China A-shares: Is now an opportune time to invest?

Summary

Which country’s stock market was more resilient than others during the COVID-19 pandemic? The answer may surprise many investors.

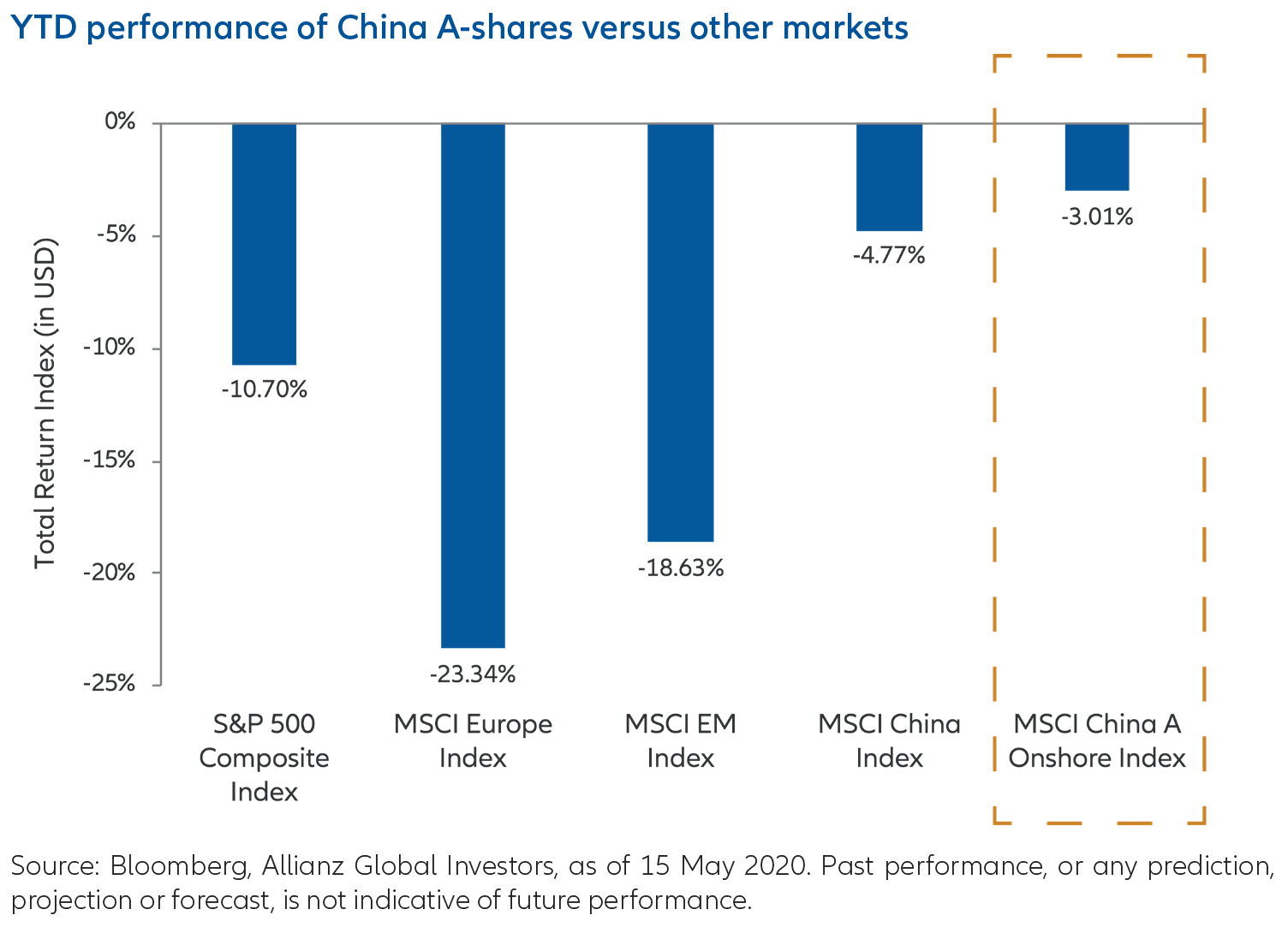

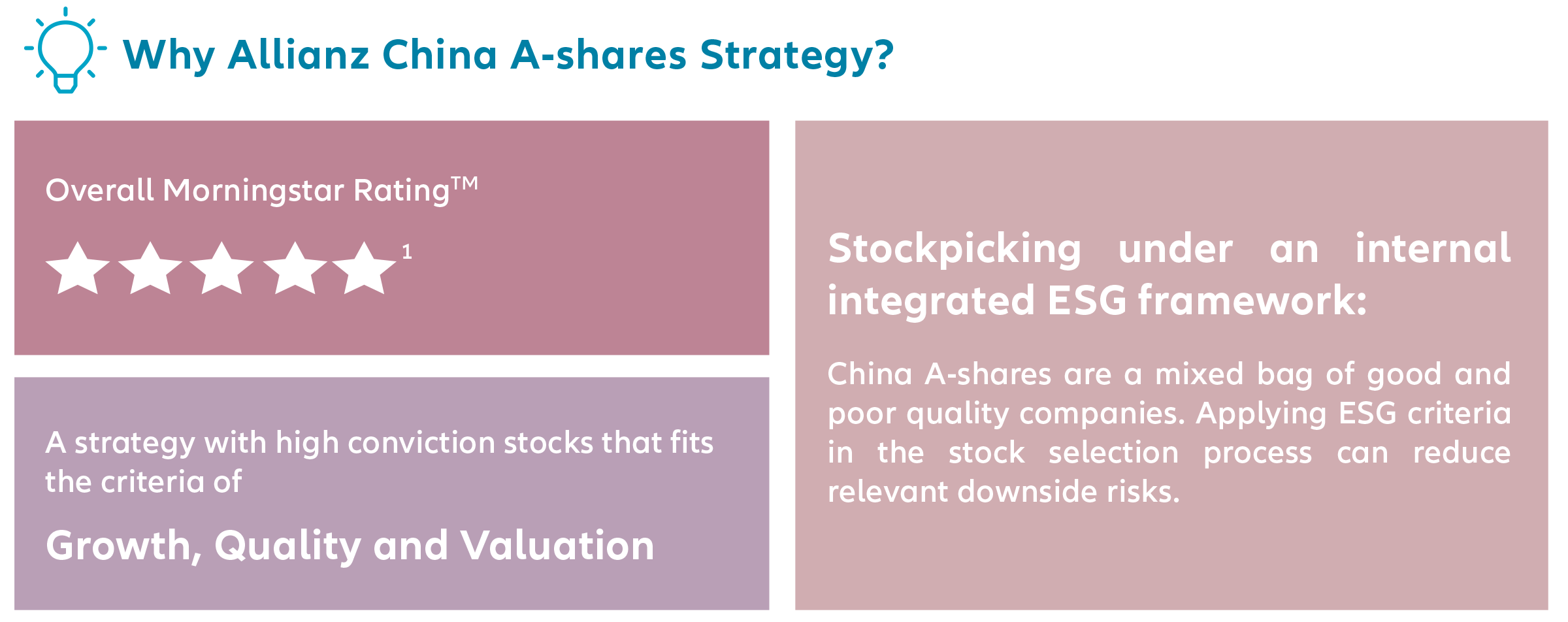

As of 15 May 2020, the MSCI China A Onshore Index (USD) fell 3% yearto-date (YTD), outperforming China’s offshore indices as well as the European and US stock markets. Mr Anthony Wong, Allianz Global Investors’ co-lead manager for Allianz China A-shares fund, explains the global stock market turbulence as primarily caused by the pandemic and the plunge in oil prices, but both have relatively limited negative impact on China’s A-shares market.

Foreign capital flows into A-shares despite COVID-19

While China was the first to face the COVID-19 outbreak, it was also the fastest to contain the disease, which has no doubt contributed to its stock market’s resurgence. As for oil prices, China is a crude oil importer, and the oil and gas industry accounts for a minimal proportion of the A-shares market. Hence, the energy sector had limited negative impact on the A-shares market.

More importantly, the A-shares market is dominated by individual retail investors, who are very sensitive to the Chinese government’s policies. Hence, when the state released economic stimulus measures, retail investors responded positively, contributing to the A-shares’ better YTD performance than other countries’ stock markets.

Moreover, the COVID-19 pandemic has not interrupted the trend of international capital inflow into A-shares through Stock Connect programmes. China is the world’s second-largest economy, but China’s A-shares makes up less than 1% in the MSCI World Index and merely 4% in the MSCI Emerging Market Index. As the A-shares’ weight in global indices is set to rise, it will become international investors’ go-to option for long-term asset allocation.

This year's global stock market crash highlights the importance of risk diversification. Retail investors, who account for 80% of the A-shares market’s trading volume, invest differently from international institutional investors. Therefore, the A-shares market has a relatively low correlation with the foreign stock markets, making it a functional device for risk diversification.

Mr Wong noted that as the A-shares market gradually opens up, its correlation with other stock markets will increase gradually, but the process will be prolonged. He believes the A-shares market will remain relatively independent in the coming three years.

