not expect the five-year plan to be a market-moving event. In practice, these plans have included fewer hard, quantitative targets over time.

- It should, however, help to reinforce some existing trends such as the commitment to innovation, high levels of R&D and support for tackling “self-sufficiency” technology bottlenecks.

- One outcome for global investors is that accessing the China growth story through multinationals will likely not be so effective. As China pivots increasingly to a technology-led growth model, it is domestic companies that should increasingly take market share.

- To conclude, recent events do not change our market outlook. Tariff-related flare-ups will likely be an ongoing feature of the investment landscape.

- Overall, we see China’s equity markets as still being underpinned by the technology narrative and strong domestic liquidity.

- Household and corporate cash levels in China are high. We expect these to be incrementally deployed into equities, particularly given the low interest rate environment and still muted outlook for other asset classes such as property.