US elections Q&A: investors can find an advantage in volatility

Summary

Financial markets could remain volatile as we head towards US elections in November – particularly with the prospect of a contested result. But this could provide a tactical opportunity for investors to add risk to portfolios, or to further diversify their holdings.

Key takeaways

|

How should investors view the run-up to the US elections, particularly in the context of Covid-19?

Mona Mahajan: Historically, the months before US elections have been volatile for the markets, and this year may be no different. The pre-election period comes during a global pandemic that has already caused tremendous swings. In February, the S&P 500 Index reached all-time highs before Covid-19 triggered a 34% drawdown. The S&P then rebounded nearly 60% before a correction in September. We expect some form of this volatility to continue until the election results are known. Market performance will also largely be driven by virus trends, which continue to remain precarious heading into autumn, while President Donald Trump’s Covid-19 diagnosis makes an already volatile period even more uncertain.

However, if infection rates improve, an effective vaccine comes online next year and the global economy continues to recover, the market outlook for the US and elsewhere could improve notably. So investors may want to use periods of market volatility in the coming months as a tactical opportunity to add to their positions in stocks and other risk assets.

Peter Lefkin: Even in the face of Covid-19, US election polls have been remarkably stable, with former Vice President Joe Biden holding a steady and consistent lead over President Trump. Yet the key to winning is not in the national popular vote, but instead in how the candidates do in about eight swing states. That means Mr Trump has a fighting chance – although probably not as much as he did at this point in 2016, when he was down in the polls by a smaller margin. The health, economic and social fallout from the pandemic is the most prominent issue of the 2020 election, but it is intertwined with existing long-term tensions in the US that Covid-19 revealed and amplified. For example, some US citizens are faring comparatively well despite Covid-19: they can stay home and work virtually. Other Americans are having a much harder time: they must report to work and risk getting sick, or they can’t work and have lost their income. The coronavirus hasn’t changed many minds in terms of who supports which candidate, but people who did change their views seem to have moved to Mr Biden. In a close election, any movement is critical. Perhaps equally important, the pandemic has hardened existing attitudes, making it less likely that there will be any significant shifts from one candidate to the other before the election.

So far, just a few sectors have powered stock markets’ tentative recovery. Will that continue, and what does it mean for investors?

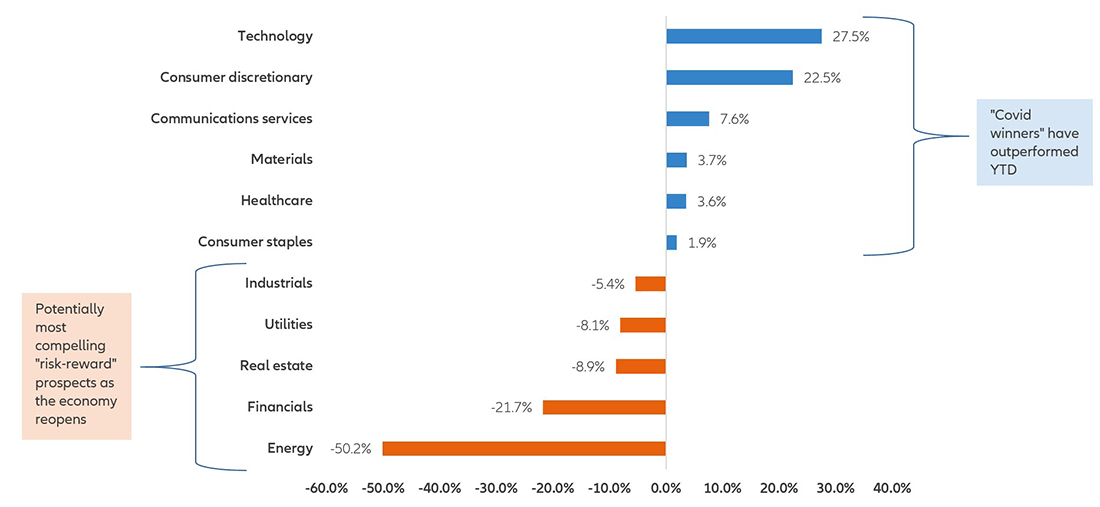

Mona Mahajan: We’ve been expecting market participation to broaden – meaning more segments should do well beyond the “Covid winners” of technology, consumer discretionary and healthcare. A steadily reopening economy, more fiscal stimulus and favourable developments in the fight against Covid-19 would help speed this rotation. In the US, the value cyclical sectors of industrials, financials and energy have been beaten up this year while growth sectors have soared – but this may shift somewhat in the next six to 12 months. For example, consider that both major presidential candidates are proposing strong infrastructure-spending packages. That seems to be positive for industrials and manufacturing no matter who wins.

