How to rethink US allocations during the coronavirus crisis

Summary

The social distancing required to contain the coronavirus outbreak has led to an unprecedented forced shutdown of the US economy in the short term, with substantial downgrades to GDP and earnings growth likely. But in anticipation of a peak in cases and potential drug approvals, investors should look for opportunities now to prepare for a rebound in the months ahead.

Key takeaways

|

A downturn is likely, but investors can form a strategy now

The coronavirus pandemic is affecting the world in untold ways, but one thing is all but certain: it will soon trigger the fastest and sharpest economic downturn in US history. Hundreds of thousands of people have already felt the direct effects of the virus on their health, and millions more will feel its impact on unemployment, corporate earnings and GDP. However, hope is building that the economy can return to pre-crisis activity levels in the second half of 2020, assuming cases stabilise and a medical therapy is approved. Notably, the US is roughly five to six weeks behind China in battling the virus, and China’s economy has begun re-opening already.

In the corporate world, small and medium-size businesses stand to be hit hardest in the near term, though firms of all sizes could be affected. The companies that will be most likely to sustain themselves through this crisis are those with stronger balance sheets and stable leverage profiles. Selecting the most attractive securities – whether equity or credit – will take in-depth research and discerning active management.

Markets have plunged this year, but 2001 and 2008 were worse from peak to trough

As the virus spread around the US in March, financial markets dropped based on fears of the economic consequences of shutting down businesses, curtailing travel and other “social distancing” measures. According to Bloomberg, US equity markets have fallen around 23% year to date as at 25 March, and European markets have dropped more than 27%. However, this overall market decline is still far below the roughly 50% peak-to-trough drops during the economic downturns of 2001 and 2008 (although certain sectors, such as energy and airlines, have fallen more than 50% this year).

The expected multi-trillion-dollar stimulus package should keep the economy functioning

Markets may not fully stabilise until they see a peak in total coronavirus cases and the approval of an effective medical therapy for covid-19 – the disease caused by the new coronavirus. In the meantime, historic levels of fiscal and monetary stimulus have been announced – more than USD 6 trillion, or nearly 30% of US GDP – to support the economy through this crisis.

- The Federal Reserve has already lowered interest rates close to zero, committed to unlimited levels of quantitative easing and launched creative measures to support market functions (including directly investing in corporate bonds). Overall stimulus from the Fed amounts to upwards of USD 4 trillion.

- The US government is also expected to spend more than USD 2 trillion in fiscal stimulus measures, including direct support to consumers, small businesses, the health-care system, and state and local governments.

These efforts won’t fight the virus itself; just its economic effects. But they would almost certainly provide a bridge for the next few months, and would likely ensure adequate liquidity and functioning of the markets. These are critical steps as the US approaches a peak in the number of covid-19 cases, and then begins the gradual return to normal economic activity.

In the near term, we will be watching trends in four economic and market areas:

- Downgrades of GDP forecasts, including perhaps a 20% to 30% contraction in the second quarter alone. But by summer, if the number of cases peaks and an effective treatment is announced, we expect GDP to stabilise in the second half of the year. China’s economy is a good model: the country has started to re-open for business, only two months after its coronavirus cases began accelerating. Of course, we will be watching to see if China is able to stave off a second wave of infections.

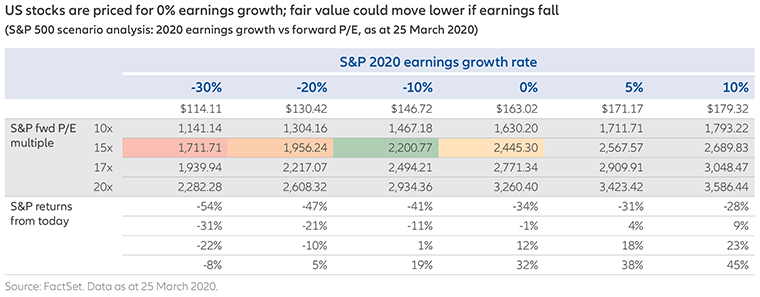

- Downward revisions in earnings forecasts. Based on current S&P 500 earnings growth expectations and past downturns, we believe the S&P’s fair value in the near term could be 10%-20% lower (see the accompanying chart). We expect to see some market dislocations as markets go through a bottoming-out process over the next few months which should present opportunities for longer-term investors.

- Depressed Treasury yields. Investors have fled to US Treasury bonds during the coronavirus outbreak as a safe-haven asset class, largely driving prices up and yields down. But as the economic outlook stabilises over time, we expect the benchmark 10-year Treasury yield to move back above the 1.0% level.

- Elevated volatility. Volatility levels around this crisis have been historic. The CBOE Volatility Index (VIX), known as the “fear index”, reached a new all-time high of 83 in March according to Bloomberg – significantly higher than its 2019 average of 15. But from a technical perspective, we have seen recent market lows accompanied by lower VIX levels (which have now settled in the 50s) – which could be a good sign that “peak fear” may have happened. We will be watching this closely as the US enters the height of its epidemiologic curve.

Considerations for investors

In past bear markets, equities have often rebounded – sometimes substantially – before falling back to or below their previous lows. We caution investors to be wary of false starts as the world moves through the peak of the health crisis and the market begins its bottoming-out process. Nonetheless, we don’t expect this pandemic to derail the fundamental health of the US economy over the long term. Ultimately, these lower asset prices and market dislocations could provide opportunities for investors who have been waiting for more attractive risk-reward levels.

As we await “peak coronavirus” in markets, investors may want to take a barbell approach with their portfolios:

- On one end of the barbell, consider defensive assets such as Treasury bonds, gold and US dollars.

- On the other end, look for risk assets that could benefit as the economy recovers – such as health care and technology (including 5G, cloud computing and e-gaming). Consider China A-shares as well, since China has been the first to emerge from the crisis so far. We also suggest looking for asset classes or sectors that have been priced to distressed levels but may ultimately recover; certain airlines may be one such example. It’s never a bad time to get your wish list ready.