Summary

The opening of the China A-share market to foreign investors – and the subsequent growing inclusion of a much larger number of Chinese companies in widely used equity indices – is poised to be, in our view, one of the most transformative events in the financial markets over the next decade.

Key takeaways

|

Introduction

The opening up of the China A-share market to foreign investors – and the subsequent growing inclusion of a much larger number of Chinese companies in widely used equity indices – is poised to be, in our view, one of the most transformative events in the financial markets over the next decade. The implications for investors are numerous, complex and, above all, inevitable, making the maintenance of the status quo, in our view, an unviable solution.

Investors considering an investment in the domestic China A-share market are now able to tap into the full China equity pool, with a significantly larger market capitalisation than Europe, for example. The A-share market alone encompasses more than 3,700 listed companies worth nearly USD 8.8 trillion across the entire market-capitalization spectrum (Exhibit 1). That’s comparable to the USD 9.3 trillion market capitalization of equities in the euro area.1

In this paper, we argue that an allocation to China A-shares presents a unique opportunity for investors to optimise their global equity portfolios.

Our analysis shows that the Chinese domestic market exhibits low correlation with other widely held asset classes (such as Hong Kong-listed H-shares as well as US and European equities), a trait that stems from the fact that a) the Chinese domestic market is influenced by unique economic, political, and monetary policy considerations, and b) it has very different market participants than elsewhere. In addition, because these companies generate the vast majority of their revenues domestically, the effects of ongoing trade tensions with the US are less pronounced than may be commonly assumed.

Exhibit 1: China A-shares give foreign investors broad access to a significant opportunity

| Shenzhen A-shares | Shanghai A-shares | China stocks listed in HK |

US-listed ADRs | Total | |

|---|---|---|---|---|---|

| Market cap (USD tn) | 3.8 | 5.1 | 3.2 | 1.0 | 13.1 |

| Number of stocks | 2,199 | 1,578 | 953 | 153 | 4,883 |

As of 31 January 2020.

Only the market cap of the listed share class is included. Offshore China stocks are defined based on companies with ultimate parent domiciled in China. Suspended stocks are excluded.

Source: Nasdaq, Shanghai Stock Exchange, Shenzhen Stock Exchange, Bloomberg, Allianz Global Investors

Also, we explain why we believe that – given China’s long-term economic growth prospects as well as the still-abundant inefficiencies seen in the country’s domestic equity market – an investment in China A-shares exhibits superior alpha-generating potential.

Lastly, we present our views on the future evolution of the market – as well as its growing representation in equity benchmarks – and weave our thoughts on how investors should consider tapping this market as well as what potential impact an allocation to China A-shares may have on existing portfolios.

All in all, we see this as an evolving story, for both the China A-share market itself – which, we expect, should continue to grow and modernise – and Western investors – who, we believe, should take a progressive approach to allocating to this momentous asset class.

A long path to access, but a potentially rewarding one nonetheless

Before 2003, foreign investors could only trade some Chinese firms listed on the Hong Kong Stock Exchange (H-shares), which is dominated by state-owned enterprises, such as banks and energy firms, or American Depositary Receipts (ADRs) traded in the United States. Together, H-shares and ADRs are known as “offshore China”.

Access improved in 2003, with the launch of the Qualified Foreign Institutional Investor (QFII) programme, which offered foreign investors access via quotas to China A-shares – listed in the Shenzhen and Shanghai bourses (known as “onshore China”) and traded in renminbi. The RMB Qualified Foreign Institutional Investor (RQFII) scheme, launched in late 2011, further expanded access by allowing Chinese financial firms to establish renminbi-denominated funds in Hong Kong for investment in the mainland.

Subsequently, the launches of the Shanghai-Hong Kong Stock Connect programme in 2014 and the Shenzhen Connect programme in 2016 gave foreigners access to Shanghai- and Shenzhen-listed stocks, without quotas or the need for a licence. Importantly, these Stock Connect programmes also significantly lowered the costs of accessing the Chinese onshore market. Finally, on 1 June 2018, MSCI added China A-shares into its emerging market indices for the first time. Although it was a long road until foreign investors gained access to China’s domestic stock market, we believe that investors will come to realise that it might have been worth the wait given the size and scope of the opportunity.

