Navigating sustainable bond opportunities

Sustainable debt instruments are one of the most direct routes to finance sustainable development. The market for such bonds is gaining significant momentum. Investors now have greater opportunities to align their values with investing in fixed income, where previously equities have led the way. With a burgeoning range of sustainable debt labels, understanding these different types of products is key to making the right investment decisions.

Key takeaways

- Sustainable bond issuance volume has risen presenting more potential options for investors

- This growth is underpinned by emerging guidelines and regulations that are driving greater clarity and credibility

- The easier measurability of green bonds makes them dominant amid the broadening range

- For advancement in this asset class, products require greater quality, credibility, and robustness

The first sustainable bond was the European Investment Bank’s Climate Awareness Bond issued in 2007, while the World Bank sold a green bond in 2008.1 Since then, the market has continued to grow, with issuance volume rising rapidly. Furthermore, the variety of sustainable bonds has expanded.

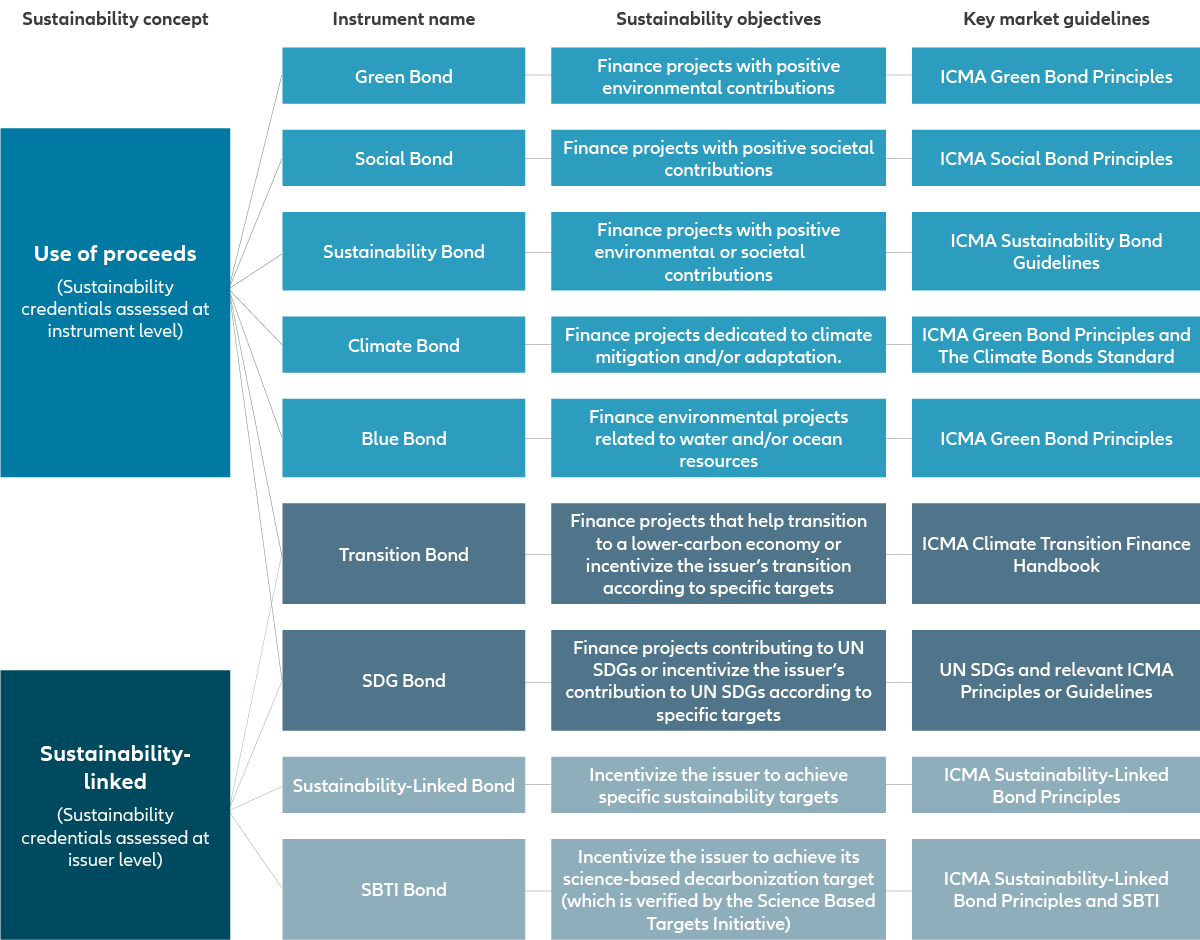

Sustainable debt instruments:

- Use of proceeds bonds were the first sustainable fixed income products. The funds from the debt sale are linked to projects or activities that seek to generate positive environmental or social outcomes. Depending on their objectives they can be labelled as green, social, or sustainability bonds. While green bonds and sustainability bonds are the most popular instruments, social bonds have experienced a sharp increase in capital allocated over the past two years in response to the Covid-19 pandemic, which further exposed the urgency of social needs in society.

