Active is: Inventing new opportunities

Why it pays to stay agile in an age of low interest rates

Summary

With low rates to the left of them, inflation concerns to the right, investors may feel stuck in the middle as they seek to protect and enhance their savings. How should they rethink portfolios to keep pace?

Key takeaways

|

Last year, during the most acute phase of the Covid-19 crisis, the world’s major central banks intervened on an unprecedented scale – cutting interest rates, buying government bonds and providing massive liquidity to the global economy. Sovereign bond yields reacted by sinking to historic lows: -0.9% on the 10-year German Bund and 0.5% on 10-year US Treasuries.

With a brisk – albeit uneven – economic recovery underway across much of the world, and yields well above their recent low point, some commentators believe global rates have turned a corner. The argument goes that the four-decade bond bull market, which has pushed yields steadily lower, is now over. A resurgence of growth and inflation means that materially higher rates are inevitable.

Though it is tempting to think that the recent climb in bond yields heralds a change of regime, we think this view is mistaken. While rates may rise somewhat from here, there is ample evidence that they will remain extremely low against all historical measures.

Indeed, multiple factors indicate that interest rates will stay “lower for even longer”, based on both long-term economic trends and more recent developments. Rethinking portfolios to account for this outlook should be an urgent priority for investors.

Slower growth is suppressing interest rates

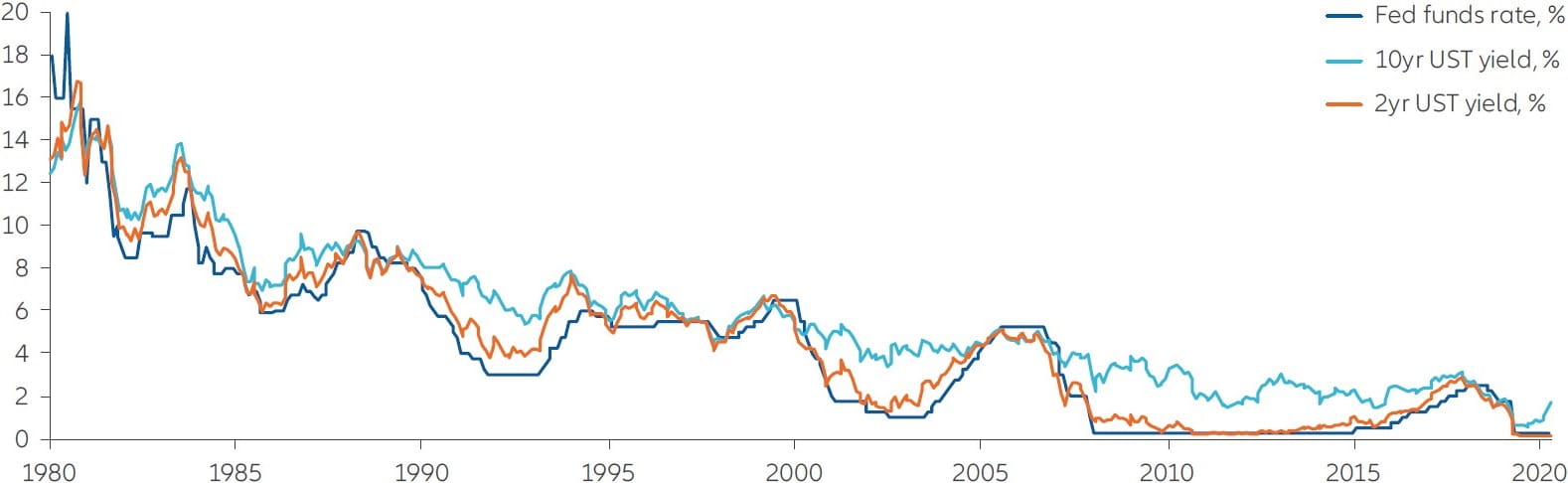

To take the longer-term factors first, the forces that have propelled a 40-year bull market in government bonds – and the accompanying decline in developed-world interest rates (see Chart) – seem far from exhausted. Until they are, it is premature to call a decisive turn.

Two key factors have helped to drive rates lower: a decades-long deceleration in economic growth and inflation, and falling long-term inflation expectations. Nominal bond yields track nominal GDP closely. As growth slows, interest rates and bond yields tend to moderate. In this context, a given rate of interest represents an equilibrium that balances demand for capital to invest and the supply of savings available to meet that demand. Slower growth tends to suppress investment demand for investment capital and therefore puts downward pressure on interest rates.