Now the second-largest economy globally, China is forecast to overtake the United States as the world’s largest economy by 2030. That growing economic importance will increasingly be reflected in global equity indices and in portfolios.

Further, adding China A-shares to portfolios adds meaningful diversification, as evidenced by China A-shares’ low historic correlation with major equity markets globally (Exhibit 2). Two main reasons are behind this low correlation.

Exhibit 2: Because of domestic revenues and distinct economic and monetary policy, China A-shares have a low correlation with major equity markets

As of 31 January 2020.

Correlation data is calculated based on historical return of respective MSCI indices for the past 10 years, using weekly USD return. See full names of all specific benchmarks at the end of this paper.

Source: Bloomberg, Allianz Global Investors

First, the Chinese domestic equity market is, by many measures, still in its infancy. Trading is still dominated by retail investors (more on that later) and the regulatory environment – albeit evolving quickly – remains volatile and susceptible to the vicissitudes and trends of the Chinese domestic political environment.

Second, the companies trading in this market sell primarily to local consumers. In fact, China A-share companies yield 90% of their revenue domestically, in many cases leaving them well placed to avoid significant negative impacts associated with ongoing trade tensions with the US. This local revenue base makes them less sensitive to global macroeconomic trends, and more sensitive to the directions set by both the Chinese government as well as the People’s Bank of China, the country’s central bank. Traditionally, Chinese fiscal and monetary policies have “marched to their own beat”, and have not been highly correlated to the policies adopted by the US and other Western monetary authorities.

China A-shares and the promise of the “new economy”

In addition to the low-correlation factor, the China A-share market provides an entry door for investors to more deeply benefit from China’s ongoing shift from an export-driven economy into the so-called “new economy”, characterised by an increased role of domestic consumption and higher-value-added sectors, such as tourism, entertainment, healthcare equipment, industrial automation, new energy vehicles, biotech, software and new materials.

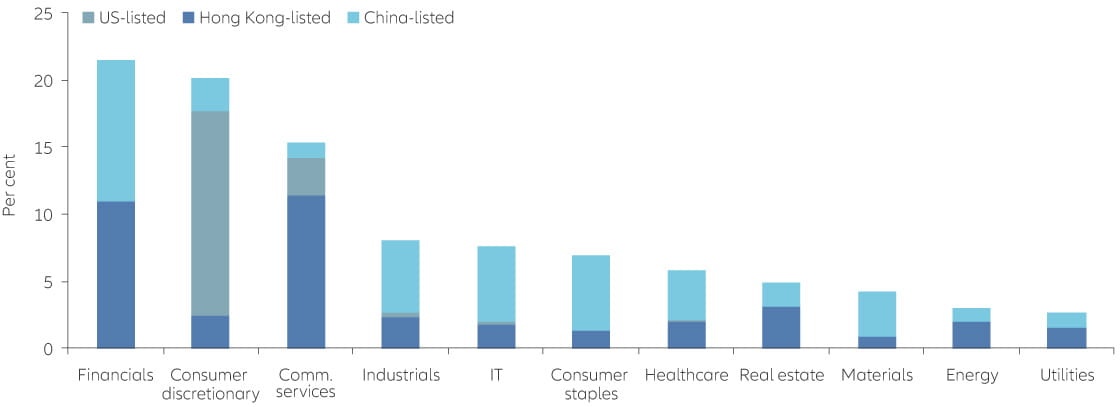

As shown in Exhibit 3, investing in China A-shares gives investors greater access to the small- and mid-cap companies set to be the future drivers of China’s economic growth – technology, innovation and the rapidly expanding Chinese middle class.

Exhibit 3: China A-shares better reflect faster-growing sectors of the “new economy”

MSCI China All Shares Index, index breakdown by listing location

As of 31 January 2020

Data analysis based on the MSCI All China Index (broken down by sector and stock exchange).

Source: Bloomberg, Allianz Global Investors

In fact, more than half of China’s economic output comes from the services sector, and the country is a major investor in, and adopter of, digital technologies. So, China A-shares – especially when accessed through non-passive instruments – better reflect the promise of the country’s digital future than emerging-market benchmarks such as the MSCI Emerging Markets Index, which is highly biased towards Chinese mega- and large-cap stocks.