Climate bonds and blue bonds are two further emerging categories of use of proceeds bonds under the green bonds umbrella. Climate bonds finance projects related to climate action and blue bonds finance projects related to water or ocean resources. - Sustainability-linked bonds emerged in 2017. Adopted from the loan market, the proceeds can be used for general purposes2, but the instrument is structured in such a way that it features commitments by the issuer to improve sustainability performance through pre-determined sustainability performance targets.

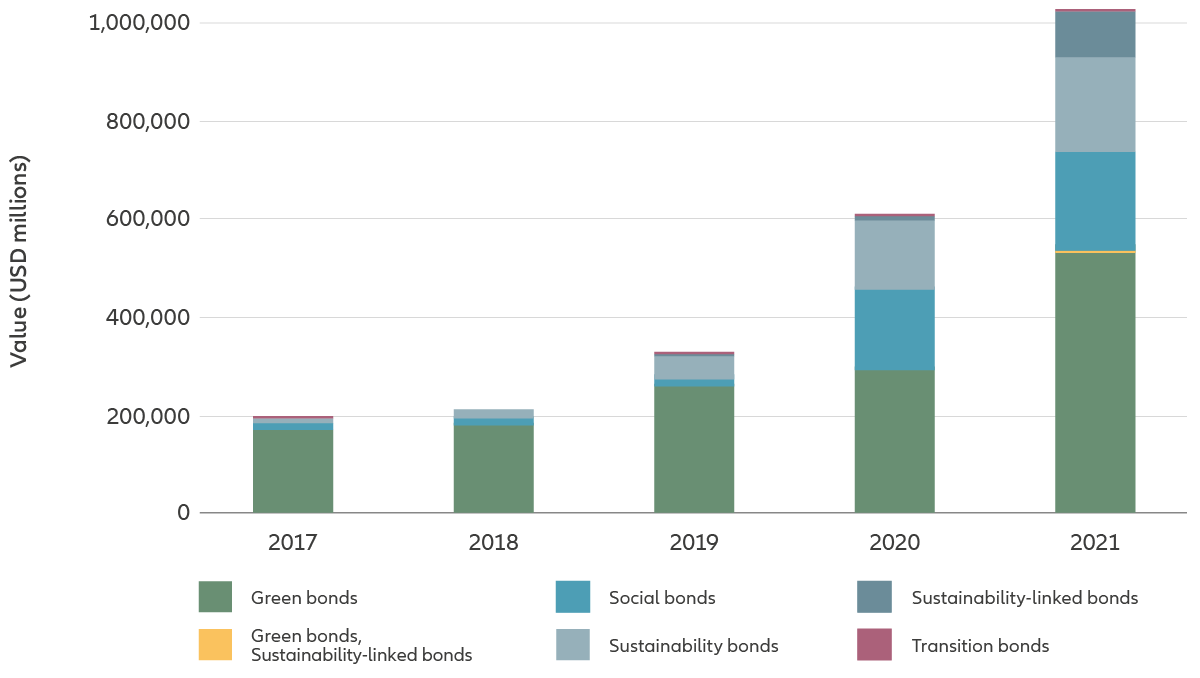

In 2021, sustainability-linked bonds recorded the strongest growth amongst all sustainable debt instruments - see Exhibit 1.3 This instrument is gaining popularity since it is not constrained by the use of proceeds framework, enabling an alternative pathway to sustainable financing. For example, rather than financing climate-related projects directly, a climate-themed sustainability-linked bond could be linked to the issuers’ decarbonisation targets verified by the Science-based Targets initiative (SBTi).

Exhibit 1 : Issuance of sustainable bonds by type 2017-2021

Source: Environmental Finance, Sustainable Bonds Insight 2022

Exhibit 1 shows steady growth of green bonds due to being the first of such debt instruments and addressing the market interest in environmental issues. However the later, faster growth of social and sustainability bonds illustrates how debt instruments have been leveraged to address a broader range of societal needs.

Exhibit 2: Allianz Global Investors’ classification of bonds aligned with sustainable investing

Source: Modified from blog post by V. Lutz and M. Comble, ISS ESG, Going Beyond “Use-Of-Proceeds” to Reach International Sustainability Targets, June 2020 – published by Harvard Law School Forum on Corporate Governance, June 2020

Innovations: transition bonds, thematic bonds and sustainability-linked green bonds

Considering the importance of transitioning towards a low carbon economy, products are emerging to support issuers in hard-to-abate sectors that are not “green” but are making meaningful progress in transitioning towards a more sustainable mode of operation. Instruments that support this endeavour (whether in a use of proceeds format or a sustainability-linked structure) are labelled as transition bonds. It is important to note that transition bonds must demonstrate that they are aligned with a credible and science-based climate transition pathway, which can be challenging.