Broader participation also applies to other regions globally. Europe has attractive opportunities in value cyclicals in the healthcare and financial sectors, as well as parts of the energy sector. And China offers exposure to secular growth stories – particularly in growth technologies such as artificial intelligence and 5G communications. The US dollar has also weakened this year, which could help non-US assets.

Some unloved sectors could be well-positioned as the economy reopens

Year-to-date 2020 S&P 500 Index returns by sector

Source: Bloomberg and AllianzGI. Data as at 30 September 2020. Past performance is not indicative of future results.

Will US interest rates stay low – and what does that mean for inflation?

Mona Mahajan: The Federal Reserve has made it clear that it won’t raise rates for some time – potentially until the end of 2023. Low rates are keeping investors on the hunt for income, and some are being forced to invest in riskier assets to meet return and yield targets. The Fed has also announced a shift in its inflation-targeting policy, indicating that it will allow inflation to temporarily overshoot its 2% target to balance the nearly 10 years that inflation hasn’t met that goal. This scenario – low rates, ongoing monetary and fiscal stimulus, and the potential for economic growth to accelerate – could push up inflation expectations in the coming years. But in the near term, rising economic growth and normalising inflation should provide a good backdrop for stocks and other risk assets.

If Mr Biden is elected president, how could that affect the financial services industry and regulations?

Peter Lefkin: Mr Biden’s platform is more nuanced than Mr Trump’s, whose policies have generally been good for the financial services industry. Mr Trump helped repeal the Obama administration’s fiduciary-duty regulations, and he has been a strong supporter of private investment plans. Still, only about 50% of people employed in the US private sector have access to private retirement accounts such as a 401(k). Mr Biden has proposed policies to encourage broader participation in the markets – including implementing tax credits that could increase retirement-savings rates for lower-income earners and younger workers.

Mona Mahajan: Mr Biden’s policy proposals call for higher corporate taxes, capital gains taxes and taxes on wealthy individuals. He would also roll back some of the recent financial-sector deregulation measures. Taken together, these policies could hurt corporate earnings, especially for those sectors that benefited the most from tax cuts and deregulation – financials in particular – as well as large multinational companies with overseas operations, including technology and healthcare firms. However, tax hikes may not be an immediate priority for Mr Biden while the US is recovering from recession, and he plans to use the proceeds from any tax increases to invest in growth areas such as renewable energy. Mr Trump, meanwhile, wants to maintain the status quo: he would like to preserve his tax cuts and deregulation measures, and perhaps even make his recent payroll tax cuts permanent. Overall, however, the implementation of either candidate’s plans will depend on which party controls the US Congress after the elections.

What are the main risks investors should keep an eye on?

Mona Mahajan: In the near term, we think the two primary risks are a resurgent coronavirus and the election result being contested in the courts. These factors would likely create uncertainty for markets, compounded by traditionally volatile September and October months. But the election result will eventually be decided, and as of now it appears that 2021 could bring one or more viable vaccines. So if these risks are resolved, and if consumer activity around the globe improves, financial markets could perform well – particularly against a backdrop of low rates and ongoing fiscal and monetary stimulus measures.

Investors may face volatility in the near term, but they could use periods of consolidation – market pullbacks or sideways movement – as tactical opportunities to add risk to portfolios, or to further diversify their portfolios. We see the potential for a broader range of sectors and regions to participate in the market’s upside over the next 12-month period. Europe and China are regions to watch, as are industrials and select parts of the financials and energy complex – particularly clean energy.

Active is: Anticipating what’s ahead

2021 outlook: portfolios need a broader mix as the pandemic prolongs the uncertainty

Summary

While investors can approach 2021 with optimism that an effective Covid-19 vaccine will be available, the path of the economic recovery remains unclear. A broader toolkit of investments is needed – not just the regions, sectors and strategies that have recently done well.