Buying the MSCI EM Index alone is not the ideal way to boost China exposure

Today, most investors benchmark their exposure to China to international equity (ie., MSCI ACWI ex-US) and/or global emerging market (ie., MCSI EM) indices. But simply increasing allocations to those indices may not be an ideal way to broaden China exposure.

Here’s why: although China A-shares are now included in MSCI indices, their weighting within the MSCI EM Index and MSCI ACWI Index are, as of this writing, just 4.1% and 0.5%, respectively. To put that into context, the market cap of China A-shares as a percentage of global equities was 9% (at the end of 2019) and the overall Chinese economy accounted for 15.8% of global economic output in 2018.2 As the numbers show, China A-shares are considerably under-represented in one of the benchmarks most widely used by investors.

The current Chinese exposure within the MSCI EM Index is weighted heavily toward low-growth companies and concentrated in a few mega-cap technology firms, such as Alibaba and Tencent.3 This extra “mega/large-cap bias” creates further imbalances for investors seeking to establish an exposure to Chinese equities that is concomitant to the current growth opportunity for that market.

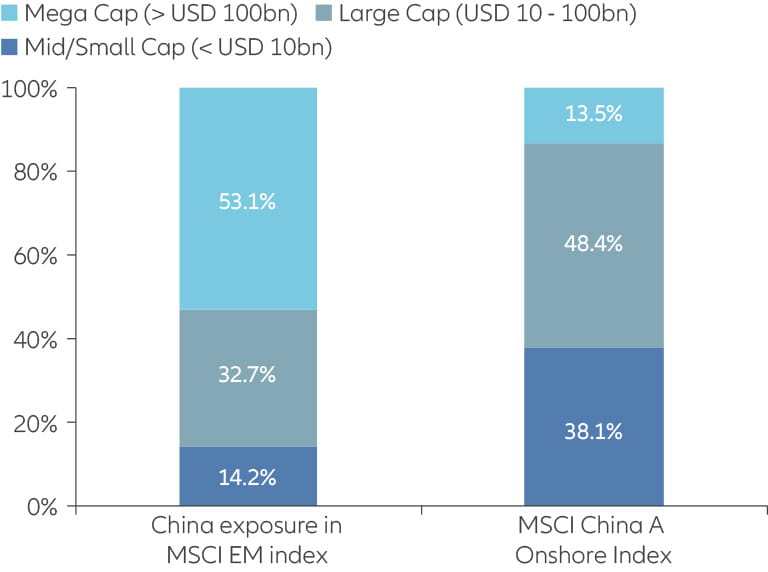

In this context, we argue that a direct allocation to China A-shares – especially when done through non-passive instruments – can provide investors a more well-adjusted exposure to the Chinese market. For example, investing in A-shares gives investors greater access to a plethora of opportunities among small- and mid-cap companies. As illustrated in Exhibit 4, 38.1% of the MSCI China A-Shares Onshore Index is represented by small- and mid-cap companies with a market cap below USD 10 billion, compared to 14.2% in offshore China.

Exhibit 4: China A-shares complement China stocks in the MSCI EM Index and offer a plethora of opportunities among small- and mid-cap companies

As of 31 January 2020

Source: Bloomberg, Allianz Global Investors

Further, while it’s certainly a positive step that MSCI has begun adding China A-shares to its key MSCI EM Index, representation will likely remain very small and, in our view, artificially depressed. From this perspective, we don’t believe that investors who decide to define their China A-share exposure by simply “buying the MSCI EM Index” will be properly positioned to seize this opportunity in the next few years.

