Growth in China set to outlast the pandemic and trade wars

Summary

Despite the impact of the coronavirus pandemic, and continuing tensions with the US, China remains on course to become the world’s largest economy by 2030. This could represent the coming decade’s most transformative development in global financial markets – and a major opportunity for investors.

Key takeaways

|

As the world combats the coronavirus and confronts what many believe will be an epic recession, investors need to find new sources of growth potential. We think one answer is to look towards China – in particular, China’s A-share equity markets.

Investing in China is not without risks or controversy. China and the US are embroiled in a long-running trade dispute, and the coronavirus has added another dimension to existing tensions. The outbreak also slowed China’s growth, just as it has impacted growth in the rest of the world.

But the fact remains that China may be a fundamentally attractive investment opportunity for three key reasons: it has opened its markets to foreign investment, it offers compelling growth stories for investors, and it is executing a strategy to become the world’s largest economy by 2030. Over time, this will likely add up to a structural investment trend of steadily growing exposure to China – and proactive investors may want to pre-empt that shift.

China’s markets are open for business

China has undertaken a concerted effort to open its markets to international investors. The launch of the Stock Connect programme in 2014 facilitated access to China A-shares listed on the Shanghai and Shenzhen exchanges – representing a total market capitalisation of around USD 8.5 trillion, which is comparable to the eurozone.

In 2018, the inclusion of A-shares in two key MSCI indices – meaning that money that follows those benchmarks must buy Chinese stocks – significantly boosted inflows. The increasing institutionalisation of Chinese markets has also enhanced their appeal.

Listed companies on the A-shares indices are now required to file quarterly reports, and more than half of the largest A-shares companies have embraced global accounting standards and employed international auditors. Greater transparency and improved governance have also helped counter the volatility that has characterised A-shares in the past, although investors should stay cautious.

China offers compelling growth stories

China’s economy is changing. Once regarded as the world’s factory, it is now focusing more on higher-value goods and services. With its “Made in China 2025” initiative, it has ramped up domestic production in sectors like biotech, automotive and semiconductors, reducing reliance on foreign suppliers.

Meanwhile, other high-value sectors, including tourism, have benefited from wider changes in Chinese society. The emerging middle class that drove the economy’s pre-coronavirus growth should help fuel its tentative emergence from the outbreak, continuing China’s transformation from an export-driven economy towards one with a greater focus on domestic consumption.

The A-shares market offers investors access to small- and mid-cap companies within those high-value sectors that are set to be the future drivers of China’s economic growth.

China is on track to become the world’s largest economy

China doubled its GDP in the 12 years to 2020, with an average annual growth rate of 7%. A slowdown seemed inevitable even before the pandemic, largely due to China’s rapid accumulation of debt since the global financial crisis and the government’s desire to limit future credit growth. The coronavirus exacerbated these challenges, and in April 2020 China reported the first drop in economic output in more than 40 years, with first-quarter GDP 6.8% lower year-on-year.

Amid continuing tensions with the US, China also announced it would not set a GDP target for 2020 – for the first time in 30 years. Although the IMF is forecasting 1.2% GDP growth for China in 2020 – significantly lower than previous expectations – most major economies are expected to shrink due to the coronavirus, including a projected 5.9% GDP drop in the US. Any positive growth in China would vindicate President Xi Jinping’s long-term strategy and signify a resumption of the country’s growth trajectory.