With the United Nations Sustainable Development Goals (SDG) now the recognised global agenda for sustainable development, thematic bonds have also emerged to align specifically with the SDGs. Within the area of thematic bonds, both use-of-proceeds and sustainability-linked products have become available.

In addition, products such as the sustainability-linked green bond with a hybrid approach combining the use of proceeds and sustainability-linked concepts are also gaining traction. This is deepening the sophistication of constructing sustainable bond instruments.

Towards greater transparency

|

Use of proceeds bonds’ four key structural and disclosure components under the ICMA principles |

Sustainability-linked bonds’ |

|

1. Use of proceeds |

1. Selection of key performance indicators |

|

2. Process for project evaluation |

2. Calibration of sustainability performance targets |

|

3. Management of proceeds |

3. Bond characteristics |

|

4. Reporting |

4. Reporting |

|

|

5. Verification |

While the ICMA guidelines primarily offer principles-based frameworks, the Climate Bonds Initiative has developed technical use of proceeds criteria to determine whether financed projects are indeed aligned with the goals of the Paris Agreement. The Climate Bonds Standard has been developed by the Climate Bonds Initiative to provide criteria that verifies certain green credentials of a bond. Additionally, besides activity-specific technical requirements, the Climate Bonds Initiatives’ certification requirements ensure greater due diligence in terms of actual allocation to proceeds and post-issuance reporting.

Regulations are also emerging to provide greater clarity on sustainable debt instruments. The EU Taxonomy, for example, provides a basis to determine the extent to which green bond projects are considered sustainable.

China has also developed the Green Bond Endorsed Project Catalogue, which serves as guidance to determine what projects qualify as green. Similar regulations are also emerging in other markets globally and moving forward, they will play an increasing role in shaping how sustainable instruments are defined.

Future drivers of sustainable fixed income solutions for investors to consider

While we have seen a significant growth in the sustainable bond market, there is still work to be done, especially around the sustainability integrity of these instruments.

- Use of proceeds – greater adoption of science-based eligibility criteria

Given that the widely adopted ICMA guidelines are principles-based and voluntary in nature, the detailed criteria and definitions of eligibility could vary between bonds, even if they are of the same theme.

Investors should identify issuers that maintain science-based criteria when defining eligibility definitions, to uphold the integrity and impact of the sustainable instruments. - Science and net zero to become the norm in sustainability-linked instruments

For sustainability-linked bonds, it’s important to determine if the sustainability performance target covers the key material sustainability issues relevant to the issuer. Additionally, is the scope of the target meaningful in the context of the issuers’ overall business activities? Furthermore, is the target ambitious and science-based?

Investors should consider that science-based and net-zero-aligned targets could become the norm and even the default expectation for sustainability-linked instruments in light of the focus on net-zero transition. - Greater transparency to minimise double counting risks

There have been many cases of refinancing in the sustainable bond market. Since use-of-proceeds instruments are typically project-linked, refinancing the same eligible projects with multiple bonds could lead to double-counting risks. Hence any sustainable refinancing should be approached with diligence.

Investors should seek transparency to ensure their understanding of the project-linked nature of use of proceeds products. - External reviewers to uphold the integrity of sustainability claims

Obtaining an external review can be a method to demonstrate the integrity of sustainability features of bonds. This can include second-party opinions on sustainable bond frameworks; assurances; certifications and verifications. The role of an external reviewer should help to ensure transparency, and fair presentation of the issuer and instrument’s sustainability credentials.

Investors should leverage second-party opinions, and where possible also utilise information from third-party sources to assess the sustainability integrity of the issuer and instrument. - Consistency and quality of post-issuance reporting to be enhanced

The consistency and quality of post-issuance reporting by sustainable bond issuers varies hugely. Issuers often report proceeds allocation information, but actual sustainability output and outcome metrics are less consistently reported. Furthermore, they also differ between issuers challenging comparability and data aggregation.

Investors should expect issuers to focus on development of sustainability outputs and outcome metrics in their reporting. Enhancing quality and consistency in this area will demonstrate the true impacts of sustainable debt instruments.

Although the broader fixed-income market is starting to feel headwinds – to which sustainable bonds are not immune – the increased sophistication of investors seeking sustainable fixed-income products has highlighted myriad opportunities. Clarity and transparency are required to aid investors’ understanding of the potential and the constraints of the different types of bonds. Meanwhile regulation will mature to support the future development pathway for sustainable fixed-income products to take shape.

1) The World Bank,Launch of the Green Bond Partnership, September 2018

2) EM Compass, Sustainability-Linked Finance – Mobilizing Capital for Sustainability in Emerging Markets, January 2022

3) Environmental Finance, Sustainable Bonds Insight 2022 (see also Linklaters – Sustainable Futures, Sustainable bond issuance crossed the $1 trillion milestone in 2021, January 2022)

4) The Climate Bonds Initiative is an international organisation working to mobilise global capital for climate action through the development of the Climate Bonds Standard and Certification Scheme, policy engagement and market intelligence work.