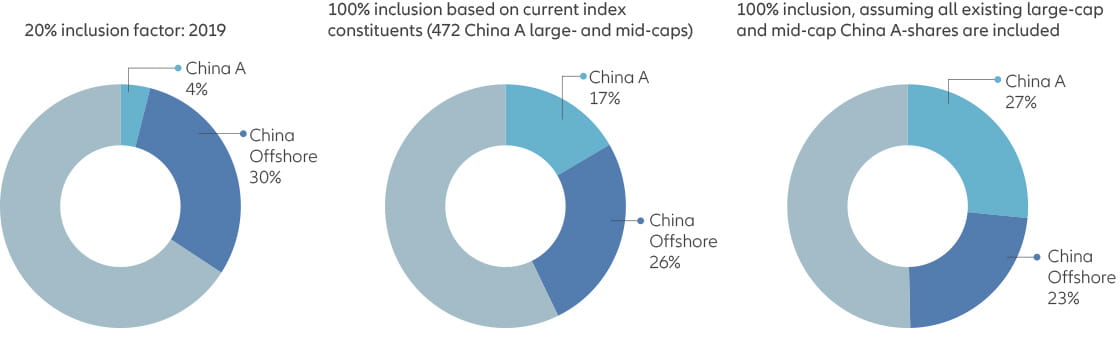

That said, we do expect that the A-share weightings of the MSCI EM Index will increase significantly over time to reflect the size of China A-share markets, altering the composition of future EM benchmarks. Exhibit 5 extrapolates what China weights would look like in the MSCI EM index if those weights were calculated by a) the current selected number of China A-shares included in the index, and b) all shares currently trading in the China A-shares market.

Exhibit 5: China A-shares are substantially under-represented in the MSCI Emerging Market Index

As of February 2020

Middle chart is based on MSCI’s proposal in November 2019 to include 472 large- and mid-cap China A-share stocks into the MSCI Emerging Market Index. Right chart is based on the assumption that all China stocks are available to be included into the MSCI Emerging Market Index. We use an 85% discount factor, which should approximately

represent the large- and mid-cap universe within China A-shares.

Source: MSCI, Bank of America Merrill Lynch, Allianz Global Investors

As Exhibit 5 shows, China would account for 43% of the index in the first scenario and 50% of the index in the second one. Although we don’t expect those levels of exposure will be reached any time in the foreseeable future, the analysis does reiterate an important issue: investors seeking to be “ahead of the curve” to fully capture the current opportunity in the Chinese equity market are unlikely to achieve that goal by simply sticking to current benchmark weights.

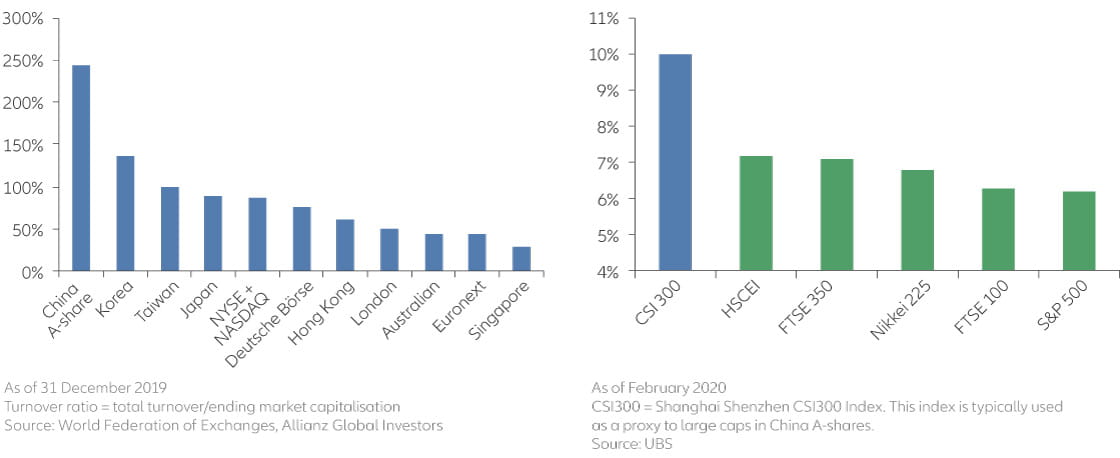

Understanding China A-share risks and how to mitigate them

While the China A-share market represents a significant opportunity, it carries risks. We expect that the increased access to China A-shares and the rising importance of the country’s economy will attract greater participation from investors. Nevertheless, the market for now remains dominated by retail investors. Indeed, domestic retail investors, primarily focused on chasing short-term trading profits, account for more than 80% of daily turnover. Also, local Chinese equity analysts tend to be less experienced than is the case in developed markets, leading to a greater frequency of earnings surprises than in more mature markets.