Equally, if long-term nominal growth rates rise, increasing demand for capital should push up interest rates. But this is unlikely in the foreseeable future. The major reasons are demographics, the changing nature of modern economies and slower productivity growth – which combine to suppress demand for capital while increasing supply.

Chart: Rates and yields-have dropped for decades chart

Fed funds rate and US Treasury yields (1980-2021)

Source: Refinitiv Eikon Datastream, Bloomberg, Allianz Global Investors GmbH.

Demographics mean the world is “drowning” in savings

Increased longevity across the developed world has tipped the demographic balance, reducing the size of working populations relative to older generations. This has helped to create a worldwide glut of savings that is seeking a home in safe assets, notably bond markets.

At the same time, there are fewer opportunities to put these savings to work. This is because of a long-term transition in developed economies from capital-intensive industry and manufacturing towards capital-light, services-oriented businesses, which have lower investment needs.

Slowing productivity growth has reinforced this trend by reducing long-term rates of economic expansion, again suppressing demand for investment capital.

The result is an abundance of capital and a relative shortage of opportunities to invest it, leading to downward pressure on interest rates. All these factors are long-term in nature and firmly entrenched – none of them is likely to reverse imminently.

Debt is at record levels

In addition, the world has accumulated a vast amount of debt – public and private – in the years since the global financial crisis, and especially since the Covid-19 crisis began in 2020. Massive debt burdens, although more easily financeable at very low interest rates, tend to suppress future growth by diverting cash flows from productive investment to servicing debt. They also make borrowers more vulnerable to any unexpected increase in interest rates.

With debt levels in major developed economies at record levels, central banks face a daunting challenge. Any significant rise in interest rates could render huge swathes of existing debt unsustainable and destabilise governments and financial markets. As a result, financial repression – where inflation is consistently higher than interest rates – becomes a necessary tool of monetary policy to ensure borrowers’ debt burdens remain sustainable. But it creates challenges for investors who are hunting for yield to protect their savings.

In effect, the centre of gravity in central banking has shifted. Policies such as quantitative easing (QE), which were experimental a decade ago, are now routine. Far from seeking an exit from current policies as soon as possible, central banks are now more likely to stress the dangers of providing too little support to the economy, rather than providing too much.

So, it is not surprising that even though a powerful rebound in economic activity is likely, this year and next, all indications are that monetary policy will remain loose. The US Federal Reserve is expected to taper its bond purchase programme very gradually, with no rate increase likely before 2023. In the euro area, monetary policy will remain extremely loose.

Taken together, these factors strongly suggest that the most likely outlook in developed economies is for many more years of historically low interest rates that will keep returns from safe assets close to zero.

Implications for portfolios

How should investors react? It has rarely been harder to generate reliable income. Equally, preserving the purchasing power of money in an age of financial repression is a constant headache. And if investors venture beyond traditional assets in search of extra yield, how should they diversify and manage their risks?

- Think of allocations as a barbell – In addressing these challenges, investors should view their choices as a “barbell” that spans two groups of assets: those suited to preserving capital (including sovereign bonds, credit and cash alternatives) and those designed to generate capital growth and income (including emerging-markets bonds, equities and private-markets assets such as infrastructure equity and debt and private credit). They can then choose from a range of multi-asset solutions that combine elements from each group to target a range of outcomes.

- Staying agile is key – The past few years have illustrated a key feature of today’s investment markets: how rapidly conditions can shift. In an environment where scenarios can change quickly, the optimum mix of assets will naturally need to shift in response. This calls for a highly dynamic approach to positioning that rapidly switches asset allocations within the portfolio as the economic conditions evolve to preserve the benefits of diversification and ensure agile risk management.

- Consider permanent portfolio changes – Some changes in portfolios could be more permanent. In particular, this points to a future in which the balance of traditional equity/fixed income portfolios will shift decisively towards equities: a conventional balanced portfolio of 70% bonds and 30% equities may move towards a 50:50 position, for example. A more aggressive 60:40 portfolio might shift to 80% equity and 20% fixed income, or even 100% equities with an equity-risk hedge overlaid. It also suggests that allocations to private-market assets intended to generate capital growth and additional yield will increase substantially. They may reach 20% in a typical institutional multi-asset portfolio.

The forces that have driven interest rates steadily towards zero over the past four decades are still at work and will remain dominant for the foreseeable future. Against this background, the way investors approach asset allocation must change, and their approach to risk management and diversification must become far more agile to navigate an era when market conditions can be changeable.

Growth. The China Way.

China: taking the long view

Summary

China’s regulatory crackdown on “big tech” does not alter its strategic goals. It will continue opening up and global investors will likely keep increasing their China allocations. What long-term lessons can investors take away from this period?

Key takeaways

|