Bond Price and Interest Rate

Difference between coupon and yield

The coupon is expressed as a percentage of a bond’s par value (or face value). While coupons are generally fixed, they can also be floating, or even set at zero. Although zero-coupon bonds do not pay out any interest, these are issued at a discount to par value.

Yield refers to the returns on bonds which are based on both the bond’s price and the interest, or coupon payment received.

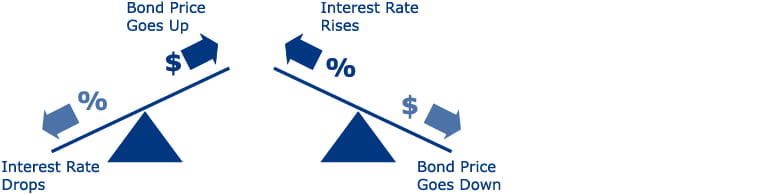

Inverse relationship between bond price and interest rate

In general, bond purchasers would hold the bonds to maturity. Even if a bond is not traded prior to its maturity, its price still fluctuates in the meantime due to its intimate relationship with interest rate movements. Bond prices are inversely related to interest rates. When the interest rate goes up, the price of bonds falls; conversely, when the interest rate falls, the price of bonds goes up.

Take the following hypothetical example. Suppose the current interest rate in the market is 5% p.a. and Mr. Chan decides to buy a 30-year bond with a par value of HKD10,000 at a coupon of 5% p.a.. Subsequently Mr. Chan wishes to sell his bond holding but the prevailing market rate at the time has gone up to 7% p.a.. As the coupon offered is less than the market rate, Mr. Chan has to attract investor interest with a price below its HKD10,000 par value in order to sell his investment.

The above information used is for illustrative purposes only and are not indicative of the actual returns likely to be achieved by the investor.