As shown in Exhibit 6, all this contributes to higher volatility – something underlined in June 2018, when onshore China suffered declines of nearly 11%. There is also higher sector rotation for China A-shares compared to developed-market indices, and a high dispersion of returns (Exhibit 7). Exacerbating risks, while the regulatory environment is evolving at a fast pace, it remains fairly unpredictable.

Exhibit 6: China A-share stock suspensions have declined

% of China A-share stocks suspended

As of 20 February 2020

Source: Goldman Sachs, Allianz Global Investors

Those risks, however, are characteristic of many developing markets, and they tend to dissipate as the market matures. It’s worth noting, for example, that the trading experience of the past 20 years in Taiwan shows that as the influence of foreign investors and domestic institutions increases and the dominance of retail investors diminishes, so too does volatility. As highlighted in Exhibit 6, stock-trading suspensions, relatively common just a few years ago, have become less of a concern as the regulatory framework has strengthened.

Exhibit 7: China A-share turnover has spiked and far exceeds comparable developed-market indices, leading to a high dispersion of returns

On balance, we believe that the time has come for investors to consider a dedicated allocation to China A-shares, especially since, as noted previously, the asset class can offer a significant source of diversification for global stock investors. The opportunity set is substantial, especially for investors seeking to optimise their equity exposures.

To underscore how relatively absent foreign investors are from what could be the most significant market opportunity today, they still only own around 3.8% of China A-shares4, at a time when MSCI EM is adding China A-shares exposure.

All in all, it is our view that, despite current risks, the China A-share market has matured enough to accommodate the arrival of foreign investors. But investors should approach the market with caution to avoid potential pitfalls and mitigate inherent risks.

We believe that active management can help investors to properly – and wisely – exploit the China A-shares market’s inefficiencies to generate potential outsized returns in general, and alpha in particular.

Just as important, however, active management can – as our experience in investing in China A-shares has taught us – generate potential outperformance not only by selecting the highest-performing stocks but also by avoiding problematic ones.

This is especially true when investing in a still-developing marketplace, with volatility levels that are higher than in developed markets. In the Chinese domestic market, potential downside protection is as critical as potential upside reward.

Deploying China A-shares in an institutional portfolio

In light of the current opportunity and the early stage of development of the China A-shares market, investors should, in our view, take an incremental approach to deploying this new asset class in their portfolios. We consider the case for investing in onshore China today as similar to investing in emerging markets a quarter of a century ago: back then, many investors viewed deploying capital to developing economies (and immature capital markets) as risky. Today, however, an emerging-market allocation is a typical part of any serious investor’s strategic asset allocation. We forecast that allocations to onshore China will follow a similar trajectory.

As mentioned previously, it is our view that the importance of China – and China A-shares in particular – is underrepresented in the benchmark index typically used for emerging-market allocations, falling far short of both the importance of China’s economy and its equity market. Consequently, we believe that adding a more significant allocation to China A-shares as part of a portfolio’s current emerging-market allocation makes sense for both risk-return reasons and for portfolio optimisation, especially given the asset class’ low correlation to other global equities.

The question then becomes, how heavily should an emerging-market allocation tilt toward onshore China? While the precise answer varies among investors, data suggests that the sweet spot may be between a 10% to 30% direct allocation to China A-shares, with the money to fund that allocation coming from investors’ existing emerging-market portfolios.

Using the MSCI EM index as our proxy for a “core” emerging-market portfolio, we compiled historical data from the past 15 years (Exhibits 8 and 9) to observe what the impact of adding the MSCI China A-Shares Onshore Index to an MSCI EM index allocation would be on annualised returns and on risk.

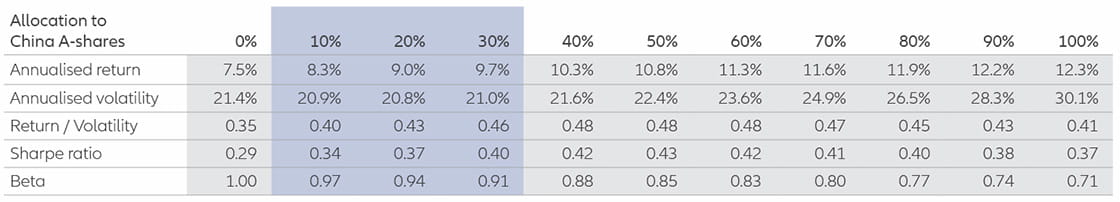

Exhibit 8: Overweighting emerging market allocations to China A-shares may increase the risk-adjusted returns of portfolios

Allocation from global emerging markets to China A-shares

Table shows analysis of returns for the MSCI Emerging Market Index (used as proxy for global emerging markets) and MSCI China A Onshore Index (used as proxy for

the China A-share market) indices from 31 January 2005/2020. Percentages shown in the table represent portion of portfolio allocated to China A-shares.

