Active is: Anticipating what’s ahead

“Year of the Ox” symbolises China’s strong future

Summary

This lunar new year, China has much to celebrate – including resilient economic growth, widespread success at suppressing Covid-19 and a steady transformation into an advanced economy. That’s why the ox is a suitable symbol for a country that continues to do the hard work needed to maintain its trajectory.

Key takeaways

|

Investment outlook

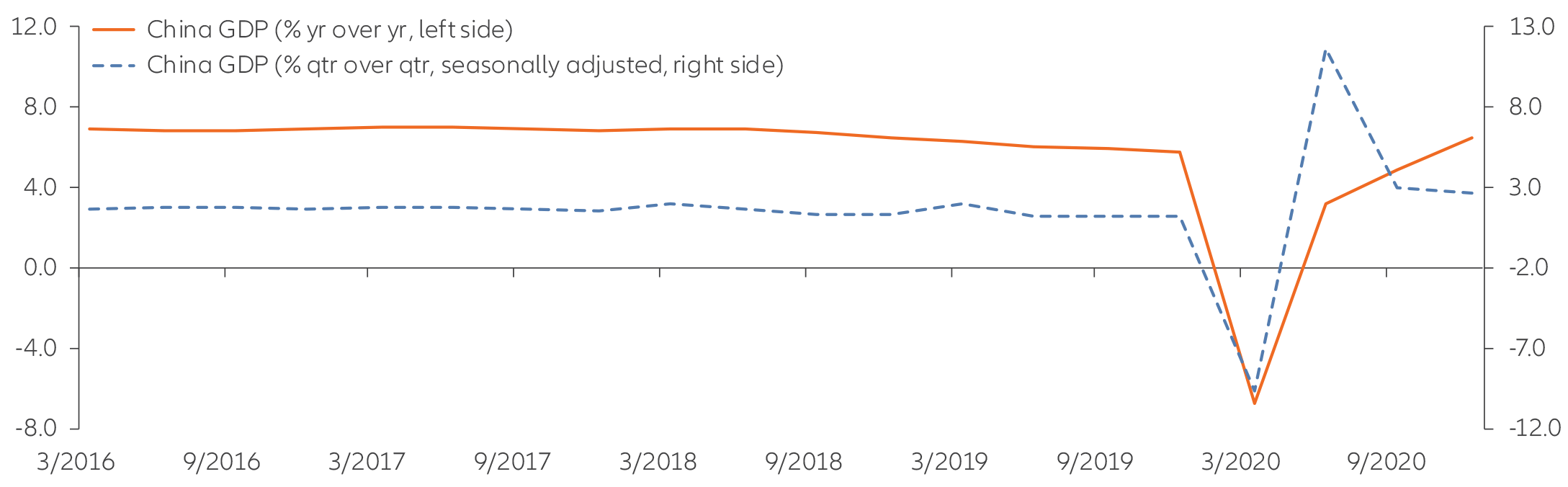

China was the only major world economy to grow its GDP over the last year. We expect it will continue its strong recovery from the coronavirus crisis, although perhaps at a slightly slower pace. Year-on-year GDP growth numbers look strong because of the weak comparisons with 2020 at the height of the pandemic (see chart).

China’s GDP rebounded sharply in 2020

Quarter-over-quarter and year-over-year GDP growth

Source: Bloomberg, CEIC, Allianz Global Investors. Data as at December 2020.

Still, China seems set to continue its upward climb. The service sector should do well, assuming the government can suppress renewed outbreaks of the coronavirus. The manufacturing sector also appears likely to keep growing, helped by public investment projects (which may slow slightly in 2021 compared with 2020) and a gradual recovery of global demand as

Over the course of 2021, this economic strength may enable China to do something that other major economies haven’t been able to: ease back on the massive stimulus that the government is pumping into the economy. This could take the form of slightly lower government spending – perhaps resulting in less investment in physical infrastructure – though we expect to see continued support for innovative technologies, small- and medium-size enterprises and the “green economy”. The People’s Bank of China is also slowing down credit growth by reducing the amount of new loans provided by financial institutions. However, we don’t anticipate these fiscal or monetary policy changes to be sudden or drastic.

What does this mean for investors? Financial markets tend not to like it when stimulus is withdrawn – or, in this case, slightly reduced – so this could make China’s short-term investment outlook a bit bumpier. But over the long term, China’s economic story is compelling, which we believe makes for an attractive long-term investment case as well. As such, we think investors should continue to think of China as an asset class in its own right – one that may warrant a dedicated, standalone allocation.

As investors look ahead towards what the Year of the Ox will bring, what could cause our economic outlook to become less bullish – or even more? Here are some of the more significant variables for investors to watch.

Four key investment questions for the coming year

Investment implications

Even though we are bullish overall on China and Asia over the long term, the coming year holds some significant unknowns – including the path of the coronavirus. As such, we suggest that investors take a close look at their portfolio mix – adding to strategic, long-term allocations where they may be underinvested, and making tactical shifts to reflect the risks and opportunities present in this changing environment.

