The China Briefing

A policy ‘beat’

Beijing seems determined to reignite animal spirits in China’s onshore equity markets

Please find below our latest thoughts on China:

- Earlier this week, China launched a series of wide-ranging policy initiatives designed to provide support both to the real economy and, perhaps more eye-catchingly, to domestic equity markets.

- The initiatives, amounting to a significant and coordinated package of monetary easing measures, were a significant “policy beat” in our view. Highlights included:

- Cutting the main policy interest rate and the reserve ratio requirement (RRR)

- Reducing interest rates on existing mortgages (note: mortgage refinancing is only permitted in China in special circumstances approved by the central bank)

- Reducing the downpayment ratio for second-time homebuyers from 25% to 15% – the same level as for firsttime buyers

- Providing significant liquidity for share buybacks and stock purchases

- Considering a stabilisation fund for equity markets. - The timing and extent of these measures were triggered by two recent developments. First, there is the strong rally in US bond markets and the 0.5% Fed rate cut. With lower rate differentials between China and the US, the risk of capital outflows from China and a weaker currency were also reduced. In other words, the People’s Bank of China (PBoC) had significant additional flexibility.

- Indeed, it is notable that the Chinese currency has appreciated further vs. the US dollar this week. The renminbi has rallied by close to 4% over the last month.1

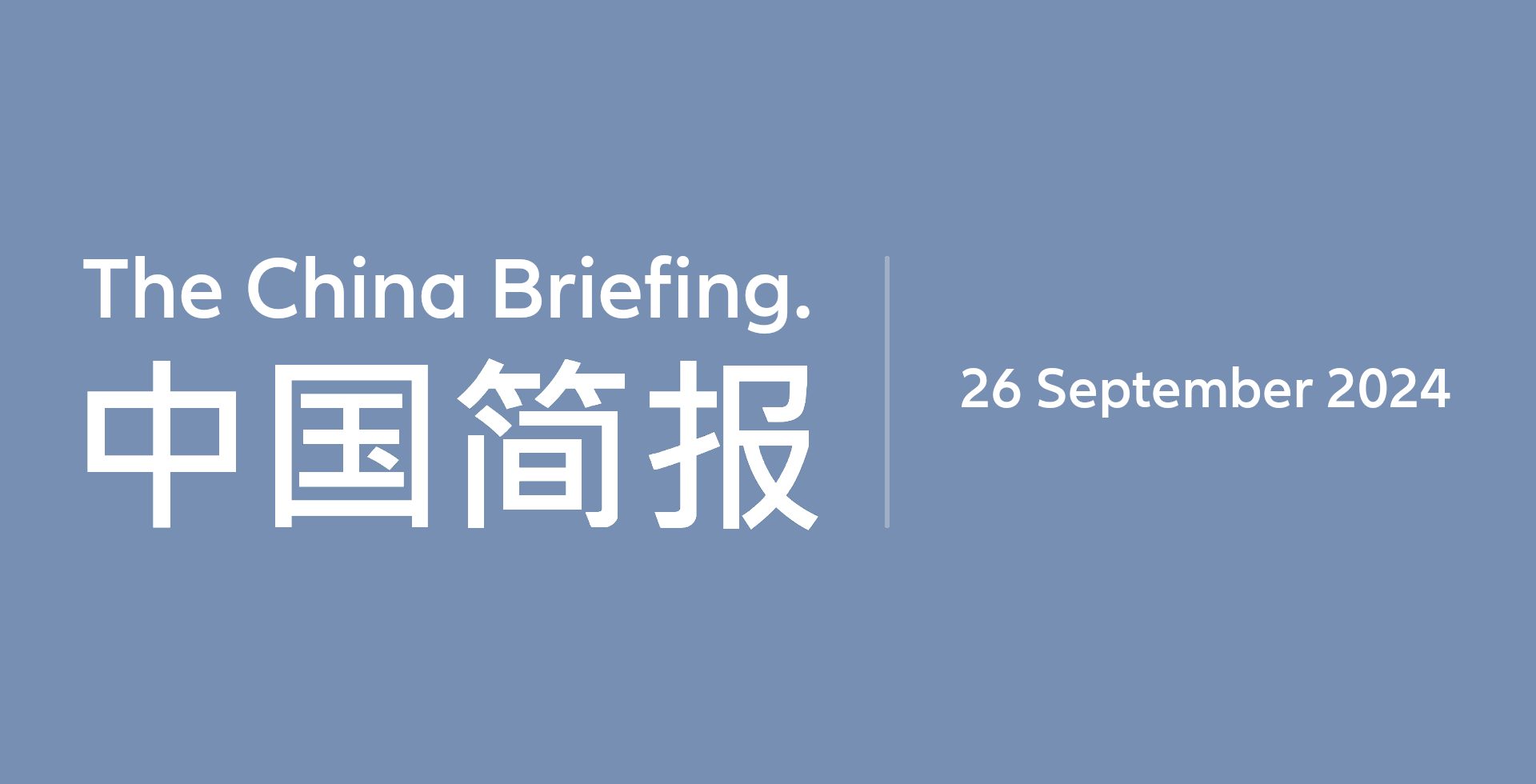

Chart 1: China A dividend yield vs China 10 year government bond yield

Source: Wind, Allianz Global Investors as at 25 September 2024. Past performance is not indicative of future results.

- The second development has been the weakness of China economic data in recent months. This is to a large extent because of the sustained downturn in the property market, and the associated erosion of the biggest component of household wealth.

- The monthly macro data was consistent with GDP growth well below the official 2024 target of “around 5%”. With just over three months to go, there was increasing urgency to take action to boost economic growth.

- Equity markets reacted positively and vigorously following the announcement. China A-shares have rallied by around 11% this week and are now in positive territory year-to-date. It was a broad-based advance with all sectors in positive territory and on high volumes. The offshore-dominated MSCI China Index has now registered a 15% gain year-to-date (in USD).2

- Looking ahead, the key question for equity investors is whether this rally marks a change, or will turn out to be another false dawn.

- Framing this in the context of risk and return, our view is this announcement should at worst provide a floor to China A markets and, in a more optimistic scenario, potentially sets the scene for a more sustained market rally.

- Certainly Beijing seems determined to reignite animal spirits in China’s onshore equity markets. The policy tools announced this week, including a swap facility of RMB 500 billion (that could be increased to RMB 1 trillion) and a relending programme of RMB 300 billion (that could be doubled if warranted) to support share buybacks and equity purchases from eligible institutions, are unprecedented measures.

- To reinforce this point, it appears the new policies were accompanied by the “national team” buying domestic ETFs.

- Additionally, the widening yield gap between domestic bonds (China’s 10-year government bond yield is touching 2%) and equities (dividend yield around 3.5%)3 provides enhanced valuation support.

- The unexpected extent of the policy easing measures will certainly give asset allocators food for thought, given the overall very light positioning in China. The initial market move certainly seems to be more than a short covering reaction. One major sell-side broker’s flows showed long buys exceeded short covering by a ratio of nine to one on the day of the announcement, representing the largest single day buying in China for more than three years.

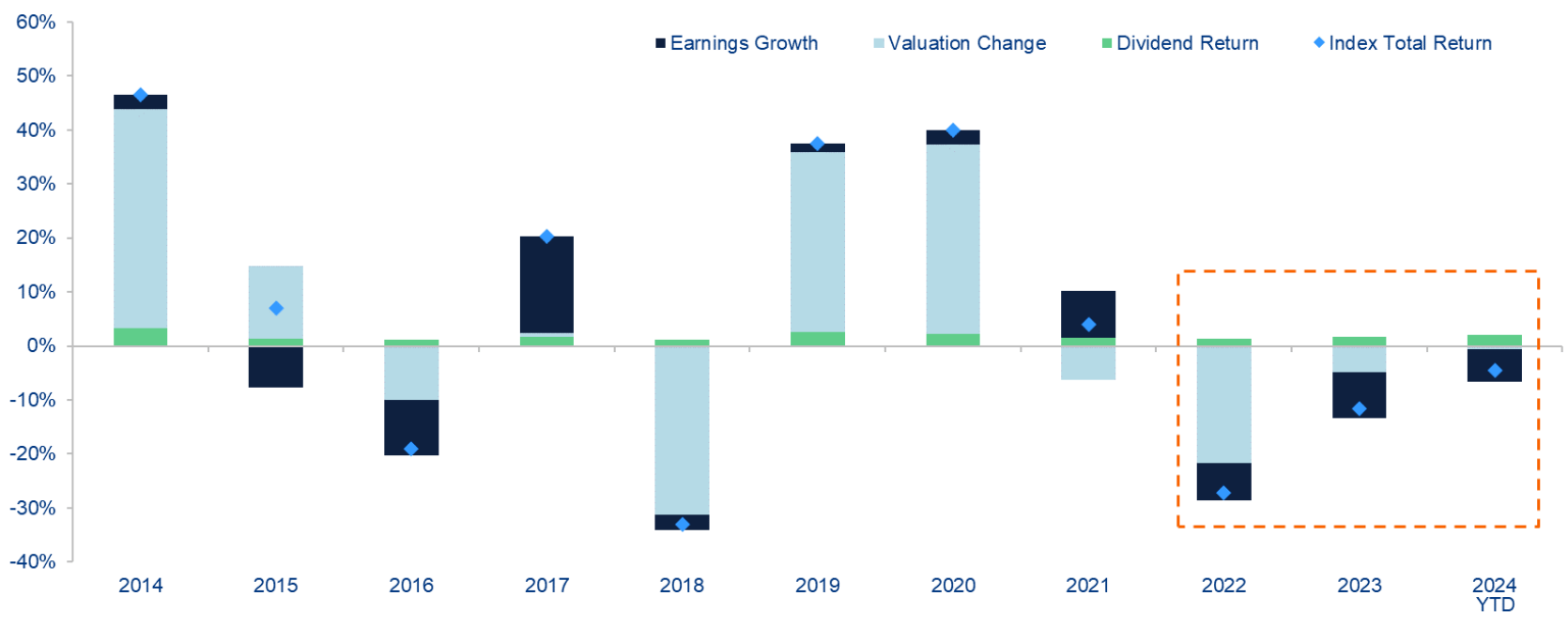

Chart 2: MSCI China A Onshore Total Return Breakdown (10 years)

Source: Bloomberg, Allianz Global Investors as at 31 August 2024, using total return in USD terms. Past performance is not indicative of future results.

- Whether the measures also have a meaningful impact on the macro situation is more questionable, with the key issues of weak consumption and the property market remaining unresolved.

- The move to reduce interest rates on existing mortgages by around 0.5% on average is certainly a step in the right direction. According to the PBoC, it should benefit up to 150 million people by lowering interest expenses by the equivalent of 2.5% of annual disposable income.

- Nonetheless, overall the easier monetary conditions will likely have somewhat limited macro effects, because the real bottleneck faced by the economy is a lack of domestic demand rather than a lack of domestic liquidity.

- As such, a key issue is whether the door is now open to further policy initiatives, and especially if they end up being the prelude to more stimulative fiscal policy which is needed to spur a more robust economic environment. News that Shanghai will issue consumption vouchers is another step in the right direction.

- In summary, from an equity investor perspective, the announcements this week provide important support for market valuations. The next step is to build greater confidence in the outlook for corporate earnings which has been the major drag on equities over the last year.

- And finally… next week is “golden week” in China, which coincides with National Day. Domestic financial markets are closed from Tuesday 1 October and reopen on Tuesday 8 October.

1 Source: Bloomberg as at 26 September 2024

2 Source: Bloomberg as at 27 September 2024

3 Source: Wind as at 25 September 2024