Past performance is not indicative of future results.

Source: Allianz Global Investors

Our analysis reveals that shifting 10% of one’s global emerging-market allocation to China A-shares would improve the overall portfolio return from an annualised 7.5% to 8.3%. And, mainly due to the asset class’ low correlation characteristics, the portfolio’s Sharpe ratio would see a significant enhancement from 0.29 to 0.34.

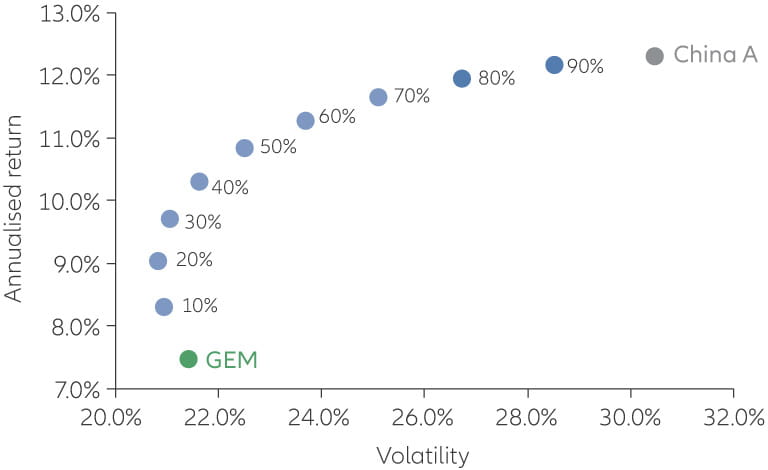

Exhibit 9: Adding China A-shares to MSCI EM allocations can enhance the risk/return profile of an emerging-market allocation

Chart shows analysis of returns for the MSCI Emerging Market Index (used as proxy

for global emerging markets) and MSCI China A Onshore Index (used as proxy

for the China A-share market) indices from 31 January 2005/2020.

Percentages shown on the chart represent portion of portfolio allocated to China

A-shares.

Source: Allianz Global Investors

A bolder shift of 30% of one’s allocation to China A-shares would compound the enhancements further, with the annualised return of the overall portfolio rising to 9.7% and the Sharpe ratio jumping to 0.4. Our 15-year historical risk/return analysis suggests that a portfolio’s Sharpe ratio would be maximised with an allocation of 50%. While any such historical analysis is very dependent on its start and end points, these results suggest that a meaningful allocation to China A-shares would be beneficial from a portfolio construction perspective.

The historical analysis highlights many of the benefits that investors can reap from allocating to the Chinese onshore equity markets and, we believe, can be used as a starting point when considering exposure to the asset class. Further, we recognise that historical analyses are very start- and end-point sensitive. Those caveats notwithstanding, history and experience have shown us that the Chinese domestic equity market is clearly on an evolutionary path, especially in terms of its outlook for broader investor participation and potential lower volatility.

With that in mind, we firmly believe that it behooves investors to consider an increased allocation to China equity through exposure to the country’s domestic market. But – due to the evidence presented in this paper – investors should deploy capital in a steady yet evolutionary fashion, to benefit from a “first-mover” advantage without overly taxing their risk budgets.

Conclusion

Investors can finally access the domestic Chinese economy with relative ease through Stock Connect programmes to invest in China A-shares, giving them the ability to harness the promise of an increasingly consumer-driven “new economy” – one that is set to grow into the world’s largest economy within a dozen years. Put bluntly, the opportunity could be the single most transformative event in financial markets in the coming decade. However, simply “buying the MSCI EM Index” – currently still sorely underweight onshore China – would leave investors at risk of missing out on most of the potential opportunity.