A-shares gained 40% since Donald Trump’s inauguration

Going forward, Mr Wong believes the escalating US-China tensions will have minimal impact on the A-shares market. This is because US institutional investors’ A-shares holdings account for only 1% of the A-shares’ total market value. In fact, the repercussion of the US-China relations on China equities has been arguably overblown. From the beginning of Donald Trump’s presidential term in 2016 to April 2020, the MSCI China Index has accumulated a 42% gain, outperforming the U.S. S&P 500 Index’s 37%. Also, as China strives to reduce reliance on imported technology and electronic parts, it prioritizes homegrown research and development (R&D) and innovation. This benefits companies with relevant technologies, providing investors with brand new investing opportunities.

Capturing opportunities in a diverse new economy

Mr Wong added that, the COVID-19 pandemic has brought transformative changes to the mainland Chinese economic structure. In the past few years, there were still residents who were not used to online shopping or accessing electronic services. But during the nation-wide lockdown, many consumers have embraced digital technology and developed a habit of ordering daily necessities online. This has expanded the e-commerce industries’ customer base and offers potential opportunities for investors.

When compared to the Hong Kong stock market, the A-shares market features more diverse new economy sectors, such as 5G equipment, healthcare, biotechnology, industrial automation, new energy, and travel and entertainment, from which investors can capture enhanced returns from China’s economic restructuring.

1 Based on Allianz China A-shares Class AT (USD) accumulation share class. Source: Morningstar, as at 30/04/2020. Copyright © 2020 Morningstar Asia Limited (“Morningstar”). All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

China - the journey continues

Summary

The strong rally in Chinese equities this year has been driven by a combination of domestic economic recovery post COVID-19 and strong liquidity with the return of ‘’animal spirits’’ among onshore retail investors. While the rally may have gone a little too far too fast, and some consolidation would be healthy, we see this as a very different situation to the boom-and-bust experience in China A-shares in 2015.

Key takeaways

|

-

Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security.

Some or all the securities identified and described may represent securities purchased in client accounts. The reader should not assume that an investment in the securities identified was or will be profitable. The securities or companies identified do not represent all of the securities purchased, sold, or recommended for advisory clients. Actual holdings will vary for each client. BAT is a widely used acronym for three large cap tech companies in China: Baidu, Alibaba and Tencent.

The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted.

This material has not been reviewed by any regulatory authorities. In mainland China, it is used only as supporting material to the offshore investment products offered by commercial banks under the Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations. This document does not constitute a public offer by virtue of Act Number 26.831 of the Argentine Republic and General Resolution No. 622/2013 of the NSC. This communication's sole purpose is to inform and does not under any circumstance constitute promotion or publicity of Allianz Global Investors products and/or services in Colombia or to Colombian residents pursuant to part 4 of Decree 2555 of 2010. This communication does not in any way aim to directly or indirectly initiate the purchase of a product or the provision of a service offered by Allianz Global Investors. Via reception of his document, each resident in Colombia acknowledges and accepts to have contacted Allianz Global Investors via their own initiative and that the communication under no circumstances does not arise from any promotional or marketing activities carried out by Allianz Global Investors. Colombian residents accept that accessing any type of social network page of Allianz Global Investors is done under their own responsibility and initiative and are aware that they may access specific information on the products and services of Allianz Global Investors. This communication is strictly private and confidential and may not be reproduced. This communication does not constitute a public offer of securities in Colombia pursuant to the public offer regulation set forth in Decree 2555 of 2010. This communication and the information provided herein should not be considered a solicitation or an offer by Allianz Global Investors or its affiliates to provide any financial products in Brazil, Panama, Peru, and Uruguay. In Australia, this material is presented by Allianz Global Investors Asia Pacific Limited (“AllianzGI AP”) and is intended for the use of investment consultants and other institutional/professional investors only, and is not directed to the public or individual retail investors. AllianzGI AP is not licensed to provide financial services to retail clients in Australia. AllianzGI AP (Australian Registered Body Number 160 464 200) is exempt from the requirement to hold an Australian Foreign Financial Service License under the Corporations Act 2001 (Cth) pursuant to ASIC Class Order (CO 03/1103) with respect to the provision of financial services to wholesale clients only. AllianzGI AP is licensed and regulated by Hong Kong Securities and Futures Commission under Hong Kong laws, which differ from Australian laws.

This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors U.S. LLC, an investment adviser registered with the U.S. Securities and Exchange Commission; Allianz Global Investors Distributors LLC, distributor registered with FINRA, is affiliated with Allianz Global Investors U.S. LLC; Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG; Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424, Member of Japan Investment Advisers Association and Investment Trust Association, Japan]; and Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan.