The China Briefing

Lessons from the latest earnings season

The Q2 results season has just ended - overall results were generally in line with expectations

Please find below our latest thoughts on China:

- China’s equity markets continue to test the patience of investors. China A-shares have drifted lower from their peak in May. Offshore markets have at least delivered positive returns year-to-date.1

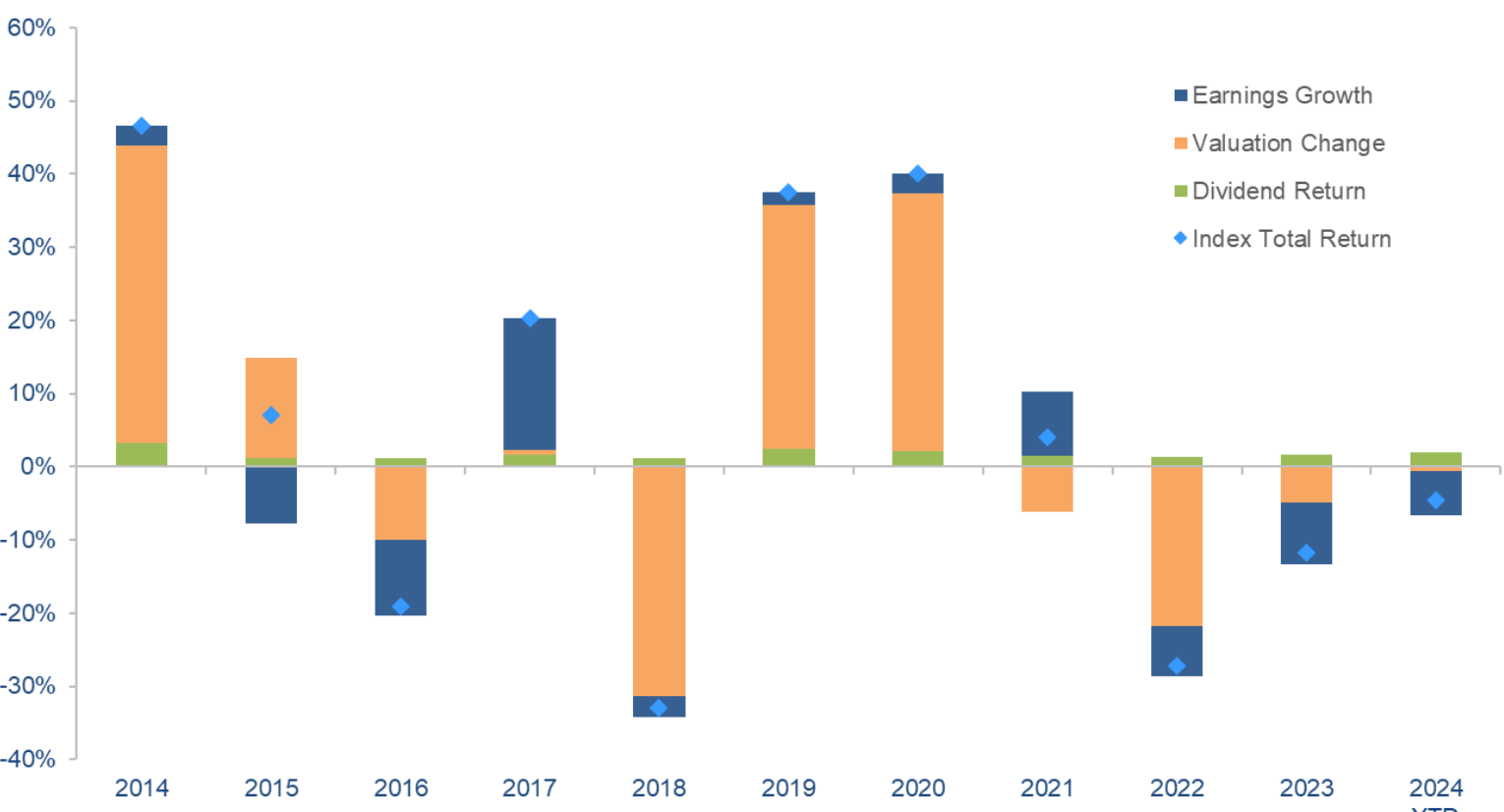

- Unlike in previous years, when a significant derating of equities was a major contributor to market declines, so far this year valuations have remained quite stable.

- Indeed, on a forward price-to-earnings ratio of close to 11 times and a price-to-book ratio of 1.3 times,2 China A valuations continue to provide an important downside cushion.

Chart 1: MSCI China A Onshore Total Return Breakdown (10 years)

Source: Bloomberg, Allianz Global Investors as at 31 August 2024, using total return in USD terms. Past performance is not indicative of future results.

- The main headwind this year has instead been weaker corporate earnings, with particular pressure on smaller companies.

- Having just completed the second quarter results season, our overall takeaway is that results were to a large extent in line with expectations.

- There were some notable “beats” in sectors such as technology hardware, where AI infrastructure capex combined with China’s push for enhanced self-sufficiency is leading to a more positive demand outlook. Offsetting this was weakness in real estate, which remains a key drag.

- While there are clear signs that life is still going on for Chinese consumers, they have generally become more cautious. Non-essential purchases have either been postponed or traded down to cheaper brands. China’s largest online travel agency, for example, posted more than 20% growth year-on-year, boosted by searches for cheaper flights and hotel options.3

- Another takeaway is the focus on dividends: 670 companies have announced interim dividend payout plans, more than the three previous years combined.4 Corporate balance sheets in China generally remain in a very healthy state.

- Overall, however, the tone of management guidance for the most part remains quite cautious. Which is not unexpected given the broader macro backdrop.

- The official purchasing managers index (PMI) came in at 49.1 in August compared to 49.4 in July. This marks four consecutive months of contraction.5

- In our view, the main issue is relatively lacklustre domestic demand, which in good part is a function of the depressed property market.

- For while there have been high levels of investment in what are seen as the growth industries of the future, especially high-tech manufacturing, these sectors are not yet large enough to fully offset the drag from property, leaving the economy as a whole with significant slack.

- The weaker recent economic data increasingly calls into question whether China will reach its growth target for the year of “around 5%”.

- Given the credibility issues associated with falling short, and the focus on this target during the closely watched Third Plenum, it seems likely there will be additional monetary and fiscal stimulus quite soon.

- Indeed, in this direction, a recent media report has suggested that China is considering an 80 basis point reduction on existing mortgage rates nationwide.6

- Mortgage refinancing is currently not allowed in China. However, reductions on rates of existing mortgage loans are permitted in special circumstances when approved by the People’s Bank of China (PBoC).

- The background is that because of lower interest rates this year, the gap between existing and new mortgage rates has widened significantly. This has resulted in a surge of discontent among existing mortgage borrowers.

- According to initial estimates, if all existing mortgages are refinanced, borrowers would save around USD 42 billion in interest payments annually, equivalent to 0.6% of total retail sales.7

- In practice, the impact would very likely be somewhat less than this. Nonetheless, it would certainly be helpful in raising household disposable income and, to an extent, boosting consumer purchasing power.

1 Source: Bloomberg as at 4 September 2024

2 Source: Bloomberg as at 4 September 2024

3 Source: Macquarie as at 29 August 2024

4 Source: JP Morgan as at 2 September 2024

5 Source: Nomura as at 1 September 2024

6 Source: Bloomberg as at 5 September 2024

7 Source: Macquarie as at 5 September 2024