As a result, we believe that the time is right for investors to consider increasing allocations to onshore China, as they did with emerging-market allocations a generation ago. That can be achieved by investors altering their existing emerging-market allocations to add direct allocation to China A-shares in order to better position portfolios for the intermediate and long term. Historical data suggests that doing so could improve returns and may also diminish risk, making it a compelling portfolio optimiser.

List of benchmarks used in Exhibit 2

| Bloomberg Ticker | Index name | Proxy for: |

|---|---|---|

| MXCN1A Index | MSCI China A Onshore Index | China A-shares |

| MXCN Index | MSCI China Index | HK-listed China stocks |

| MXAPJ Index | MSCI AC Asia ex-Japan Index | Asia-Pacific ex-Japan equities |

| MXEF Index | MSCI Emerging Markets Index | Global Emerging Market equities |

| TPX Index | TOPIX Index | Japan equities |

| SPX Index | S&P 500 Index | US equities |

| MXEU Index | MSCI Europe Index | European equities |

| MXWO Index | MSCI World Index | World equities |

* As of 31 December 2019

1) European Central Bank data, as of 31 December 2019.

2) Source: FactSet, MSCI, Goldman Sachs Investment Research, as of 31 December 2019.

3) Some or all the securities identified and described may represent securities purchased in client accounts. The reader should not assume that an investment in

the securities identified was or will be profitable. The securities or companies identified do not represent all of the securities purchased, sold or recommended for

advisory clients. Actual holdings will vary for each client. Alibaba and Tencent are two of the three large-cap technology companies which make up the widely

used “BAT” acronym.

4) Source: FactSet, MSCI, Goldman Sachs Investment Research, as of 31 December 2019.

1121234

Active is: Sharing insights

China is positioned to lead Asia’s economic recovery from the coronavirus

Summary

The coronavirus pandemic applied a sudden brake to China’s growth story, as it did to most economies around the world. But there are signs that China could be ready to lead the way out of the downturn and resume its long-term growth trajectory.

Key takeaways

|

-

Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security. The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted.

This material has not been reviewed by any regulatory authorities. In mainland China, it is for Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations and is for information purpose only. This document does not constitute a public offer by virtue of Act Number 26.831 of the Argentine Republic and General Resolution No. 622/2013 of the NSC. This communication's sole purpose is to inform and does not under any circumstance constitute promotion or publicity of Allianz Global Investors products and/or services in Colombia or to Colombian residents pursuant to part 4 of Decree 2555 of 2010. This communication does not in any way aim to directly or indirectly initiate the purchase of a product or the provision of a service offered by Allianz Global Investors. Via reception of his document, each resident in Colombia acknowledges and accepts to have contacted Allianz Global Investors via their own initiative and that the communication under no circumstances does not arise from any promotional or marketing activities carried out by Allianz Global Investors. Colombian residents accept that accessing any type of social network page of Allianz Global Investors is done under their own responsibility and initiative and are aware that they may access specific information on the products and services of Allianz Global Investors. This communication is strictly private and confidential and may not be reproduced. This communication does not constitute a public offer of securities in Colombia pursuant to the public offer regulation set forth in Decree 2555 of 2010. This communication and the information provided herein should not be considered a solicitation or an offer by Allianz Global Investors or its affiliates to provide any financial products in Brazil, Panama, Peru, and Uruguay. In Australia, this material is presented by Allianz Global Investors Asia Pacific Limited (“AllianzGI AP”) and is intended for the use of investment consultants and other institutional/professional investors only, and is not directed to the public or individual retail investors. AllianzGI AP is not licensed to provide financial services to retail clients in Australia. AllianzGI AP is exempt from the requirement to hold an Australian Foreign Financial Service License under the Corporations Act 2001 (Cth) pursuant to ASIC Class Order (CO 03/1103) with respect to the provision of financial services to wholesale clients only. AllianzGI AP is licensed and regulated by Hong Kong Securities and Futures Commission under Hong Kong laws, which differ from Australian laws.

This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG; in HK, by Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; in Singapore, by Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; in Japan, by Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424], Member of Japan Investment Advisers Association, the Investment Trust Association, Japan and Type II Financial Instruments Firms Association; in Taiwan, by Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan; and in Indonesia, by PT. Allianz Global Investors Asset Management Indonesia licensed by Indonesia Financial Services Authority (OJK).