How to invest in China

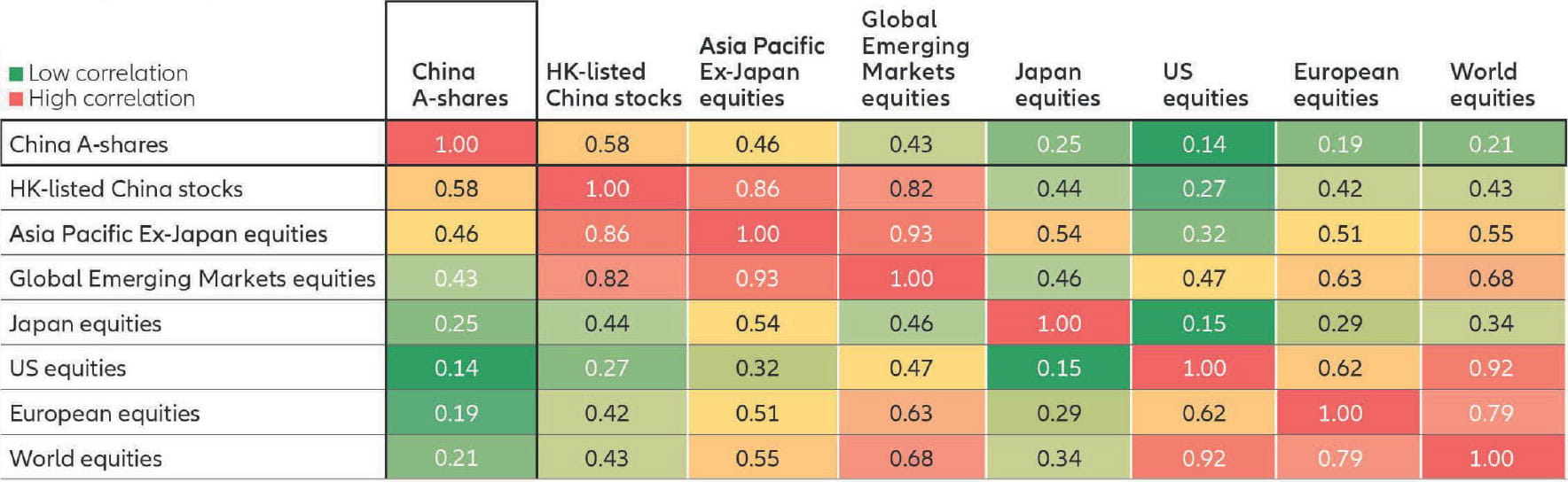

For investors considering China, A-shares have historically displayed very low correlation with global markets, suggesting that investing in A-shares could bring additional diversification benefits. While the ongoing institutionalisation of China’s A-share markets may result in higher correlations, this change will likely be a gradual process over many years.

Because of domestic revenues and distinct economic and monetary policy, China A-shares have a low correlation with major equity markets

As of January 31 2020.

Correlation data is calculated based on historical return of respective MSCI indices for the past 10 years, using weekly USD return. See full names of all

specific benchmarks at the end of this paper.

Source: Bloomberg, Allianz Global Investors.

Some investors will access the China growth story through benchmark exposures, now that major indices – such as the MSCI World – include A-shares. In our view, such an approach underplays the opportunity, because China represents only a small percentage of these indices. For instance, A-shares constitute 4.1% of the MSCI EM index – a proxy for global emerging markets – and just 0.5% of the MSCI ACWI ex-US index, representing international equity performance. This is despite China currently accounting for around 15% of total global economic output.

Instead, a deliberate, active allocation may be key to seizing the full scale of the opportunity in China while managing the risks.

Investors will likely benefit from an informed, connected partner with local knowledge and the agility of an active management approach. At Allianz Global Investors, we isolate stock selection as our key driver of risk and return, whatever the prevailing market conditions. We achieve this by using our own extensive proprietary research, supported by regular engagement with listed companies’ management teams. Environmental, social and governance (ESG) factors are now integrated into our China A strategy’s investment process, applying another dimension of risk management.

While China may be a controversial topic for some investors, we expect the country to continue its upward path and the world’s investors are set to follow gradually. Now could be the time to get ahead of that trend.

List of benchmarks used in graphic

| Bloomberg Ticker | Index name | Proxy for: |

|---|---|---|

| MXCN1A Index | MSCI China A Onshore Index | China A-shares |

| MXCN Index | MSCI China Index | HK-listed China stocks |

| MXAPJ Index | MSCI AC Asia ex-Japan Index | Asia-Pacific ex-Japan equities |

| MXEF Index | MSCI Emerging Markets Index | Global Emerging Market equities |

| TPX Index | TOPIX Index | Japan equities |

| SPX Index | S&P 500 Index | US equities |

| MXEU Index | MSCI Europe Index | European equities |

| MXWO Index | MSCI World Index | World equities |

Active is: Sharing insights

The coronavirus has accelerated changes in energy supply and demand

Summary

One of the immediate impacts of the coronavirus crisis was a fall in global energy use. While demand will likely rebound to previous levels, the overall energy mix is changing. Renewables are playing a bigger role as traditional sources such as coal become increasingly uneconomic. This trend was already in place when the pandemic hit, but is now proceeding at an accelerating pace.

Key takeaways

|