Equity markets are growing

“Onshore” China A-shares (which are traded in markets in Shanghai or Shenzhen) performed very well in 2020 yet are still reasonably priced, especially compared with US markets. The forward P/E ratio for A-shares is at 17.3, versus 20.0 for global equities and 23.5 for US equities.4 The A-share markets could continue to benefit from several positive tailwinds: Chinese residents are putting more of their wealth in the stockmarket, major global benchmark indexes are increasing their allocations and the number of foreign institutional investors is growing. Moreover, with the Biden administration now steering US policy, US-China relations could become less unpredictable – and the markets always appreciate added certainty. Still, some tensions will undoubtedly linger.

In addition, it’s important to note that the negative performance in 2020 of Chinese companies listed in Hong Kong5 demonstrates Chinese equity markets are not monolithic. Valuations are more reasonable when Chinese companies are viewed in aggregate as part of an “all-China” view.

Fixed-income dynamics favour shorter durations and higher yields

In China and across emerging Asia, fiscal and monetary support – along with positive developments in the fight against coronavirus – should help fuel the appetite for yield and risk assets. Across the region, we generally prefer fixed-income investments with shorter durations, and generally favour high-yield over investment-grade securities. In addition, we believe the long-term trend is for China’s currency (the renminbi) to gradually become a more internationalised currency that gains wider use outside of China’s borders. And although currencies are notoriously volatile, over time, the renminbi also may begin to appreciate relative to the US dollar. This could provide opportunities for active asset managers to make favourable currency trades.

See our 2021 global outlook (including four key investment themes to watch), regional outlook and asset class outlook.

1) Source: BloombergNEF. Data as at 31 December 2020.

2) Source: Reuters as at January 2019.

3) Source: CFA Institute as at December 2019.

4) Source: MSCI as at 31 December 2020. Proxies: MSCI China A Onshore Index for China A-shares, MSCI World Index for global equities and MSCI USA Index for US equities. Forward P/E is a type of price-to-earnings (P/E) ratio that employs forecasted earnings.

5) Proxy for H shares: MSCI China H Index.

China: the “sleeping giant” of the equity markets

Summary

Despite the coronavirus pandemic and ensuing global slowdown, 2020 was a watershed year for China in many ways. William Russell, Global Head of Product Specialists Equity, explains how China is delivering on its long-term strategy and what opportunities this can provide for investors.

Key takeaways

|

Will China keep the coronavirus at bay?

Covid-19 is the main risk for economic growth globally – and China is no exception. But China and Asia overall seem to be in a better position than their Western counterparts, given that the United States, the European Union and other major economies are still struggling to bring the coronavirus under control. If China’s economy keeps up its strong recovery, China’s equity and bond markets may look increasingly attractive.

Will China repair relationships with existing trading partners– and strengthen new ones?

China’s troubled relationship with the US has been a major geopolitical theme in recent years. US President Joe Biden may help reduce tensions, but some issues will undoubtedly remain. This is one reason why China has been steadily becoming more self-sufficient by strengthening its supply chains, building up its own advanced-manufacturing capabilities and forming new alliances.

For example, the new Regional Comprehensive Economic Partnership (RCEP) creates an economic bloc of Asia-Pacific nations that covers a third of the world’s population. The RCEP deal will apply to almost 30% of global trade and GDP – more than the EU’s trading bloc or the US-Mexico-Canada agreement.

The EU and China also recently announced their Comprehensive Investment Agreement (CAI) after seven years of negotiations. This should provide the EU with access to important new commercial opportunities in the manufacturing, automotive and financial services sectors, among others. For China, the CAI is a strategic breakthrough, helping it form new international partnerships amid the rise of protectionism and anti-China sentiment.

Will China keep up its successful economic transformation – or will it overreach?

China continues to make progress in developing innovative technologies that help the country compete in higher value-adding, advanced-manufacturing sectors such as robotics and aviation. Recently, China officially launched its “Dual Circulation Strategy”, which involves substituting imported goods (such as semiconductors) for domestic ones while expanding domestic demand. The goal is to further advance China’s per-capita GDP so the country can more quickly complete its transformation to an advanced economy.

These policies have been well-received by the financial markets overall, but others haven’t been. China’s regulators recently clamped down on some of the country’s best-known corporations, accusing them of monopolistic and anti-consumer behaviour. However, we don’t believe Beijing will take this too far for fear of putting Chinese companies at a competitive disadvantage.

Will China continue emphasising sustainability?

Slowly but surely, China is devoting more attention to the issues that are critical to the sustainability of its economy.

At the same time, China must do more to improve transparency so investors can understand more about how companies and policymakers are approaching important ESG issues. Until then, it’s vital for investors to find partners who can provide proprietary research into what’s really happening behind the scenes.